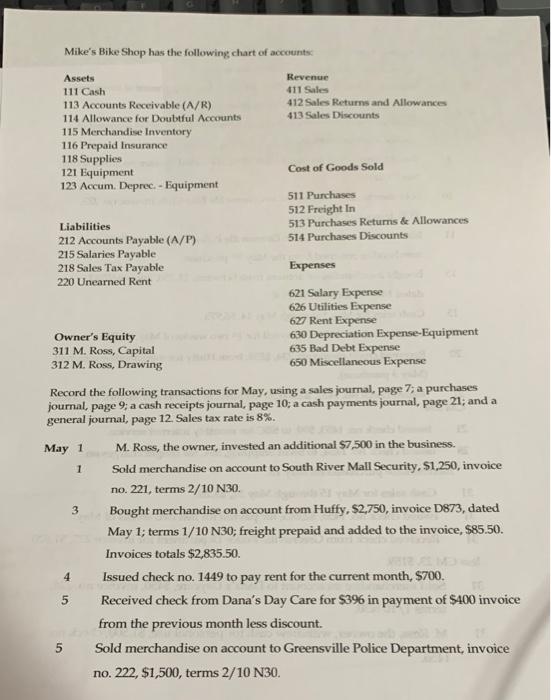

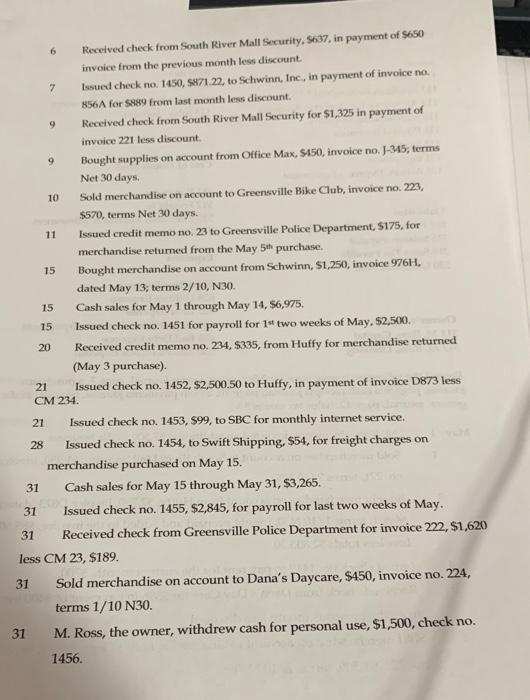

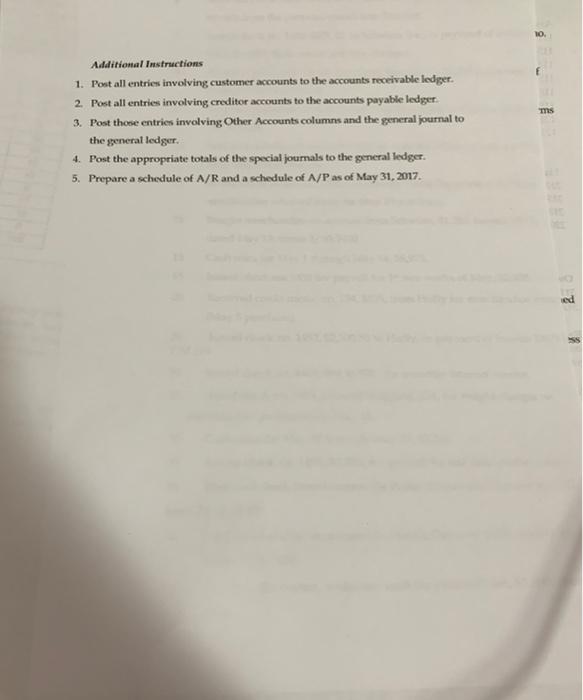

Mike's Bike Shop has the following chart of accounts Assets Revenue 111 Cash 411 Sales 113 Accounts Receivable (A/R) 412 Sales Returns and Allowances 114 Allowance for Doubtful Accounts 413 Sales Discounts 115 Merchandise Inventory 116 Prepaid Insurance 118 Supplies 121 Equipment Cost of Goods Sold 123 Accum. Deprec. - Equipment 511 Purchases 512 Freight In Liabilities 513 Purchases Returns & Allowances 212 Accounts Payable (A/P) 514 Purchases Discounts 215 Salaries Payable 218 Sales Tax Payable Expenses 220 Unearned Rent 621 Salary Expense 626 Utilities Expense 627 Rent Expense Owner's Equity 630 Depreciation Expense-Equipment 311 M. Ross, Capital 635 Bad Debt Expense 312 M. Ross, Drawing 650 Miscellaneous Expense Record the following transactions for May, using a sales journal, page 7; a purchases journal, page 9; a cash receipts journal, page 10; a cash payments journal, page 21; and a general journal, page 12. Sales tax rate is 8%. May 1 M. Ross, the owner, invested an additional $7,500 in the business. Sold merchandise on account to South River Mall Security, $1,250, invoice no. 221, terms 2/10 N30 Bought merchandise on account from Huffy, $2,750, invoice D873, dated May 1; terms 1/10 N30; freight prepaid and added to the invoice, $85.50. Invoices totals $2,835.50 Issued check no. 1449 to pay rent for the current month, $700. 5 Received check from Dana's Day Care for $396 in payment of $400 invoice from the previous month less discount 5 Sold merchandise on account to Greensville Police Department, invoice no. 222, $1,500, terms 2/10 N30 1 3 4 6 9 9 10 11 15 15 Received check from South River Mall Security, 5637, in payment of S650 invoice from the previous month less discount 7 Issued check no. 1450, 5871.22. to Schwinn, Inc., in payment of invoice no 856A for SR89 from last month less discount. Received check from South River Mall Security for $1,325 in payment of invoice 221 less discount. Bought supplies on account from Office Max, $450, invoice no. 1-345; terms Net 30 days Sold merchandise on account to Greensville Bike Club, invoice no. 223, $570, terms Net 30 days. Issued credit memo no. 23 to Greensville Police Department, $175, for merchandise returned from the May 5th purchase, 15 Bought merchandise on account from Schwinn, $1,250, invoice 976H, dated May 13, terms 2/10, N30. Cash sales for May 1 through May 14, 56,975. Issued check no. 1451 for payroll for 1 two weeks of May, $2,500. Received credit memo no. 234, 5335, from Huffy for merchandise returned (May 3 purchase) Issued check no. 1452, $2,500.50 to Huffy, in payment of invoice D873 less CM 234. Issued check no. 1453, 599, to SBC for monthly internet service. Issued check no. 1454, to Swift Shipping, $54, for freight charges on merchandise purchased on May 15. 31 Cash sales for May 15 through May 31, $3,265. 31 Issued check no. 1455, $2,845, for payroll for last two weeks of May. 31 Received check from Greensville Police Department for invoice 222, $1,620 less CM 23, $189. 31 Sold merchandise on account to Dana's Daycare, $450, invoice no. 224, terms 1/10 N30 31 M. Ross, the owner, withdrew cash for personal use, $1,500, check no. 1456. 20 21 21 28 ms Additional Instructions 1. Post all entries involving customer accounts to the accounts receivable ledger. 2. Post all entries involving creditor accounts to the accounts payable ledger 3. Post those entries involving Other Accounts columns and the general journal to the general ledger. 4. Post the appropriate totals of the special journals to the general ledger 5. Prepare a schedule of A/R and a schedule of A/P as of May 31, 2017. 2 SS