Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mila Limited (ML) is considering whether to lease or purchase a piece of equipment. The following information is relevant to these options: Buy: The

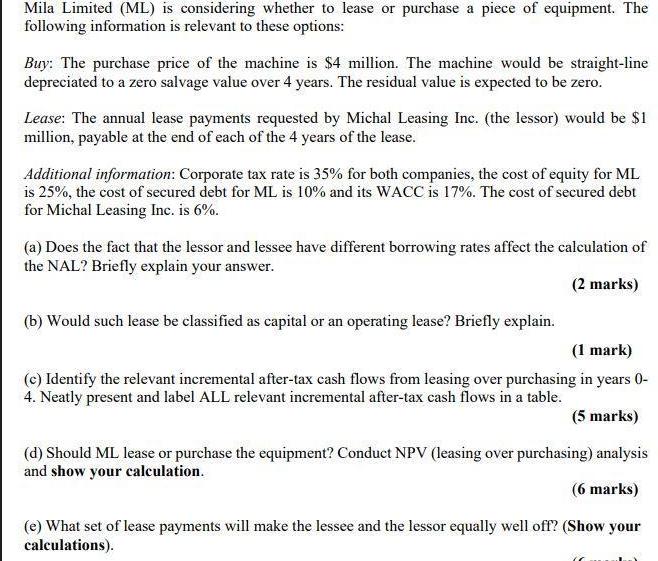

Mila Limited (ML) is considering whether to lease or purchase a piece of equipment. The following information is relevant to these options: Buy: The purchase price of the machine is $4 million. The machine would be straight-line depreciated to a zero salvage value over 4 years. The residual value is expected to be zero. Lease: The annual lease payments requested by Michal Leasing Inc. (the lessor) would be $1 million, payable at the end of each of the 4 years of the lease. Additional information: Corporate tax rate is 35% for both companies, the cost of equity for ML is 25%, the cost of secured debt for ML is 10% and its WACC is 17%. The cost of secured debt for Michal Leasing Inc. is 6%. (a) Does the fact that the lessor and lessee have different borrowing rates affect the calculation of the NAL? Briefly explain your answer. (b) Would such lease be classified as capital or an operating lease? Briefly explain. (2 marks) (1 mark) (c) Identify the relevant incremental after-tax cash flows from leasing over purchasing in years 0- 4. Neatly present and label ALL relevant incremental after-tax cash flows in a table. (5 marks) (d) Should ML lease or purchase the equipment? Conduct NPV (leasing over purchasing) analysis and show your calculation. (6 marks) (e) What set of lease payments will make the lessee and the lessor equally well off? (Show your calculations).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started