Answered step by step

Verified Expert Solution

Question

1 Approved Answer

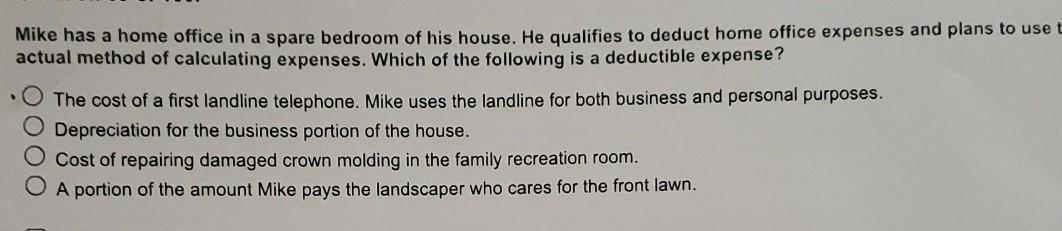

Mike has a home office in a spare bedroom of his house. He qualifies to deduct home office expenses and plans to use t actual

Mike has a home office in a spare bedroom of his house. He qualifies to deduct home office expenses and plans to use t actual method of calculating expenses. Which of the following is a deductible expense? The cost of a first landline telephone. Mike uses the landline for both business and personal purposes. Depreciation for the business portion of the house. Cost of repairing damaged crown molding in the family recreation room. A portion of the amount Mike pays the landscaper who cares for the front lawn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started