Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mid South Cellular Systems began operations in 2024. In 2025, its second year of operations, pretax accounting income was $88 million, which included the

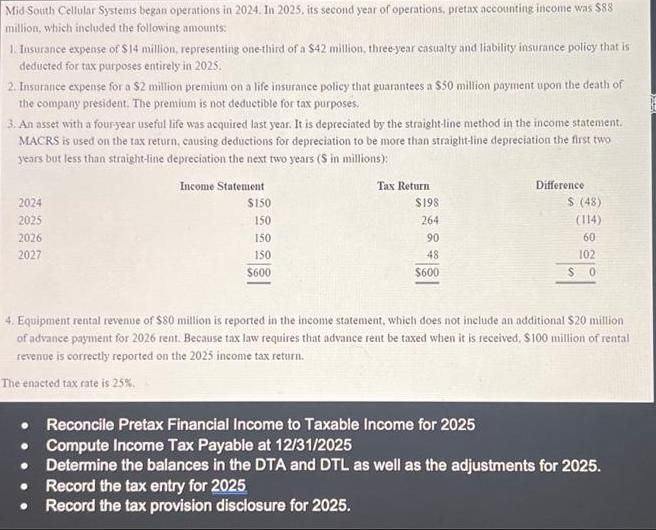

Mid South Cellular Systems began operations in 2024. In 2025, its second year of operations, pretax accounting income was $88 million, which included the following amounts: 1. Insurance expense of $14 million, representing one-third of a $42 million, three-year casualty and liability insurance policy that is deducted for tax purposes entirely in 2025. 2. Insurance expense for a $2 million premium on a life insurance policy that guarantees a $50 million payment upon the death of the company president. The premium is not deductible for tax purposes. 3. An asset with a four-year useful life was acquired last year. It is depreciated by the straight-line method in the income statement. MACRS is used on the tax return, causing deductions for depreciation to be more than straight-line depreciation the first two years but less than straight-line depreciation the next two years (S in millions): 2024 2025 2026 2027 Income Statement $150 150 150 150 $600 Tax Return $198 264 90 48 $600 Difference $ (48) (114) 60 102 $0 4. Equipment rental revenue of $80 million is reported in the income statement, which does not include an additional $20 million of advance payment for 2026 rent. Because tax law requires that advance rent be taxed when it is received, $100 million of rental revenue is correctly reported on the 2025 income tax return. The enacted tax rate is 25%, Reconcile Pretax Financial Income to Taxable Income for 2025 Compute Income Tax Payable at 12/31/2025 Determine the balances in the DTA and DTL as well as the adjustments for 2025. Record the tax entry for 2025 Record the tax provision disclosure for 2025.

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started