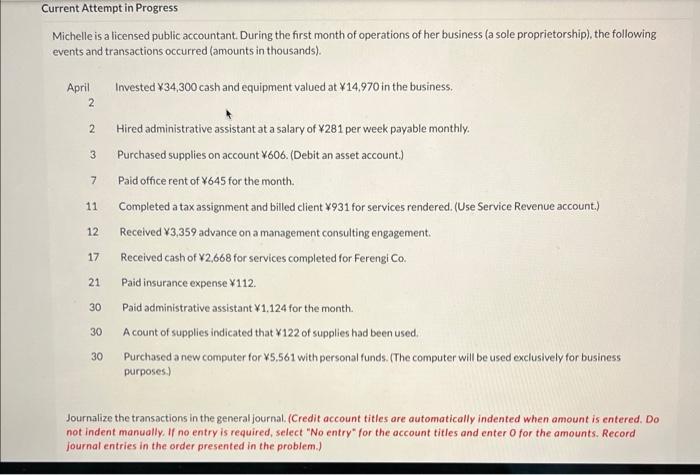

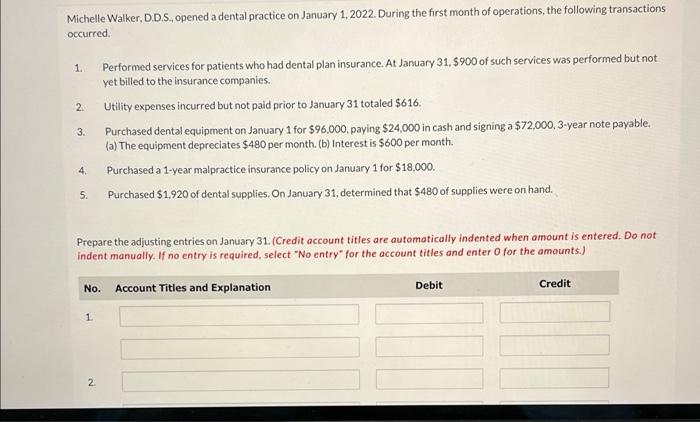

Michelle is a licensed public accountant. During the first month of operations of her business (a sole proprietorship), the following events and transactions occurred (amounts in thousands). April Invested 34,300 cash and equipment valued at 14,970 in the business. 5 2 Hired administrative assistant at a salary of 281 per week payable monthly. 3 Purchased supplies on account 606. (Debit an asset account.) 7 Paid office rent of 645 for the month. 11 Completed a tax assignment and billed client $931 for services rendered. (Use Service Revenue account.) 12 Received 3,359 advance on a management consulting engagement. 17 Received cash of $2,668 for services completed for Ferengi Co. 21 Paid insurance expense 112. 30 Paid administrative assistant 1,124 for the month. 30 A count of supplies indicated that 122 of supplies had been used. 30 Purchased a new computer for $5,561 with personal funds. (The computer will be used exclusively for business purposes.) Journalize the transactions in the general journal. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Michelle Walker, D.D.S. opened a dental practice on January 1, 2022. During the first month of operations, the following transactions occurred. 1. Performed services for patients who had dental plan insurance. At January 31,$900 of such services was performed but not yet billed to the insurance companies. 2. Utility expenses incurred but not paid prior to January 31 totaled $616. 3. Purchased dental equipment on January 1 for $96,000, paying $24,000 in cash and signing a $72,000,3-year note payable. (a) The equipment depreciates $480 per month. (b) Interest is $600 per month. 4. Purchased a 1-year malpractice insurance policy on January 1 for $18,000. 5. Purchased $1,920 of dental supplies. On January 31 , determined that $480 of supplies were on hand. Prepare the adjusting entries on January 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.)