Question

Mike has a variety of clients including lucrative contracts with large builders and rental property managers with whom he has built up strong relationships. He

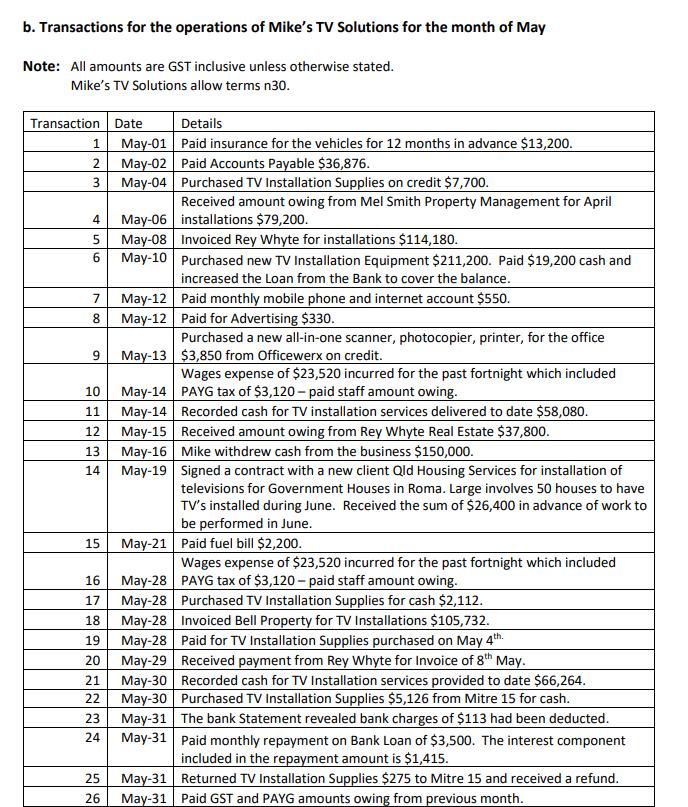

Mike has a variety of clients including lucrative contracts with large builders and rental property managers with whom he has built up strong relationships. He offers them terms of 30 days. Mike submits his Business Activity Statement (BAS) monthly on an accruals basis and pays GST and PAYG Tax monthly. The next payment is due on May 31 st . The business is operated from a commercial shed which was purchased by Mike for $696,000 three years ago. To finance this purchase Mike took out a loan over a fifteen-year period at a variable interest rate. 2 Currently the business uses a manual accounting system. However, you have been investigating the advantages of moving from a manual accounting system to a cloud-based accounting system and you have convinced Mike that the business should move to using the Xero accounting system in June.

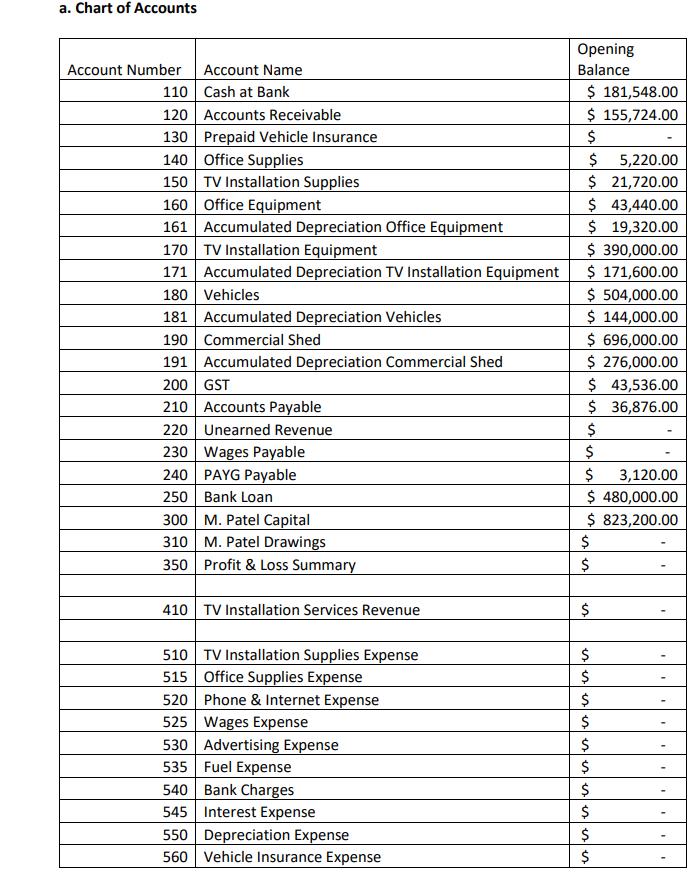

Review the Chart of Accounts provided to become familiar with account names for the business

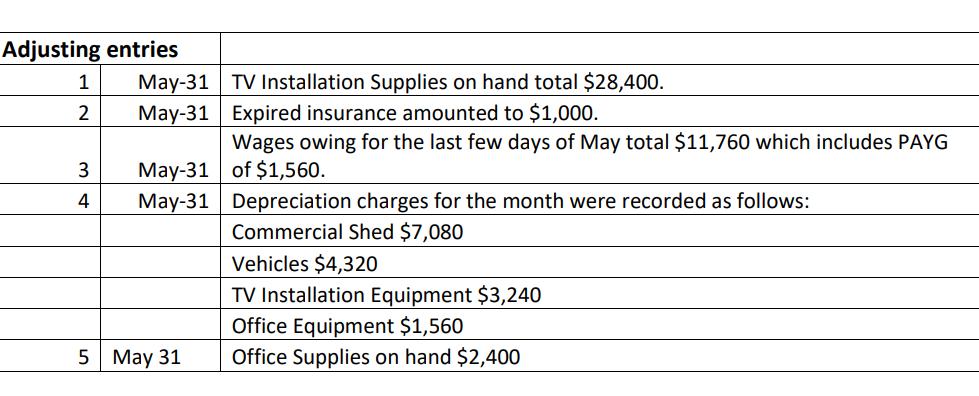

. a. Enter the transactions for the month of May into the General Journal.

a. Chart of Accounts Account Number Account Name 110 Cash at Bank 120 Accounts Receivable 130 140 Office Supplies 150 TV Installation Supplies 160 Office Equipment Prepaid Vehicle Insurance 161 Accumulated Depreciation Office Equipment 170 TV Installation Equipment 171 Accumulated Depreciation TV Installation Equipment 180 Vehicles 181 Accumulated Depreciation Vehicles 190 Commercial Shed 191 Accumulated Depreciation Commercial Shed 200 GST 210 Accounts Payable 220 Unearned Revenue 230 Wages Payable 240 PAYG Payable 250 Bank Loan 300 M. Patel Capital 310 M. Patel Drawings 350 Profit & Loss Summary 410 TV Installation Services Revenue 510 TV Installation Supplies Expense 515 Office Supplies Expense 520 Phone & Internet Expense 525 Wages Expense 530 Advertising Expense 535 Fuel Expense 540 Bank Charges 545 Interest Expense 550 Depreciation Expense 560 Vehicle Insurance Expense Opening Balance $ 181,548.00 $ 155,724.00 $ $ 5,220.00 $ 21,720.00 $ 43,440.00 $ 19,320.00 $ 390,000.00 $ 171,600.00 $ 504,000.00 $ 144,000.00 $ 696,000.00 $ 276,000.00 $ 43,536.00 $36,876.00 $ $ $ 3,120.00 $ 480,000.00 $ 823,200.00 $ $ $ | | | $ $ $ $ $ $ $ F '

Step by Step Solution

3.60 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

To enter the transactions for the month of May into the General Journal you must record each transaction that has taken place according to the details ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started