Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Michael Spear invested $10,000 today in a fund that earns 8% compounded annually. Click here to view factor tables To what amount will the

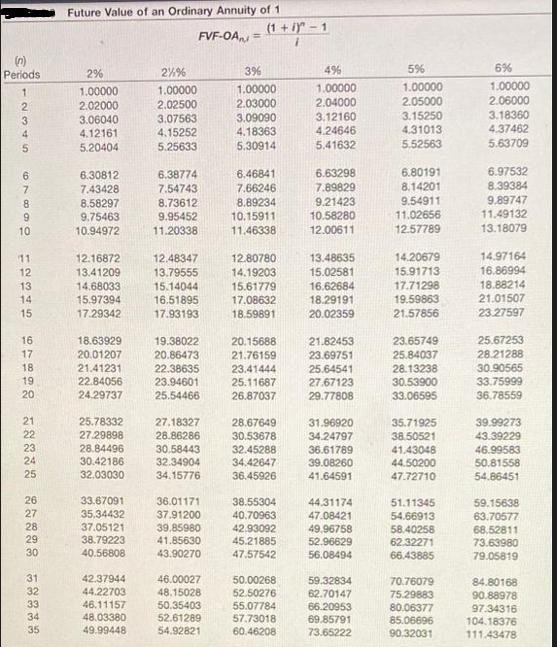

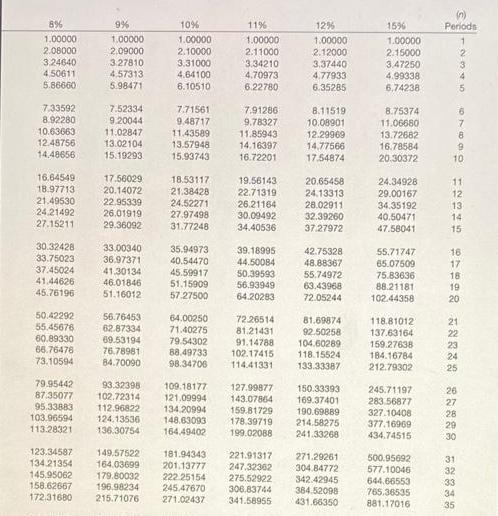

Michael Spear invested $10,000 today in a fund that earns 8% compounded annually. Click here to view factor tables To what amount will the investment grow in 3 years? To what amount would the investment grow in 3 years if the fund earns 8% annual interest compounded semiannually? (Round factor values to 5 decimal places, eg 1.25124 and final answers to O decimal places, eg 456.581) (n) Periods 12345 2 5 67899 10 12345 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Future Value of an Ordinary Annuity of 1 FVF-OAN 2% 1.00000 2.02000 3.06040 4.12161 5.20404 6.30812 7.43428 8.58297 9.75463 10.94972 12.16872 13.41209 14.68033 15.97394 17.29342 18.63929 20.01207 21.41231 22.84056 24.29737 25.78332 27.29898 28.84496 30.42186 32.03030 33.67091 35,34432 37.05121 38.79223 40.56808 42.37944 44.22703 46.11157 48.03380 49.99448 2%% 1.00000 2.02500 3.07563 4.15252 5.25633 6.38774 7.54743 8.73612 9.95452 11.20338 12.48347 13.79555 15.14044 16.51895 17.93193 19.38022 20.86473 22.38635 23.94601 25.54466 27.18327 28.86286 30.58443 32.34904 34.15776 36.01171 37.91200 39.85980 41.85630 43.90270 46.00027 48.15028 50.35403 52.61289 54.92821 = (1+i)-1 1 3% 1.00000 2.03000 3.09090 4.18363 5.30914 6.46841 7.66246 8.89234 10.15911 11.46338 12.80780 14.19203 15.61779 17.08632 18.59891 20.15688 21.76159 23.41444 25.11687 26.87037 28.67649 30.53678 32.45288 34.42647 36.45926 38.55304 40.70963 42.93092 45.21885 47,57542 50.00268 52.50276 55.07784 57.73018 60.46208 4% 1.00000 2.04000 3.12160 4.24646 5,41632 6.63298 7.89829 9.21423 10.58280 12.00611 13.48635 15.02581 16.62684 18.29191 20.02359 21.82453 23.69751 25.64541 27.67123 29.77808 31.96920 34.24797 36.61789 39.08260 41.64591 44.31174 47.08421 49,96758 52.96629 56.08494 59.32834 62.70147 66.20953 69.85791 73.65222 5% 1.00000 2.05000 3.15250 4.31013 5.52563 6.80191 8.14201 9.54911 11.02656 12.57789 14.20679 15.91713 17.71298 19.59863 21.57856 23.65749 25.84037 28.13238 30.53900 33.06595 35.71925 38.50521 41.43048 44.50200 47.72710 51.11345 54.66913 58.40258 62.32271 66.43885 70.76079 75.29883 80.06377 85.06696 90.32031 6% 1.00000 2.06000 3.18360 4.37462 5.63709 6.97532 8.39384 9.89747 11.49132 13.18079 14.97164 16,86994 18.88214 21.01507 23.27597 25.67253 28.21288 30.90565 33.75999 36.78559 39.99273 43.39229 46.99583 50.81558 54.86451 59.15638 63.70577 68.52811 73.63980 79.05819 84.80168 90.88978 97.34316 104.18376 111.43478 8% 1.00000 2.08000 3,24640 4.50611 5.86660 7.33592 8.92280 10.63663 12.48756 14.48656 16.64549 18.97713 21.49530 24,21492 27.15211 30.32428 33.75023 37.45024 41.44626 45.76196 50.42292 55.45676 60.89330 66.76476 73.10594 9% 1,00000 2,09000 3.27810 4.57313 5.98471 7.52334 9.20044 11.02847 13.02104 15.19293 17.56029 20.14072 22.95339 26.01919 29.36092 33.00340 36.97371 41.30134 46.01846 51.16012 56.76453 62.87334 69.53194 76.78981 84.70090 10% 1.00000 2.10000 3.31000 4.64100 6.10510 7.71561 9.48717 11.43589 13.57948 15.93743 18.53117 21.38428 24.52271 27.97498 31.77248 35.94973 40.54470 45.59917 51.15909 57.27500 11% 1.00000 2.11000 3.34210 4.70973 6.22780 7.91286 9.78327 11.85943 14.16397 16.72201 19.56143 22.71319 26.21164 30.09492 34.40536 39.18995 44.50084 50.39593 56.93949 64.20283 64.00250 72.26514 71.40275 81.21431 79.54302 91.14788 88.49733 102.17415 98.34706 114.41331 79.95442 93.32398 109.18177 127.99877 87.35077 102.72314 121,09994 143.07864 95.33883 112.96822 134,20994 159.81729 103.96594 124.13536 148.63093 178.39719 113.28321 136.30754 164,49402 199.02088 123.34587 149.57522 181.94343 221.91317 134.21354 164.03699 201.13777 247.32362 145,95062 179.80032 222.25154 158.62667 275.52922 196.98234 245.47670 306,83744 172.31680 215.71076 271.02437 341.58955 12% 1.00000 2.12000 3,37440 4.77933 6.35285 8.11519 10.08901 12.29969 14,77566 17.54874 20.65458 24.13313 28.02911 32.39260 37.27972 42.75328 48.88367 55.74972 63,43968 72.05244 81.69874 92.50258 104.60289 118.15524 133.33387 150.33393 169.37401 190.69889 214.58275 241.33268 271.29261 304.84772 342.42945 384.52098 431.66350 15% 1.00000 2.15000 3.47250 4.99338 6,74238 8.75374 11.06680 13.72682 16.78584 20.30372 24.34928 29.00167 34.35192 40.50471 47.58041 55.71747 65.07509 75.83636 88.21181 102.44358 118.81012 137.63164 159.27638 184.16784 212.79302 245.71197 283 56877 327.10408 377.16969 434.74515 500.95692 577.10046 644.66553 765.36535 881.17016 Periods 67890 10 11 12 13 14 15 1 2 3 16 17 18 19 20 21 22 23 24 25 26 27 28 29 31 32 33 34 35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the future value of an investment you can use the compound interest formula AP1nrnt Whe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started