Question

Microsoft is considering issuing $10b face value of convertible bonds with 10-year maturity at a premium of 40% on the current stock price. Why do

Microsoft is considering issuing $10b face value of convertible bonds with 10-year maturity at a premium of 40% on the current stock price.

- Why do companies issue convertible bonds?

- What is the conversion price and conversion ratio of the bond?

- What is the value of the embedded call option on $1000 face value of the bond?

- What is the value of the straight bond component?

For the Yield to maturity of the straight bond component, use the YTM of the following MSFT bond currently trading (data as of 4/28/2022).

| Maturity | Coupon | Price (as of June 4, 2020) | Yield |

| 5/2/2033 | 2.625% | $108.63 |

e. What is the coupon rate on a newly issued comparable straight bond with no convertibility option?

f. What is the appropriate coupon rate on the convertible bond?

g. Explain the difference in the coupon rates in (d) and (e) above.

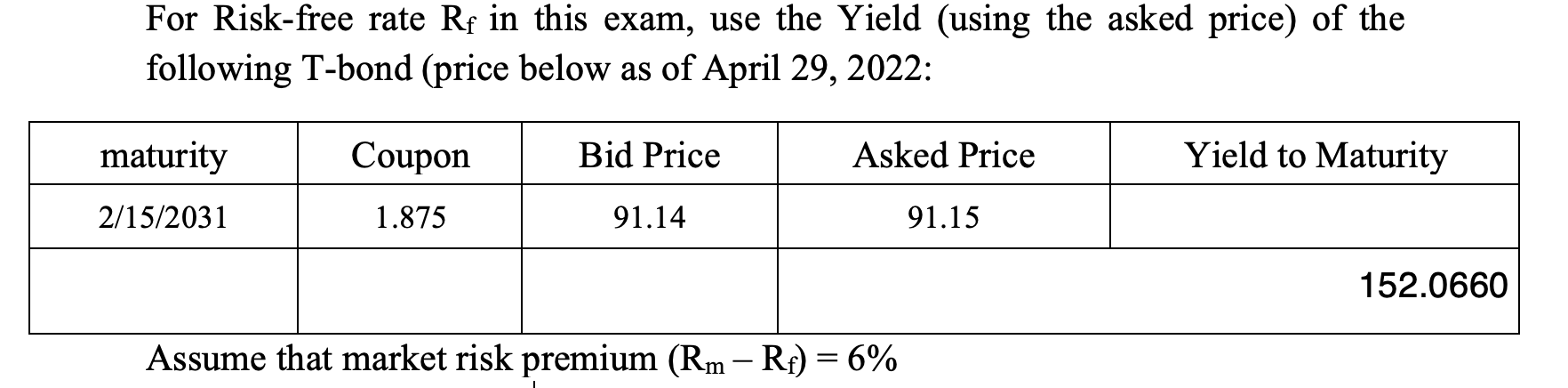

For Risk-free rate Rf in this exam, use the Yield (using the asked price) of the following T-bond (price below as of April 29, 2022: maturity Coupon Bid Price Asked Price Yield to Maturity 2/15/2031 1.875 91.14 91.15 Assume that market risk premium (Rm Rf) = 6% 152.0660 For Risk-free rate Rf in this exam, use the Yield (using the asked price) of the following T-bond (price below as of April 29, 2022: maturity Coupon Bid Price Asked Price Yield to Maturity 2/15/2031 1.875 91.14 91.15 Assume that market risk premium (Rm Rf) = 6% 152.0660Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started