Answered step by step

Verified Expert Solution

Question

1 Approved Answer

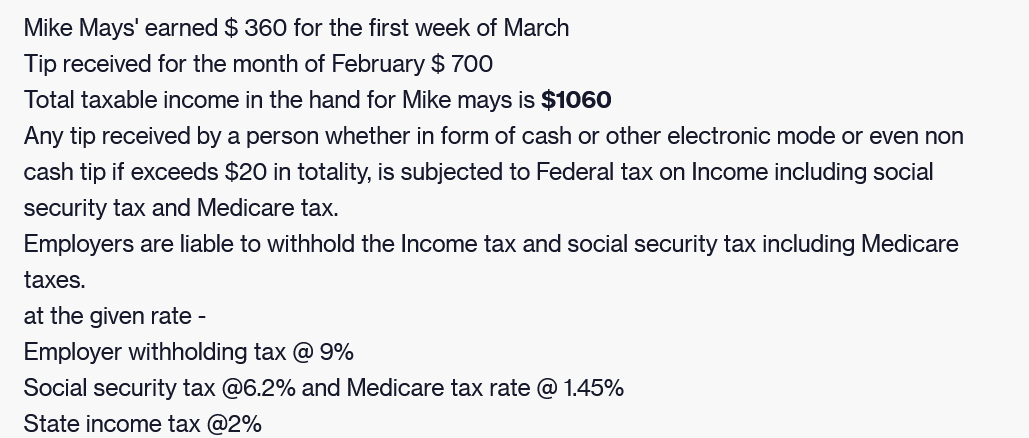

Mike Mays' earned $ 360 for the first week of March Tip received for the month of February $ 700 Total taxable income in

Mike Mays' earned $ 360 for the first week of March Tip received for the month of February $ 700 Total taxable income in the hand for Mike mays is $1060 Any tip received by a person whether in form of cash or other electronic mode or even non cash tip if exceeds $20 in totality, is subjected to Federal tax on Income including social security tax and Medicare tax. Employers are liable to withhold the Income tax and social security tax including Medicare taxes. at the given rate - Employer withholding tax @ 9% Social security tax @6.2% and Medicare tax rate @ 1.45% State income tax @2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the taxes withheld from Mike Mays total taxable income of 1060 we need to apply the res...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e378b4accf_959592.pdf

180 KBs PDF File

663e378b4accf_959592.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started