Question

(Middletown, December 2006)Owning a home is part of the American dream.Having a home creates ties to the community, provides stability, and promotes civic pride.This desire

(Middletown, December 2006)Owning a home is part of the American dream.Having a home creates ties to the community, provides stability, and promotes civic pride.This desire for home ownership is so much a part of the American culture that governments promote this ownership by providing significant tax incentives.Mary Lloyd is Senior Vice President for Mortgage Lending at a medium sized bank, Royal Bank, operating in the Midwest.Mary prides herself in her role of helping her customers realize this American dream.She wants to help extend the opportunity of home ownership to her customers who previously would not qualify for a home loan from Royal by convincing the bank management to enter into the subprime home lending market.

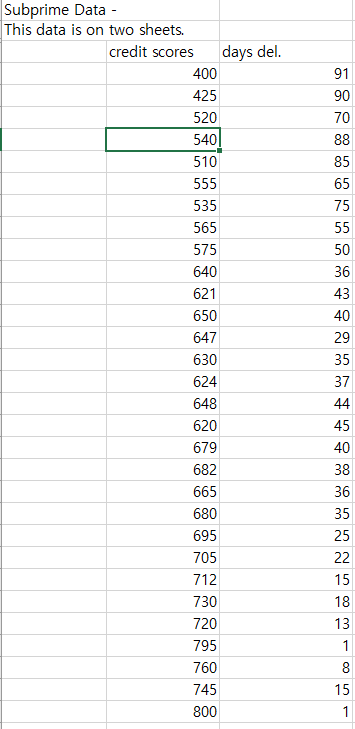

Royal has been a fairly conservative banking institution, concentrating on commercial lending to local business and low risk home loans.The home loans extended by Royal are to prime borrowers.These borrowers have reasonably well established credit and borrow in loans conforming to Fannie Mae or Freddie Mac criteria.Such loans can be packaged and sold through these government-sponsored agencies.The risk to the bank is low, many of the loans are sold to other institutions and pension funds while the bank earns fees for processing the payments.Prime borrowers generally had credit scores of 640 or higher.

In managing the loan business for her bank, Mary sees her job as dealing with two significant problems.Prior to extending a loan she must deal with adverse selection.Once the loan is extended she needs to provide sufficient incentives to reduce the moral hazard problem.Adverse selection results from asymmetric information.The potential borrower knows more about their likely behavior and financial condition than the bank.If the bank establishes a lending criteria that is significantly more lenient than its competitors, the borrowers selected are more likely to be higher risk and less likely to maintain their payments.Once the loan is extended the borrowers might expose the bank to unanticipated risk by failing to maintain the property.Mary sees this moral hazard problem being reduced by requiring a minimum down payment of10 percent of the property's value.Since the first party to incur a loss, should the property value decline, is the homeowner, they have an incentive to maintain the value.The adverse selection problem is managed by screening the applicants.A potential borrower's credit score has proven to be a useful screening device.

Mary has been frustrated by having a screening rule that only permits loans to highly qualified borrowers.Since her bank only issues prime mortgage loans, she must turn away business from borrowers with 640 or lower credit scores.She has watched her competitors enter the less than prime (subprime) market with a high degree of success and seen many of the subprime borrowers succeed in making their housing payments, improve their credit scores, and achieve their dream of home ownership.Mary believed that these potential borrowers should not be denied the opportunity of home ownership just because of a few late payments, difficulty in documenting their income and, perhaps, a prior bankruptcy.If they were given the opportunity and provided financial counseling to help them manage their incomes, they would become good customers for the bank, provide an additional source of bank income, and become more productive members of the community.

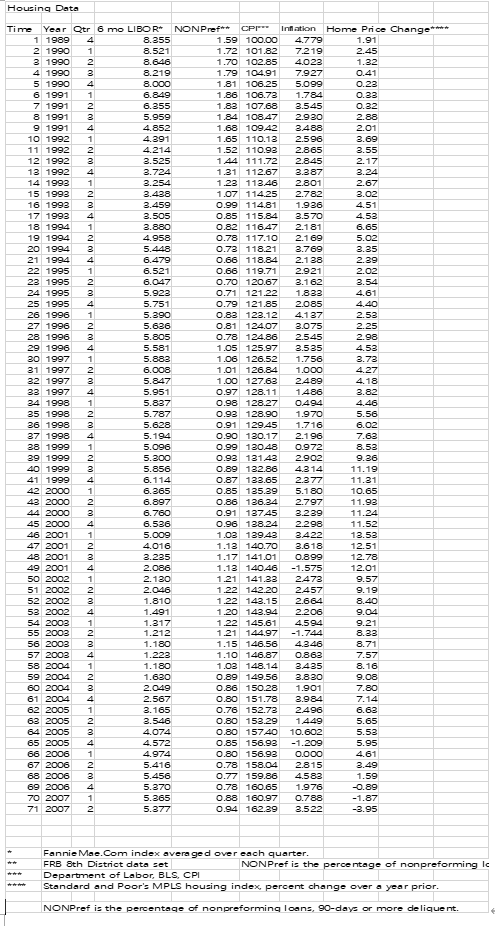

The subprime market developed in the late 1990s.These loans were designed to provide potential homeowners with less than perfect credit the opportunity to get back on their feet, improve their credit rating, and ultimately refinance into a prime loan at lower rates.The initial subprime loans required a 20 percent down payment, had a fixed interest rate for the first two years that was generally 2 percent above the prime, 30-year fixed rate, and moved into an adjustable rate mortgage (ARM) after two years.Moving into the 2000s, housing prices were rising, equity was being built up for the homeowners and the loans were profitable.With the subprime loans improving bank profitability, banks and mortgage lending institutions moved to make their loans more attractive.The down payment requirements dropped to 10 percent.Institutions, in some cases, would issue loans for 100 percent of the property's value (no down payment).In order to provide additional loans, second loans were sometimes issued to subprime borrowers to permit them to take acquired home equity out of the house.While the latest movement towards more lenient lending criteria has Mary a little worried, she still sees the subprime market as a vehicle to help both her bank, with higher profits, and her customers, by providing them with the opportunity of home ownership.

The subprime loans Mary wishes to make would require at least a ten percent down payment,have a fixed rate for two years, include a prepayment penalty during the first two years, and become an adjustable rate mortgage (ARM) after two years.To compensate for the added risk associated with these loans, the fixed rate would be 2 percent higher than the bank's traditional prime home mortgage loans.The ten percent down would protect the bank in the case of foreclosure, and the future adjustable rate would make the loan attractive on the developing secondary market for subprime loans.The ARM is indexed relative to the 6-mo LIBOR (London Interbank Offer Rate).Mary is comfortable with these features.She believes that her borrowers would make their mortgage payment, reestablish a higher credit score and be able to refinance after two years into a lower rate prime loan.

Question 3: Higher Subprime

Interest Vs. Higher Default Costs?

- Calculate average interest loss if loan becomes delinquent.

- Use estimated numbers in case and Mary's assumptions.

- No need to use outside data

- What is expected loss?

Q) Mary believes that the ten percent required down payment will protect the bank from a loss of principal.However, should the loan default, the funds are likely to be tied up, without interest income for six to nine months.The funds could have been used to fund a prime loan at around six percent interest with a default rate of well under one percent.Mary is wondering whether or not the two percent premium paid on the performing loans will cover the expected loss from the nonperforming loans.She expects a potential default rate around 3-5 percent.The average home loan is about $200,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started