Question

Michael Smith and Joan have been dating for two years. Michael earns $6,000 monthly as the General manager of Siennas Health and Fitness store. Joan

Michael Smith and Joan have been dating for two years. Michael earns $6,000 monthly as the General manager of Siennas Health and Fitness store. Joan is a single mother currently working as a volunteer. They plan to marry but must decide whether to get married now or wait a year or two.

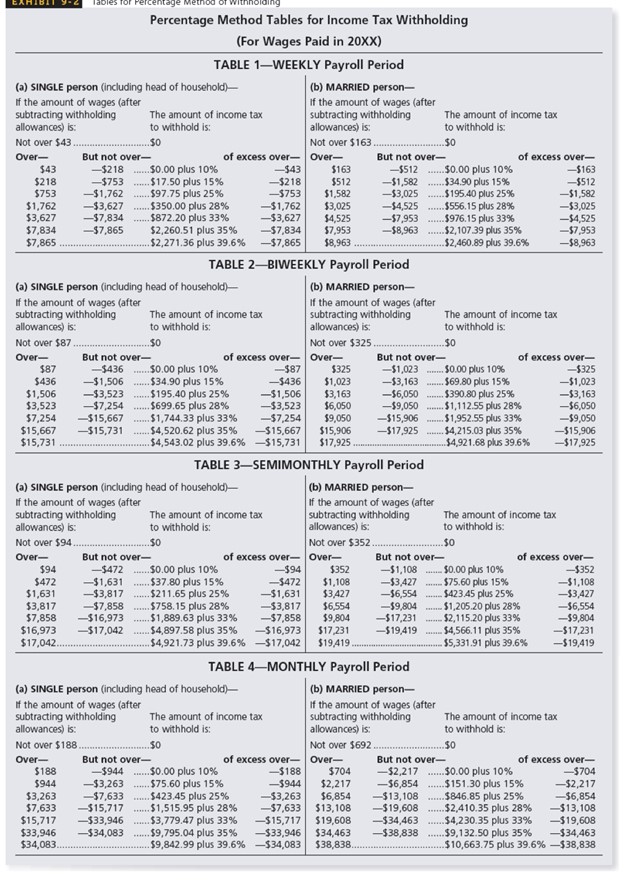

Knowing Michael would get married after studying the payroll deductions Michael would get, Sienna informs Michael that married couples generally pay fewer income taxes and that if they got married now instead of waiting, he would have less income tax withheld from his paychecks. Michael's current tax filing status is single, with one exemption. If he and Joan got married, he could file as married, and with two stepchildren, would have four exemptions.

calculate the following:

How much federal income tax withheld from Michael's monthly paycheck?

How much federal income tax be withheld from Michael's paycheck if he and Joan got married?

EXHIBIT 9-2 Tables for Percentage Met Percentage Method Tables for Income Tax Withholding (For Wages Paid in 20XX) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) If the amount of wages (after subtracting withholding allowances) is: (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) is: Not over $163. The amount of income tax to withhold is: of excess over- The amount of income tax to withhold is: Not over $43. .50 Over- But not over- of excess over-Over- But not over- $43 -$218 $218 -$753 $0.00 plus 10% $17.50 plus 15% -$43 $163 -$512 $0.00 plus 10% -$163 -$218 $512 -$1,582 $34.90 plus 15% -$512 $753 -$1,762 ........$97.75 plus 25% -$753 $1,582 -$3,025 ......$195.40 plus 25% -$1,582 $1,762 -$3,627 $350.00 plus 28% -$1,762 $3,025 -$4,525 $556.15 plus 28% -$3,025 $3,627 -$7,834 ..$872.20 plus 33% -$3,627 $4,525 -$7,953 ......$976.15 plus 33% -$4,525 $7,834 -$7,865 $2,260.51 plus 35% $7,865 $2,271.36 plus 39.6% -$7,834 $7,953 -$7,865 $8,963 -$8,963 ..$2,107.39 plus 35% -$7,953 $2,460.89 plus 39.6% -$8,963 The amount of income tax to withhold is: $0 Over- $87 $436 -$1,506 $0.00 plus 10% $34.90 plus 15% TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household)- If the amount of wages (after subtracting withholding allowances) is: Not over $87 But not over- -$436 (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) is: Not over $325 of excess over-Over- The amount of income tax to withhold is: $0.00 plus 10% ..$0 But not over- of excess over- -$87 $325 -$1,023 -$325 -$436 $1,023 -$3,163 $69.80 plus 15% -$1,023 $1,506 -$3,523 $195.40 plus 25% -$1,506 $3,163 -$6,050 $390.80 plus 25% -$3,163 $3,523 -$7,254 $699.65 plus 28% -$3,523 $6,050 -$9,050 $1,112.55 plus 28% -$6,050 $7,254 $15,667 $15,731 -$15,667 $1,744.33 plus 33% -$7,254 -$15,731 $4,520.62 plus 35% $9,050 -$15,906 -$15,667 $15,906 $4,543.02 plus 39.6% -$15,731 $17,925 $1,952.55 plus 33% -$9,050 -$17,925 $4,215.03 plus 35% -$15,906 ..$4,921.68 plus 39.6% -$17,925 (a) SINGLE person (including head of household)- If the amount of wages (after subtracting withholding allowances) is: The amount of income tax to withhold is: Over- $94 -$472 $472 -$1,631 Not over $94. But not over- $0.00 plus 10% $37.80 plus 15% $0 of excess over-Over- -$94 $352 TABLE 3-SEMIMONTHLY Payroll Period (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) is: Not over $352.. But not over- -$1,108 The amount of income tax to withhold is: $0 of excess over- $0.00 plus 10% -$352 -$472 $1,108 -$3,427 $75.60 plus 15% -$1,108 $1,631 -$3,817 $211.65 plus 25% -$1,631 $3,427 -$6,554 ......$423.45 plus 25% -$3,427 $3,817 -$7,858 $758.15 plus 28% -$3,817 $6,554 -$9,804 $1,205.20 plus 28% -$6,554 $7,858 -$16,973 $1,889.63 plus 33% -$7,858 $9,804 -$17,231 $2,115.20 plus 33% -$9,804 $16,973 -$17,042 $4,897.58 plus 35% -$16,973 $17,042. $4,921.73 plus 39.6% -$17,042 $17,231 $19,419. -$19,419 $4,566.11 plus 35% -$17,231 $5,331.91 plus 39.6% -$19,419 TABLE 4-MONTHLY Payroll Period (a) SINGLE person (including head of household) If the amount of wages (after subtracting withholding allowances) is: Not over $188. Over- The amount of income tax to withhold is: .50 But not over- $188 $944 $3,263 (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) is: Not over $692. of excess over-Over- -$188 -$944 The amount of income tax to withhold is: of excess over- But not over- $704 -$2,217 $2,217 -$6,854 -$3,263 $6,854 -$13,108 .$0.00 plus 10% $151.30 plus 15% $846.85 plus 25% -$704 -$2,217 -$6,854 -$7,633 $13,108 -$19,608 ..$2,410.35 plus 28% -$13,108 $3,779.47 plus 33% -$15,717 $19,608 -$34,463 ..$4,230.35 plus 33% -$19,608 $9,795.04 plus 35% $34,463 -$38,838 $9,132.50 plus 35% -$34,463 $9,842.99 plus 39.6% $38,838.. $10,663.75 plus 39.6% -$38,838 -$944 ........$0.00 plus 10% -$3,263 $75.60 plus 15% -$7,633 ......$423.45 plus 25% $7,633 -$15,717 $1,515.95 plus 28% $15,717 -$33,946 $33,946 -$34,083 $34,083. -$33,946 -$34,083

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the federal income tax withheld from Michaels monthly paycheck well refer to Table 4 fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started