Answered step by step

Verified Expert Solution

Question

1 Approved Answer

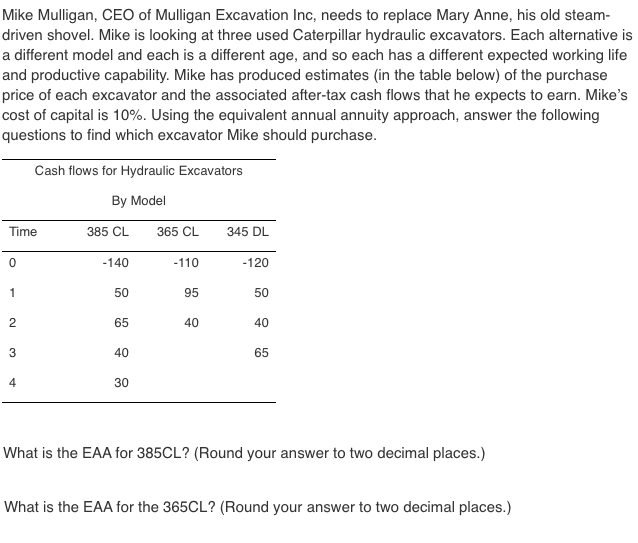

Mike Mulligan, CEO of Mulligan Excavation Inc, needs to replace Mary Anne, his old steam- driven shovel. Mike is looking at three used Caterpillar

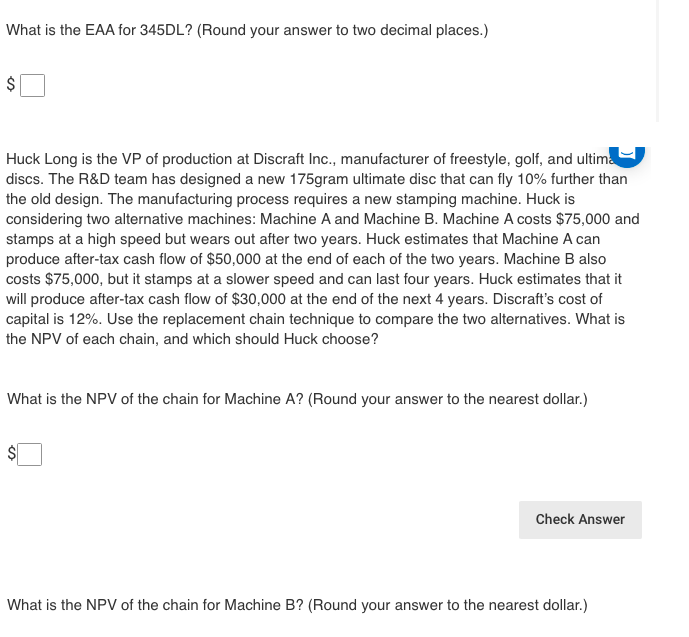

Mike Mulligan, CEO of Mulligan Excavation Inc, needs to replace Mary Anne, his old steam- driven shovel. Mike is looking at three used Caterpillar hydraulic excavators. Each alternative is a different model and each is a different age, and so each has a different expected working life and productive capability. Mike has produced estimates (in the table below) of the purchase price of each excavator and the associated after-tax cash flows that he expects to earn. Mike's cost of capital is 10%. Using the equivalent annual annuity approach, answer the following questions to find which excavator Mike should purchase. Time 0 1 3 Cash flows for Hydraulic Excavators By Model 4 385 CL -140 50 65 40 30 365 CL -110 95 40 345 DL -120 50 40 65 What is the EAA for 385CL? (Round your answer to two decimal places.) What is the EAA for the 365CL? (Round your answer to two decimal places.) What is the EAA for 345DL? (Round your answer to two decimal places.) $ Huck Long is the VP of production at Discraft Inc., manufacturer of freestyle, golf, and ultima discs. The R&D team has designed a new 175gram ultimate disc that can fly 10% further than the old design. The manufacturing process requires a new stamping machine. Huck is considering two alternative machines: Machine A and Machine B. Machine A costs $75,000 and stamps at a high speed but wears out after two years. Huck estimates that Machine A can produce after-tax cash flow of $50,000 at the end of each of the two years. Machine B also costs $75,000, but it stamps at a slower speed and can last four years. Huck estimates that it will produce after-tax cash flow of $30,000 at the end of the next 4 years. Discraft's cost of capital is 12%. Use the replacement chain technique to compare the two alternatives. What is the NPV of each chain, and which should Huck choose? What is the NPV of the chain for Machine A? (Round your answer to the nearest dollar.) $ Check Answer What is the NPV of the chain for Machine B? (Round your answer to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which excavator Mike should purchase using the equivalent annual annuity EAA approach we need to calculate the EAA for each excavator and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started