Answered step by step

Verified Expert Solution

Question

1 Approved Answer

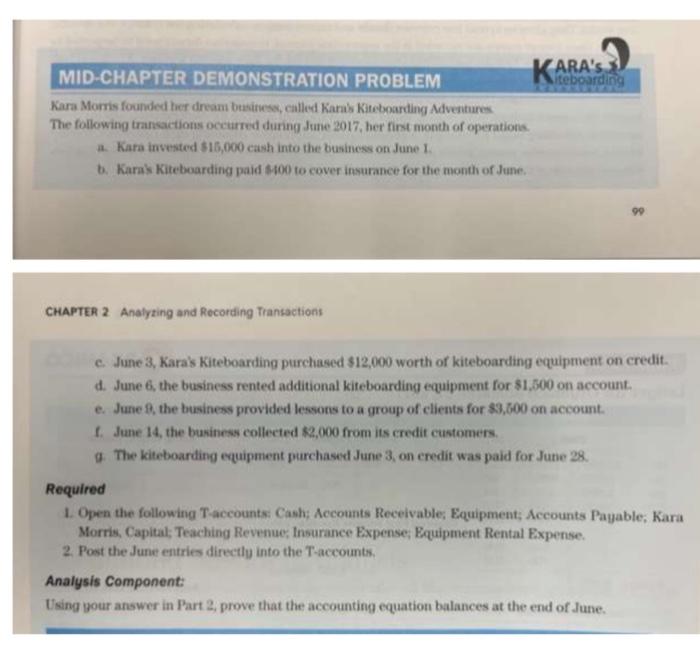

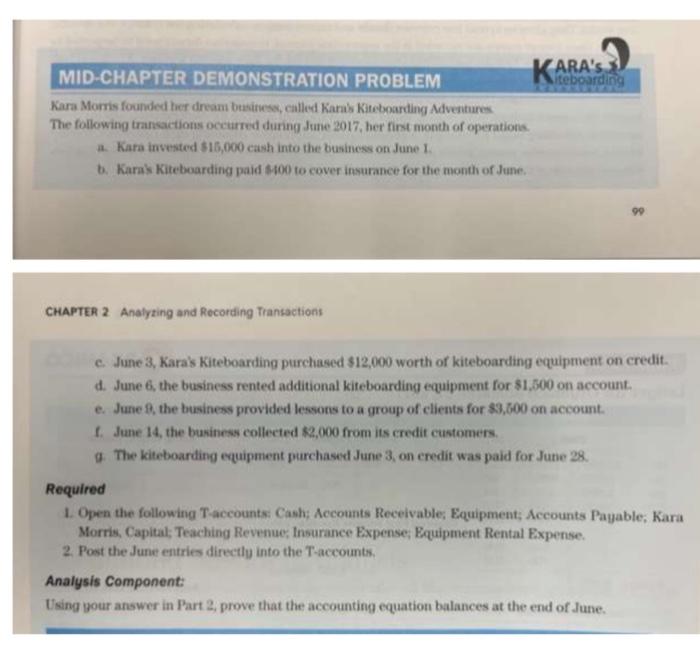

MID-CHAPTER DEMONSTRATION PROBLEM Kara Morris founded her dreans business, ealled Karus Kitcboarding Adventures The following transactions occurred during dune 2017 , her first nonth of

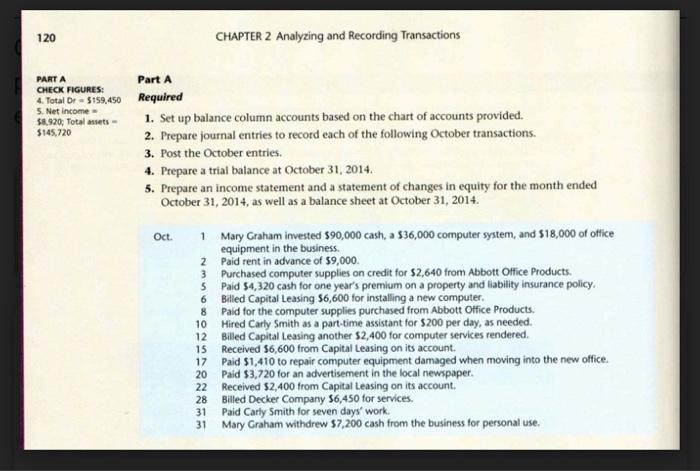

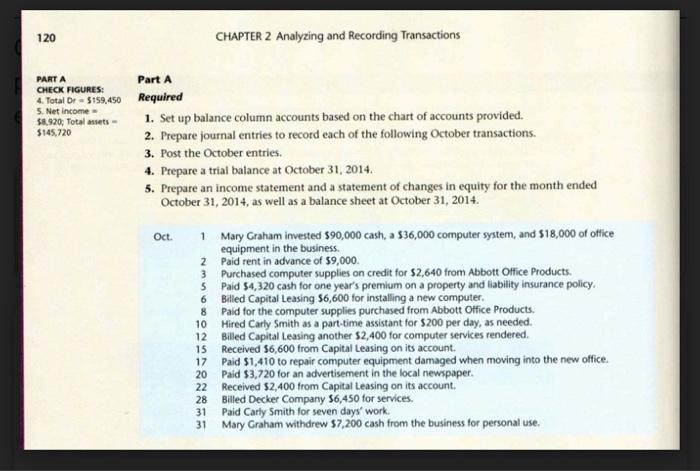

MID-CHAPTER DEMONSTRATION PROBLEM Kara Morris founded her dreans business, ealled Karus Kitcboarding Adventures The following transactions occurred during dune 2017 , her first nonth of operations. a. Kara invested $15,000 cash into the business on June 1. b. Karas Kiteboarding paid $100 to cover insurance for the month of June. CHAPTEA 2 Analyzing and Recording Transactions c. June 3, Karas Kiteboarding purchased $12,000 worth of kiteboarding equipment on credit. d. June 6 , the business rented additional kiteboarding equipment for $1,500 on account. e. June 9, the business provided lessons to a group of clients for $3,600 on account. f. June 14 , the business collected $2,000 from its credit customers. a. The kiteboarding equipment purchased June 3 , on eredit was paid for June 28. Required 1. Open the following Taccounts: Cash; Accounts Receivable, Equipment; Accounts Payable; Kara Morris, Capital; Teaching Revenue, Insurance Expense; Equipment Rental Expense. 2. Post the June entries directly into the T-accounts. Analysis Component: Using gour answer in Part 2, prove that the accounting equation balances at the end of June. 120 CHAPTER 2 Analyzing and Recording Transactions 3. Post the October entries. 4. Prepare a trial balance at October 31, 2014. 5. Prepare an income statement and a statement of changes in equity for the month ended October 31, 2014, as well as a balance sheet at October 31, 2014. Oct. 1 Mary Graham invested $90,000 cash, a $36,000 computer system, and $18,000 of office equipment in the business. 2 Paid rent in advance of $9,000. 3 Purchased computer supplies on credit for $2,640 from Abbott Office Products. 5 Paid $4,320 cash for one year's premium on a property and liability insurance policy. 6 Billed Capital Leasing 56,600 for installing a new computer. 8 Paid for the computer supplies purchased from Abbott Office Products. 10 Hired Carly Smith as a part-time assistant for $200 per day, as needed. 12 Billed Capital Leasing another $2,400 for computer services rendered. 15 Received \$6,600 from Capital Leasing on its account. 17 Paid $1,410 to repair computer equipment damaged when moving into the new office. 20 Paid $3,720 for an advertisement in the local newspaper. 22 Received \$2,400 from Capital Leasing on its account. 28 Billed Decker Company $6,450 for services. 31 Paid Carly Smith for seven days' work. 31 Mary Graham withdrew $7,200 cash from the business for personal use. MID-CHAPTER DEMONSTRATION PROBLEM Kara Morris founded her dreans business, ealled Karus Kitcboarding Adventures The following transactions occurred during dune 2017 , her first nonth of operations. a. Kara invested $15,000 cash into the business on June 1. b. Karas Kiteboarding paid $100 to cover insurance for the month of June. CHAPTEA 2 Analyzing and Recording Transactions c. June 3, Karas Kiteboarding purchased $12,000 worth of kiteboarding equipment on credit. d. June 6 , the business rented additional kiteboarding equipment for $1,500 on account. e. June 9, the business provided lessons to a group of clients for $3,600 on account. f. June 14 , the business collected $2,000 from its credit customers. a. The kiteboarding equipment purchased June 3 , on eredit was paid for June 28. Required 1. Open the following Taccounts: Cash; Accounts Receivable, Equipment; Accounts Payable; Kara Morris, Capital; Teaching Revenue, Insurance Expense; Equipment Rental Expense. 2. Post the June entries directly into the T-accounts. Analysis Component: Using gour answer in Part 2, prove that the accounting equation balances at the end of June. 120 CHAPTER 2 Analyzing and Recording Transactions 3. Post the October entries. 4. Prepare a trial balance at October 31, 2014. 5. Prepare an income statement and a statement of changes in equity for the month ended October 31, 2014, as well as a balance sheet at October 31, 2014. Oct. 1 Mary Graham invested $90,000 cash, a $36,000 computer system, and $18,000 of office equipment in the business. 2 Paid rent in advance of $9,000. 3 Purchased computer supplies on credit for $2,640 from Abbott Office Products. 5 Paid $4,320 cash for one year's premium on a property and liability insurance policy. 6 Billed Capital Leasing 56,600 for installing a new computer. 8 Paid for the computer supplies purchased from Abbott Office Products. 10 Hired Carly Smith as a part-time assistant for $200 per day, as needed. 12 Billed Capital Leasing another $2,400 for computer services rendered. 15 Received \$6,600 from Capital Leasing on its account. 17 Paid $1,410 to repair computer equipment damaged when moving into the new office. 20 Paid $3,720 for an advertisement in the local newspaper. 22 Received \$2,400 from Capital Leasing on its account. 28 Billed Decker Company $6,450 for services. 31 Paid Carly Smith for seven days' work. 31 Mary Graham withdrew $7,200 cash from the business for personal use

MID-CHAPTER DEMONSTRATION PROBLEM Kara Morris founded her dreans business, ealled Karus Kitcboarding Adventures The following transactions occurred during dune 2017 , her first nonth of operations. a. Kara invested $15,000 cash into the business on June 1. b. Karas Kiteboarding paid $100 to cover insurance for the month of June. CHAPTEA 2 Analyzing and Recording Transactions c. June 3, Karas Kiteboarding purchased $12,000 worth of kiteboarding equipment on credit. d. June 6 , the business rented additional kiteboarding equipment for $1,500 on account. e. June 9, the business provided lessons to a group of clients for $3,600 on account. f. June 14 , the business collected $2,000 from its credit customers. a. The kiteboarding equipment purchased June 3 , on eredit was paid for June 28. Required 1. Open the following Taccounts: Cash; Accounts Receivable, Equipment; Accounts Payable; Kara Morris, Capital; Teaching Revenue, Insurance Expense; Equipment Rental Expense. 2. Post the June entries directly into the T-accounts. Analysis Component: Using gour answer in Part 2, prove that the accounting equation balances at the end of June. 120 CHAPTER 2 Analyzing and Recording Transactions 3. Post the October entries. 4. Prepare a trial balance at October 31, 2014. 5. Prepare an income statement and a statement of changes in equity for the month ended October 31, 2014, as well as a balance sheet at October 31, 2014. Oct. 1 Mary Graham invested $90,000 cash, a $36,000 computer system, and $18,000 of office equipment in the business. 2 Paid rent in advance of $9,000. 3 Purchased computer supplies on credit for $2,640 from Abbott Office Products. 5 Paid $4,320 cash for one year's premium on a property and liability insurance policy. 6 Billed Capital Leasing 56,600 for installing a new computer. 8 Paid for the computer supplies purchased from Abbott Office Products. 10 Hired Carly Smith as a part-time assistant for $200 per day, as needed. 12 Billed Capital Leasing another $2,400 for computer services rendered. 15 Received \$6,600 from Capital Leasing on its account. 17 Paid $1,410 to repair computer equipment damaged when moving into the new office. 20 Paid $3,720 for an advertisement in the local newspaper. 22 Received \$2,400 from Capital Leasing on its account. 28 Billed Decker Company $6,450 for services. 31 Paid Carly Smith for seven days' work. 31 Mary Graham withdrew $7,200 cash from the business for personal use. MID-CHAPTER DEMONSTRATION PROBLEM Kara Morris founded her dreans business, ealled Karus Kitcboarding Adventures The following transactions occurred during dune 2017 , her first nonth of operations. a. Kara invested $15,000 cash into the business on June 1. b. Karas Kiteboarding paid $100 to cover insurance for the month of June. CHAPTEA 2 Analyzing and Recording Transactions c. June 3, Karas Kiteboarding purchased $12,000 worth of kiteboarding equipment on credit. d. June 6 , the business rented additional kiteboarding equipment for $1,500 on account. e. June 9, the business provided lessons to a group of clients for $3,600 on account. f. June 14 , the business collected $2,000 from its credit customers. a. The kiteboarding equipment purchased June 3 , on eredit was paid for June 28. Required 1. Open the following Taccounts: Cash; Accounts Receivable, Equipment; Accounts Payable; Kara Morris, Capital; Teaching Revenue, Insurance Expense; Equipment Rental Expense. 2. Post the June entries directly into the T-accounts. Analysis Component: Using gour answer in Part 2, prove that the accounting equation balances at the end of June. 120 CHAPTER 2 Analyzing and Recording Transactions 3. Post the October entries. 4. Prepare a trial balance at October 31, 2014. 5. Prepare an income statement and a statement of changes in equity for the month ended October 31, 2014, as well as a balance sheet at October 31, 2014. Oct. 1 Mary Graham invested $90,000 cash, a $36,000 computer system, and $18,000 of office equipment in the business. 2 Paid rent in advance of $9,000. 3 Purchased computer supplies on credit for $2,640 from Abbott Office Products. 5 Paid $4,320 cash for one year's premium on a property and liability insurance policy. 6 Billed Capital Leasing 56,600 for installing a new computer. 8 Paid for the computer supplies purchased from Abbott Office Products. 10 Hired Carly Smith as a part-time assistant for $200 per day, as needed. 12 Billed Capital Leasing another $2,400 for computer services rendered. 15 Received \$6,600 from Capital Leasing on its account. 17 Paid $1,410 to repair computer equipment damaged when moving into the new office. 20 Paid $3,720 for an advertisement in the local newspaper. 22 Received \$2,400 from Capital Leasing on its account. 28 Billed Decker Company $6,450 for services. 31 Paid Carly Smith for seven days' work. 31 Mary Graham withdrew $7,200 cash from the business for personal use

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started