Mid-Pacific Tennis Courts (MPTC), a small family-held corporation, hired Leroy Jacob as a salesperson. Jacob devised a scheme to defraud MPTC. Using MPTC customer leads, Jacob entered into contracts with potential customers to build tennis courts without informing MPTC. Jacob accepted checks from potential customers made payable to MPTC. Jacob then deposited those checks in his personal bank account with Peoples Bank & Trust Co. (Peoples Bank) without indorsement or permission by MPTC. Jacob took the money and disappeared.

When MPTC learned of the fraud and discovered that the checks were accepted for deposit by Peoples Bank in Jacobs personal account, MPTC sued Peoples Bank to recover the amount of the checks in question. Did Peoples Bank properly accept the checks for deposit?

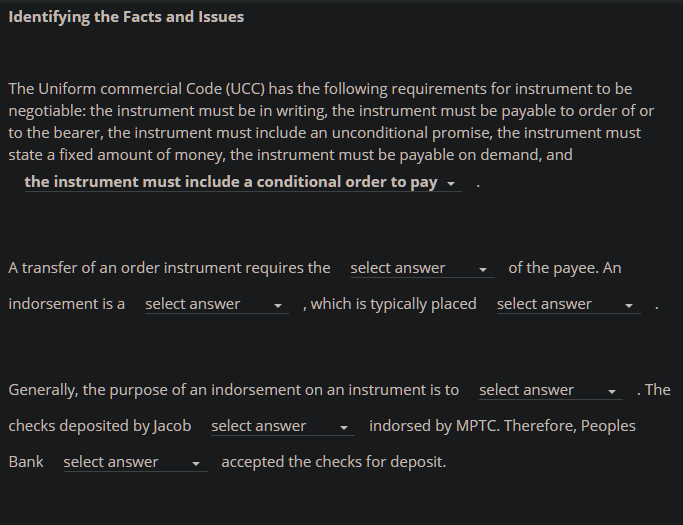

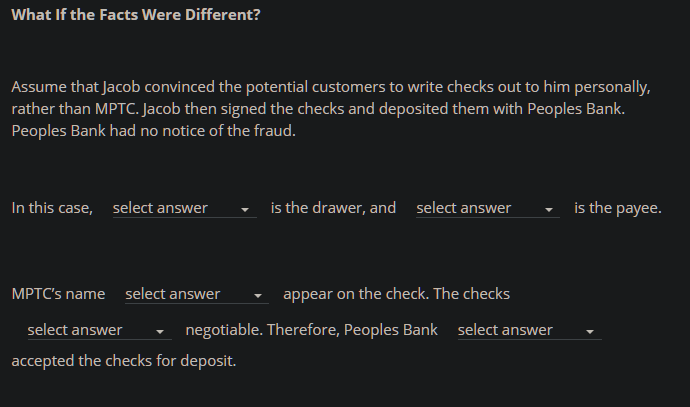

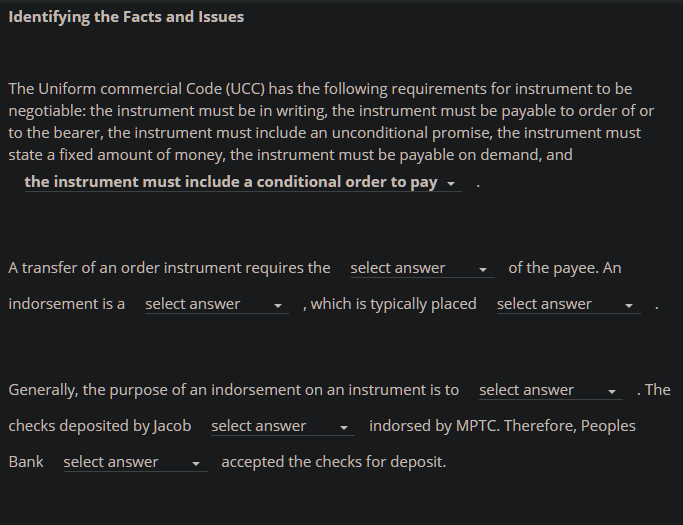

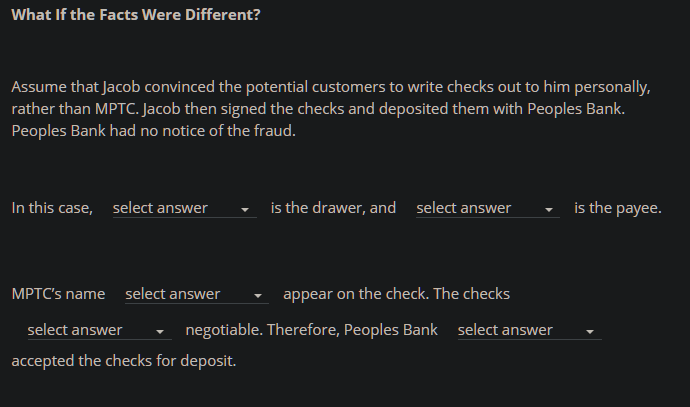

Identifying the Facts and Issues The Uniform commercial Code (UCC) has the following requirements for instrument to be negotiable: the instrument must be in writing, the instrument must be payable to order of or to the bearer, the instrument must include an unconditional promise, the instrument must state a fixed amount of money, the instrument must be payable on demand, and the instrument must include a conditional order to pay - A transfer of an order instrument requires the select answer of the payee. An indorsement is a select answer which is typically placed select answer Generally, the purpose of an indorsement on an instrument is to select answer . The checks deposited by Jacob select answer indorsed by MPTC. Therefore, Peoples Bank select answer accepted the checks for deposit. What If the Facts Were Different? Assume that Jacob convinced the potential customers to write checks out to him personally, rather than MPTC. Jacob then signed the checks and deposited them with Peoples Bank. Peoples Bank had no notice of the fraud. In this case, select answer is the drawer, and select answer is the payee. MPTC's name select answer appear on the check. The checks select answer negotiable. Therefore, Peoples Bank select answer accepted the checks for deposit. Identifying the Facts and Issues The Uniform commercial Code (UCC) has the following requirements for instrument to be negotiable: the instrument must be in writing, the instrument must be payable to order of or to the bearer, the instrument must include an unconditional promise, the instrument must state a fixed amount of money, the instrument must be payable on demand, and the instrument must include a conditional order to pay - A transfer of an order instrument requires the select answer of the payee. An indorsement is a select answer which is typically placed select answer Generally, the purpose of an indorsement on an instrument is to select answer . The checks deposited by Jacob select answer indorsed by MPTC. Therefore, Peoples Bank select answer accepted the checks for deposit. What If the Facts Were Different? Assume that Jacob convinced the potential customers to write checks out to him personally, rather than MPTC. Jacob then signed the checks and deposited them with Peoples Bank. Peoples Bank had no notice of the fraud. In this case, select answer is the drawer, and select answer is the payee. MPTC's name select answer appear on the check. The checks select answer negotiable. Therefore, Peoples Bank select answer accepted the checks for deposit