Answered step by step

Verified Expert Solution

Question

1 Approved Answer

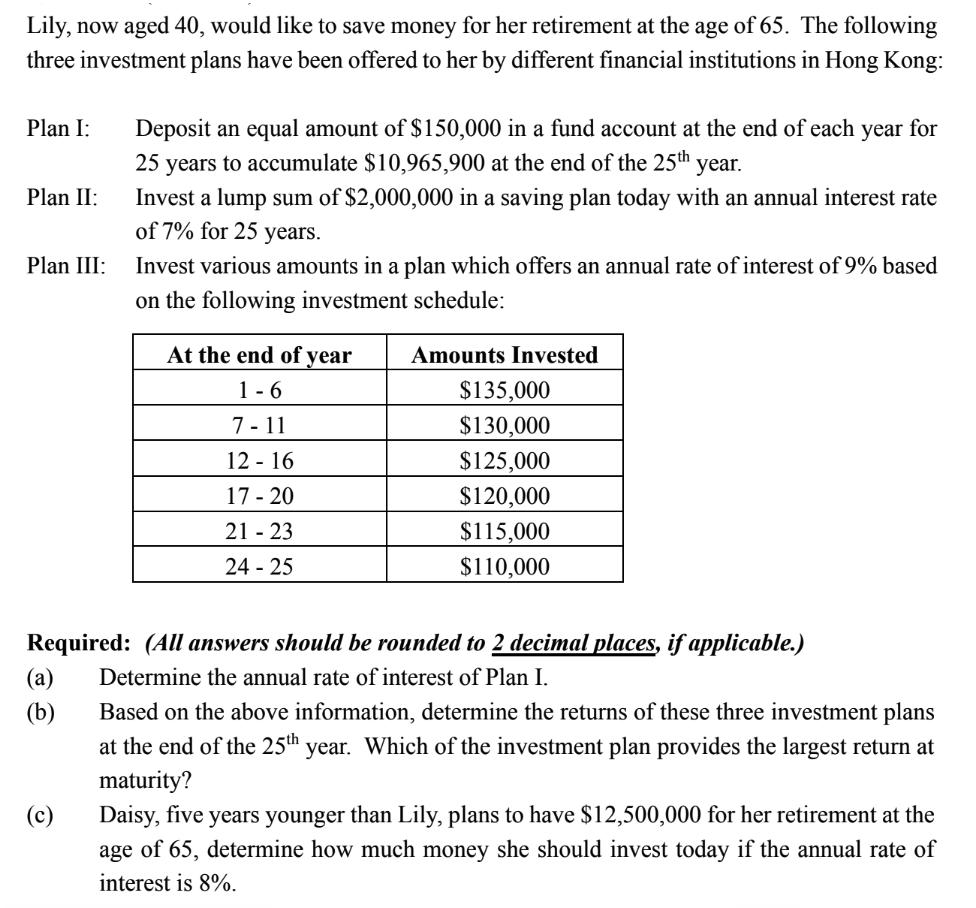

Lily, now aged 40, would like to save money for her retirement at the age of 65. The following three investment plans have been

Lily, now aged 40, would like to save money for her retirement at the age of 65. The following three investment plans have been offered to her by different financial institutions in Hong Kong: Plan I: Plan II: Plan III: (a) (b) Deposit an equal amount of $150,000 in a fund account at the end of each year for 25 years to accumulate $10,965,900 at the end of the 25th year. Invest a lump sum of $2,000,000 in a saving plan today with an annual interest rate of 7% for 25 years. (c) Invest various amounts in a plan which offers an annual rate of interest of 9% based on the following investment schedule: At the end of year 1-6 7-11 12 - 16 17-20 21-23 24 - 25 Amounts Invested Required: (All answers should be rounded to 2 decimal places, if applicable.) Determine the annual rate of interest of Plan I. $135,000 $130,000 $125,000 $120,000 $115,000 $110,000 Based on the above information, determine the returns of these three investment plans at the end of the 25th year. Which of the investment plan provides the largest return at maturity? Daisy, five years younger than Lily, plans to have $12,500,000 for her retirement at the age of 65, determine how much money she should invest today if the annual rate of interest is 8%.

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Required All answers should be rounded to 2 decimal places if applicable a Determine the annual rate of interest of Plan I ANSWER The annual rate of interest of Plan I is 548 CALCULATION i FVPV1n 1 i ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started