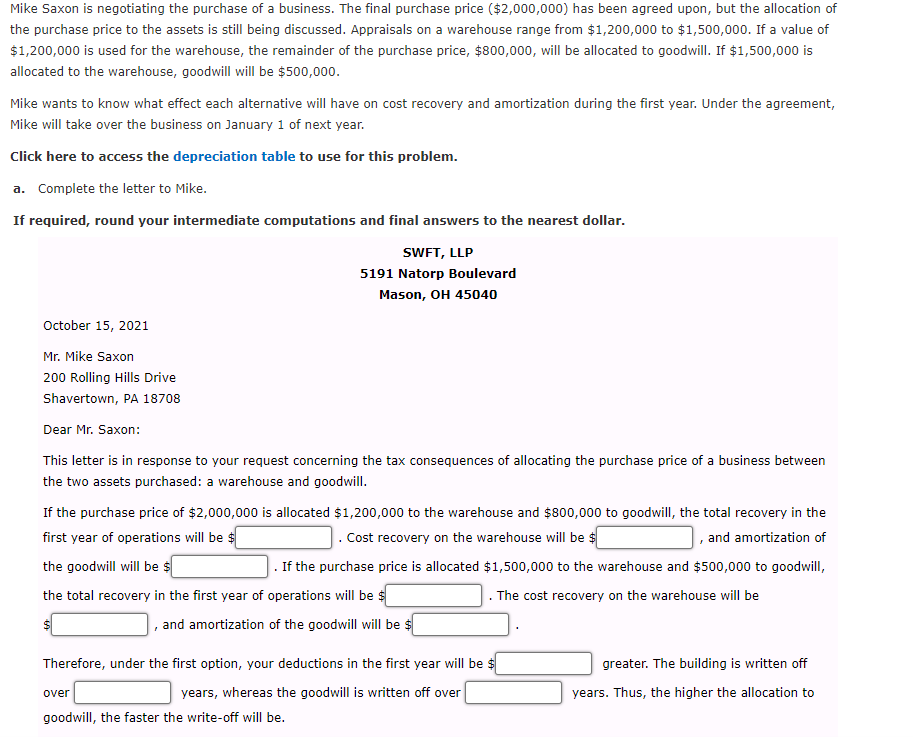

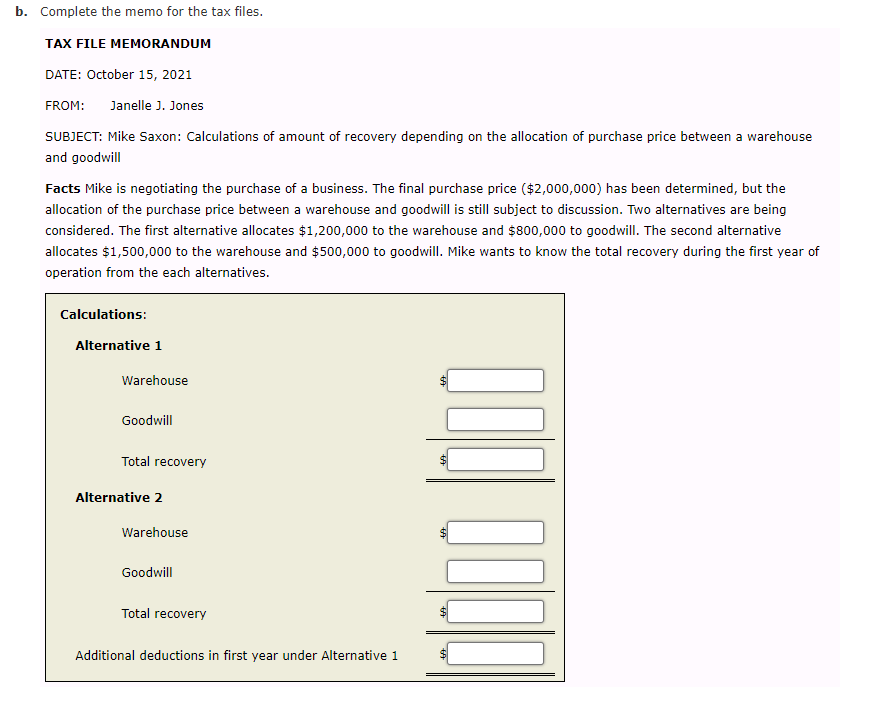

Mike Saxon is negotiating the purchase of a business. The final purchase price ($2,000,000) has been agreed upon, but the allocation of the purchase price to the assets is still being discussed. Appraisals on a warehouse range from $1,200,000 to $1,500,000. If a value of $1,200,000 is used for the warehouse, the remainder of the purchase price, $800,000, will be allocated to goodwill. If $1,500,000 is allocated to the warehouse, goodwill will be $500,000. Mike wants to know what effect each alternative will have on cost recovery and amortization during the first year. Under the agreement, Mike will take over the business on January 1 of next year. Click here to access the depreciation table to use for this problem. a. Complete the letter to Mike. If required, round your intermediate computations and final answers to the nearest dollar. SWFT, LLP 5191 Natorp Boulevard Mason, OH 45040 October 15, 2021 Mr. Mike Saxon 200 Rolling Hills Drive Shavertown, PA 18708 Dear Mr. Saxon: This letter is in response to your request concerning the tax consequences of allocating the purchase price of a business between the two assets purchased: a warehouse and goodwill. If the purchase price of $2,000,000 is allocated $1,200,000 to the warehouse and $800,000 to goodwill, the total recovery in the first year of operations will be $ . Cost recovery on the warehouse will be $ , and amortization of the goodwill will be $ . If the purchase price is allocated $1,500,000 to the warehouse and $500,000 to goodwill, the total recovery in the first year of operations will be $ The cost recovery on the warehouse will be and amortization of the goodwill will be $ greater. The building is written off Therefore, under the first option, your deductions in the first year will be $ over years, whereas the goodwill is written off over goodwill, the faster the write-off will be. years. Thus, the higher the allocation to b. Complete the memo for the tax files. TAX FILE MEMORANDUM DATE: October 15, 2021 FROM: Janelle J. Jones SUBJECT: Mike Saxon: Calculations of amount of recovery depending on the allocation of purchase price between a warehouse and goodwill Facts Mike is negotiating the purchase of a business. The final purchase price ($2,000,000) has been determined, but the allocation of the purchase price between a warehouse and goodwill is still subject to discussion. Two alternatives are being considered. The first alternative allocates $1,200,000 to the warehouse and $800,000 to goodwill. The second alternative allocates $1,500,000 to the warehouse and $500,000 to goodwill. Mike wants to know the total recovery during the first year of operation from the each alternatives. Calculations: Alternative 1 Warehouse Goodwill Total recovery Alternative 2 Warehouse Goodwill Total recovery nha Additional deductions in first year under Alternative 1 $