Question

Microhard has issued a bond with the following characteristics: Par Value: $1,000 Time to maturity: 12 years Coupon rate: 7 percent A. Calculate the

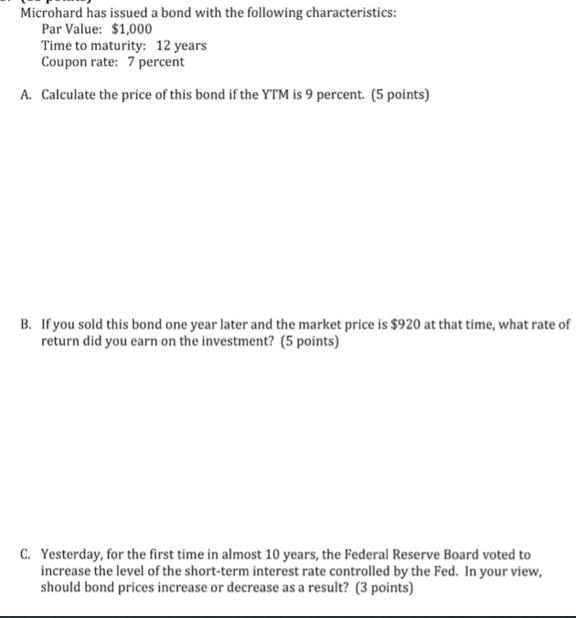

Microhard has issued a bond with the following characteristics: Par Value: $1,000 Time to maturity: 12 years Coupon rate: 7 percent A. Calculate the price of this bond if the YTM is 9 percent. (5 points) B. If you sold this bond one year later and the market price is $920 at that time, what rate of return did you earn on the investment? (5 points) C. Yesterday, for the first time in almost 10 years, the Federal Reserve Board voted to increase the level of the short-term interest rate controlled by the Fed. In your view, should bond prices increase or decrease as a result? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App