Answered step by step

Verified Expert Solution

Question

1 Approved Answer

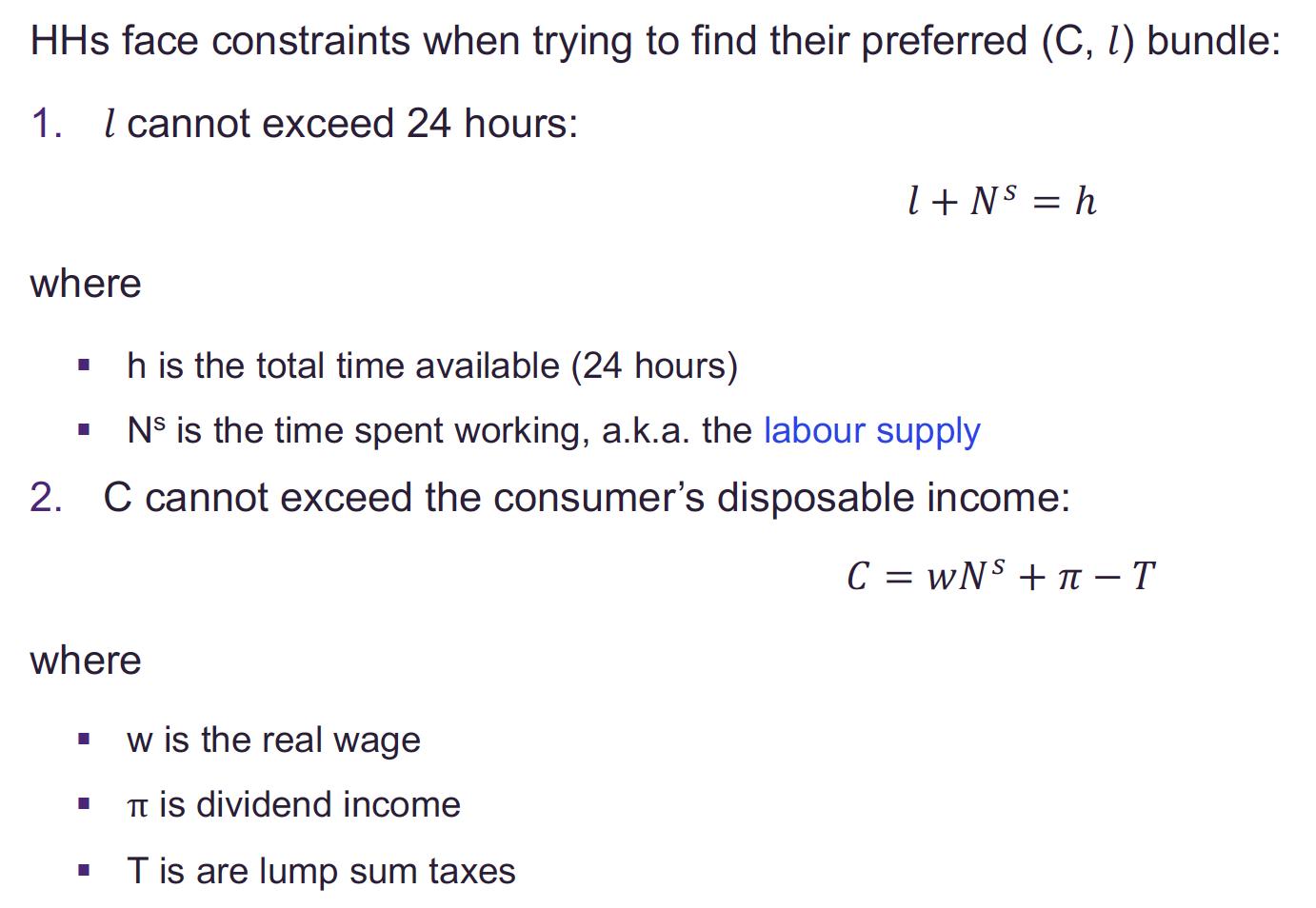

HHs face constraints when trying to find their preferred (C, 1) bundle: 1. I cannot exceed 24 hours: where h is the total time

![Question 2: The household problem [30 marks]. Consider the static model of the household discussed in Lecture](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/08/630ca1a4cd97d_1661772408319.jpg)

HHs face constraints when trying to find their preferred (C, 1) bundle: 1. I cannot exceed 24 hours: where h is the total time available (24 hours) Ns is the time spent working, a.k.a. the labour supply 2. C cannot exceed the consumer's disposable income: C = WNS +-T I where I 1 + Ns = h w is the real wage is dividend income T is are lump sum taxes Question 2: The household problem [30 marks]. Consider the static model of the household discussed in Lecture 3. Suppose that instead of being subject to a lump-sum tax, the consumer faces a labour income tax and a consumption tax tc. For simplicity, we normalize h (total time available) as 1 and there is no dividend income. a) Write down the household's budget constraint. (3 marks) b) Draw the household's budget constraint. What is the slope? (5 marks) c) Find the MRS1,c (Hint: using the Lagrange method, first order condition). How do the effects of T and Trelate to each other? Explain. (8 marks) d) If the household choose C* and 1*, how much tax revenue does the government collect? (5 marks) e) Suppose that the government had originally set Tc = 0 and T> 0 and now wants to enact a tax reform that uses consumption taxes instead of income taxes. What would be the level of Te that leaves the decisions of the household unchanged? (5 marks) f) How much the revenue does the government collect under the new system? How does it compare to the old system? Explain. (4 marks)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started