Question

Mike works as an investment analyst in OBECO, a giant funds of funds company with over $2 trillion assets under management (AUM). OBECO diversifies its

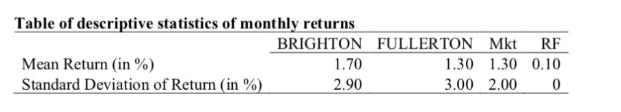

Mike works as an investment analyst in OBECO, a giant "funds of funds" company with over $2 trillion assets under management (AUM). OBECO diversifies its $2 trillion AUM among a number of professional managers' actively managed funds. Thus, the overall holdings of OBECO resembles a well-diversified portfolio with the same risk-retum profile as that of the market portfolio Mike is preparing for a meeting with his directors, Jennifer and Harry, to discuss whether their firm (OBECO) should allocate $20 million to the two actively managed funds, BRIGHTON and FULLERTON, respectively. Both funds are not in the current holdings of OBECO. To evaluate their fund performance, Mike gathered the monthly data over the past five years, and has prepared the following descriptive statistics for the two funds, the market portfolio (denoted as Mkt), and the risk-free asset (denoted as RF). See below:

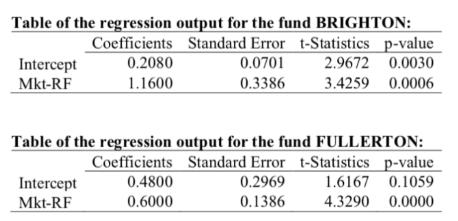

Mike believes that the excess returns of both funds are influenced by changes in excess returns of the market portfolio (denoted as Mkt-RF), so he uses the single-factor model by regressing the excess retum of the fund on that of the market. He obtains the following regression output for the two funds:

a). Based on the information above, select the more appropriate performance measure between Sharpe ratio and Treynor ratio to explain whether OBECO should allocate $20 million to FULLERTON or not?

b). During the meeting, Mike proposes that they should also allocate investments to BRIGHTON. He argues the fund manager of BRIGHTON is able to generate superior profits in the future, which is evidenced by the regression output in the table that BRIGHTON generated strong positive alphas relative to the benchmark during the past five years. He also adds that the large alpha generated by BRIGHTON is a clear indication of market inefficiency. However, Jennifer disagrees on Mike's proposal and arguments. Based on her knowledge of mutual fund performances and market efficiency, Jennifer believes Mike's arguments have several flaws and there are caveats in the regression analysis performed by Mike. Provide two valid reasons to explain why we should refute Mike's proposal and arguments.

c). During the meeting, Harry showed strong interests in BRIGHTON and requested Mike to design an arbitrage strategy, which could profit from the positive alpha of BRIGHTON. The strategy should only involve BRIGHTON, the market portfolio (Mkt), and the risk-free asset (RF). Describe how to set up the strategy. What is the weight on the risk-free asset in the strategy?

d). During the meeting. Harry told Mike that he identified another good-performing fund NEURIZON. The fund adopts a long-term investment strategy by investing in stocks of which the prior 5-year cumulative returns were among the bottom 20% of all stocks in the market. That is, NEURIZON buys these "fallen angels", which had a prior 5-year underperformance, and holds them for about 3 years before rebalancing. It turns out that NEURIZON's investment strategy works well for its fund investors. Not only for NEURIZON, other funds adopting NEURIZON's investment strategy also performs well for their investors. On average, these NEURIZON-type funds have earned superior cumulative abnormal returns over and above the CAPM for decades. Please interpret whether the superior performance of NEURIZON's investment strategy is a violation of the Efficient Market Hypothesis or not. (

Table of descriptive statistics of monthly returns BRIGHTON Mean Return (in %) Standard Deviation of Return (in %) 1.70 2.90 FULLERTON Mkt RF 1.30 1.30 0.10 3.00 2.00 0

Step by Step Solution

3.39 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

a Based on the information above select the more appropriate performance measure between Sharpe ratio and Treynor ratio to explain whether OBECO should allocate 20 million to FULLERTON or not The Shar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started