Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Michael is as a self-employed builder and has operated his business in Christchurch for over 25 years. 13 years ago he purchased a block

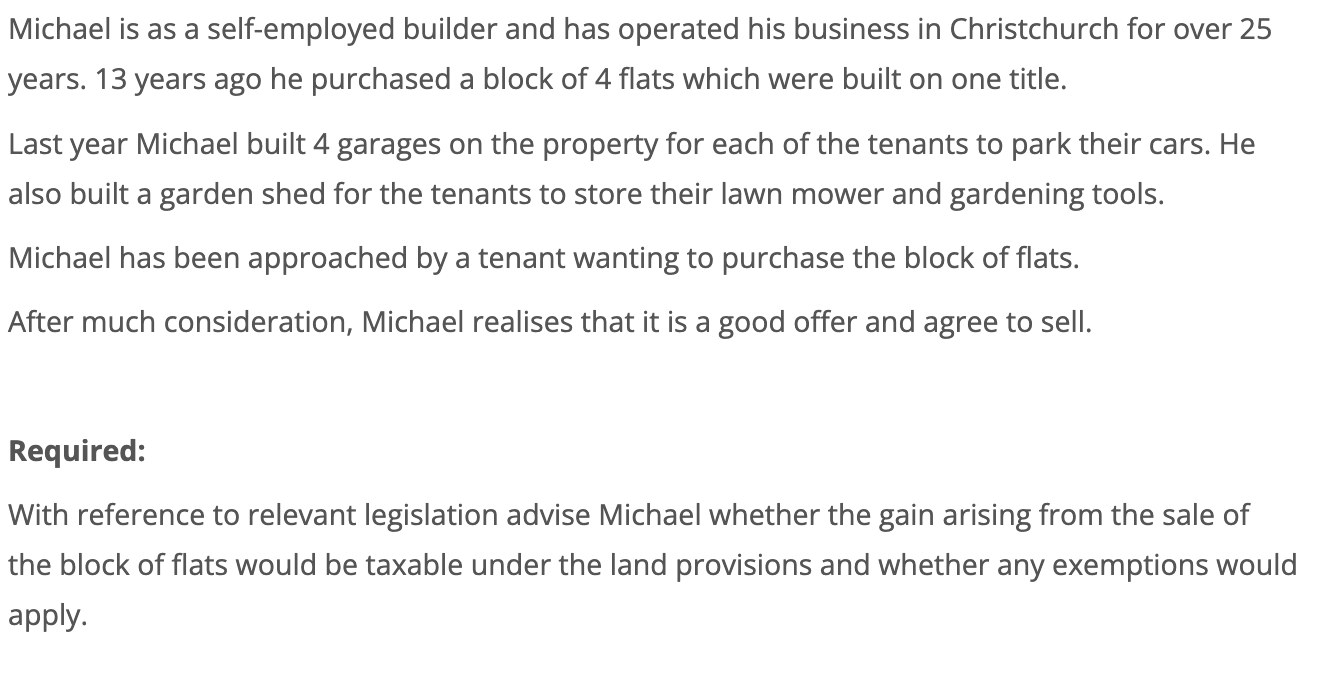

Michael is as a self-employed builder and has operated his business in Christchurch for over 25 years. 13 years ago he purchased a block of 4 flats which were built on one title. Last year Michael built 4 garages on the property for each of the tenants to park their cars. He also built a garden shed for the tenants to store their lawn mower and gardening tools. Michael has been approached by a tenant wanting to purchase the block of flats. After much consideration, Michael realises that it is a good offer and agree to sell. Required: With reference to relevant legislation advise Michael whether the gain arising from the sale of the block of flats would be taxable under the land provisions and whether any exemptions would apply.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Tax Liability for Michaels Flat Sale in New Zealand Based on the information provided heres an analysis of Michaels potential tax liability and available exemptions in New Zealand Legislation Income T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started