Answered step by step

Verified Expert Solution

Question

1 Approved Answer

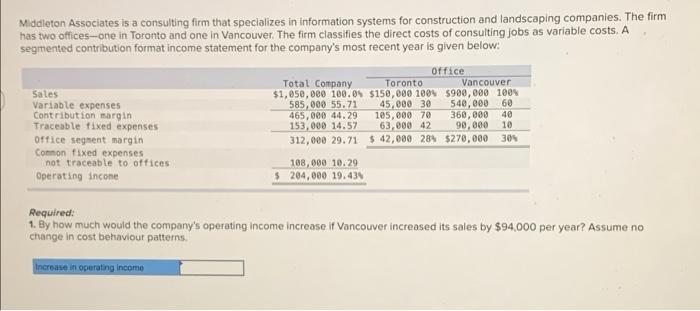

Middleton Associates is a consulting firm that specializes in information systems for construction and landscaping companies. The firm has two offices-one in Toronto and

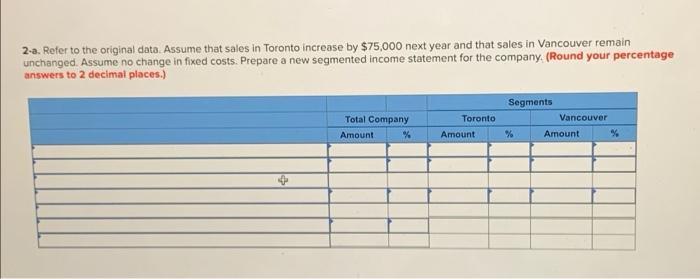

Middleton Associates is a consulting firm that specializes in information systems for construction and landscaping companies. The firm has two offices-one in Toronto and one in Vancouver. The firm classifies the direct costs of consulting jobs as variable costs. A segmented contribution format income statement for the company's most recent year is given below: Office Toronto $1,050, 000 100.0% $150,000 100 $900, 000 100% 45, 000 30 105,000 70 63,000 42 312,000 29.71 $ 42,000 28% $270, 000 30% Total Company Vancouver Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Comnon fixed expenses not traceable to offices 585, 000 55.71 465,000 44.29 153,000 14.57 540, 000 60 360, 000 40 90, 000 10 108, 000 10.29 $ 204, 000 19.434 Operating incone Required: 1. By how much would the company's operating income increase if Vancouver increased its sales by $94.,000 per year? Assume no change in cost behaviour patterns. Increase in operating income 2-a. Refer to the original data. Assume that sales in Toronto increase by $75,000 next year and that sales in Vancouver remain unchanged. Assume no change in fixed costs. Prepare a new segmented income statement for the company. (Round your percentage answers to 2 decimal places.) Segments Total Company Toronto Vancouver Amount Amount Amount

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Variable Cost varies with output whereas fixed cost remains constant Thus increa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started