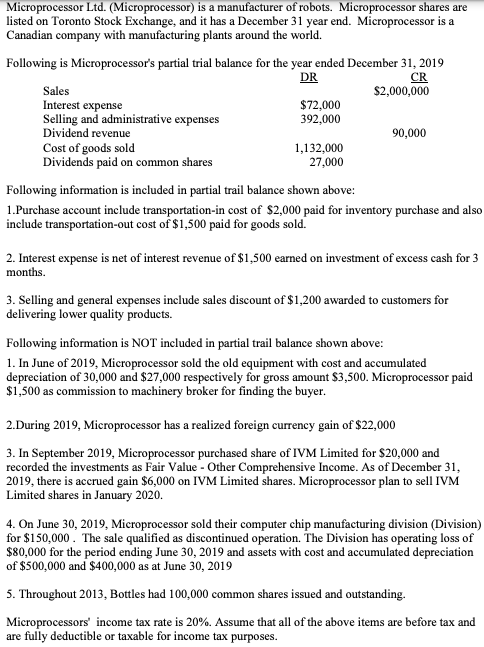

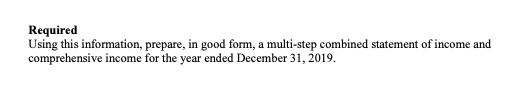

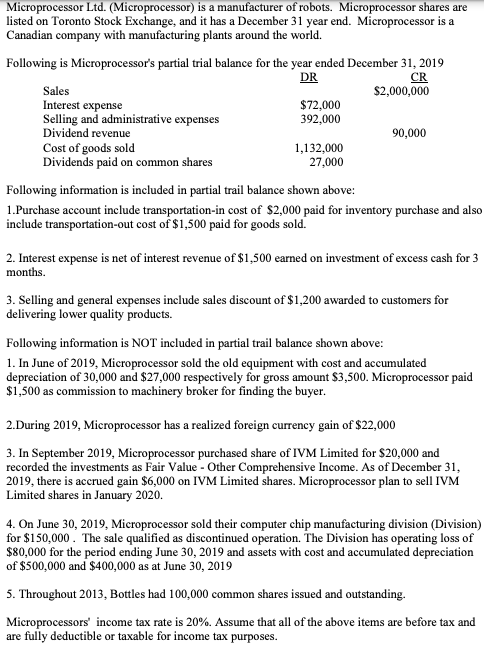

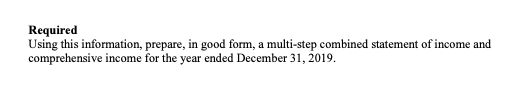

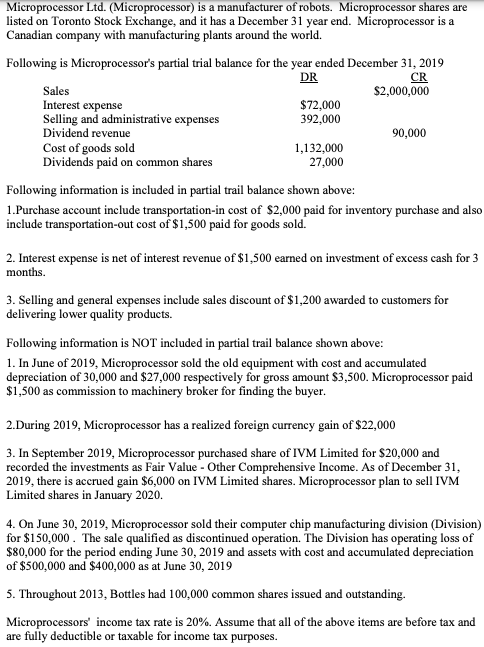

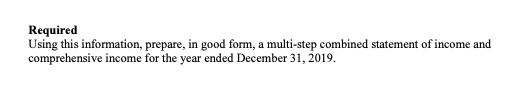

Microprocessor Lid. (Microprocessor) is a manufacturer of robots. Microprocessor shares are listed on Toronto Stock Exchange, and it has a December 31 year end. Microprocessor is a Canadian company with manufacturing plants around the world. Following is Microprocessor's partial trial balance for the year ended December 31, 2019 DR CR Sales $2,000,000 Interest expense $72,000 Selling and administrative expenses 392.000 Dividend revenue 90,000 Cost of goods sold 1,132,000 Dividends paid on common shares 27.000 Following information is included in partial trail balance shown above: 1.Purchase account include transportation-in cost of $2,000 paid for inventory purchase and also include transportation-out cost of $1,500 paid for goods sold. 2. Interest expense is net of interest revenue of $1,500 earned on investment of excess cash for 3 months. 3. Selling and general expenses include sales discount of $1,200 awarded to customers for delivering lower quality products. Following information is NOT included in partial trail balance shown above: 1. In June of 2019, Microprocessor sold the old equipment with cost and accumulated depreciation of 30,000 and $27,000 respectively for gross amount $3,500. Microprocessor paid $1,500 as commission to machinery broker for finding the buyer. 2.During 2019, Microprocessor has a realized foreign currency gain of $22,000 3. In September 2019, Microprocessor purchased share of IVM Limited for $20,000 and recorded the investments as Fair Value - Other Comprehensive Income. As of December 31. 2019, there is accrued gain $6,000 on IVM Limited shares. Microprocessor plan to sell IVM Limited shares in January 2020. 4. On June 30, 2019, Microprocessor sold their computer chip manufacturing division (Division) for $150,000 . The sale qualified as discontinued operation. The Division has operating loss of $80,000 for the period ending June 30, 2019 and assets with cost and accumulated depreciation of $500,000 and $400,000 as at June 30, 2019 5. Throughout 2013, Bottles had 100,000 common shares issued and outstanding. Microprocessors' income tax rate is 20%. Assume that all of the above items are before tax and are fully deductible or taxable for income tax purposes.Required Using this information, prepare, in good form, a multi-step combined statement of income and comprehensive income for the year ended December 31, 2019