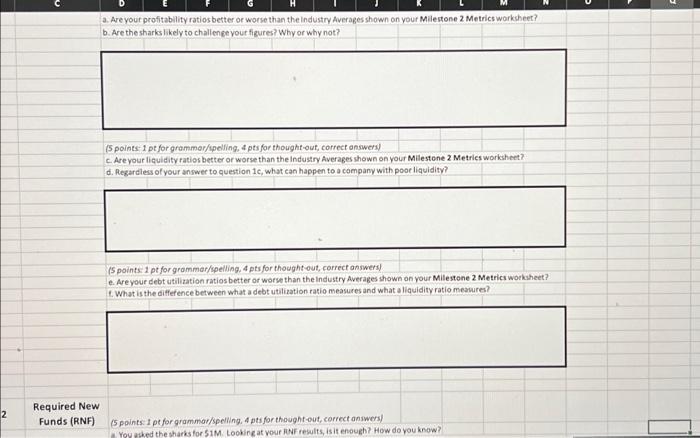

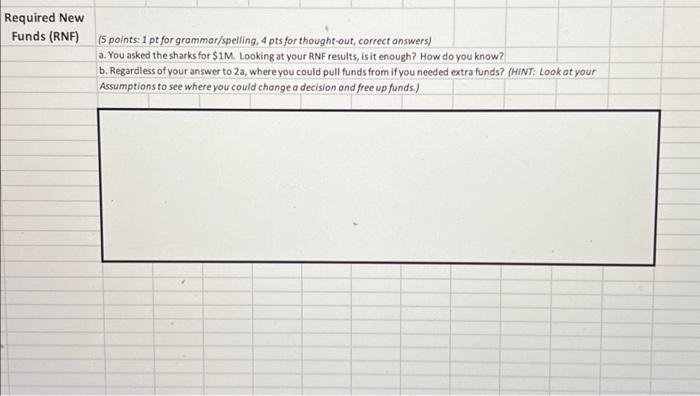

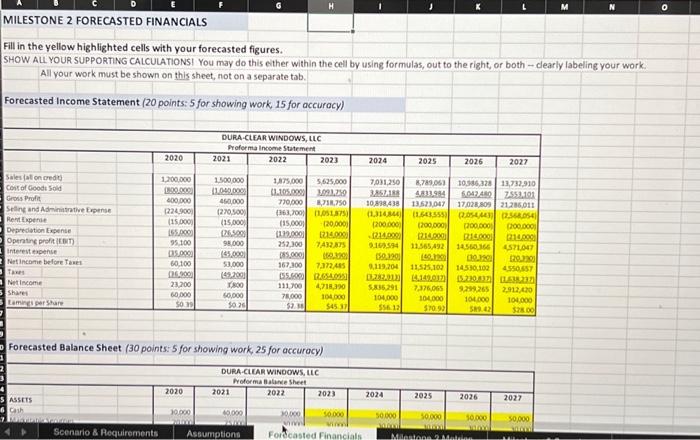

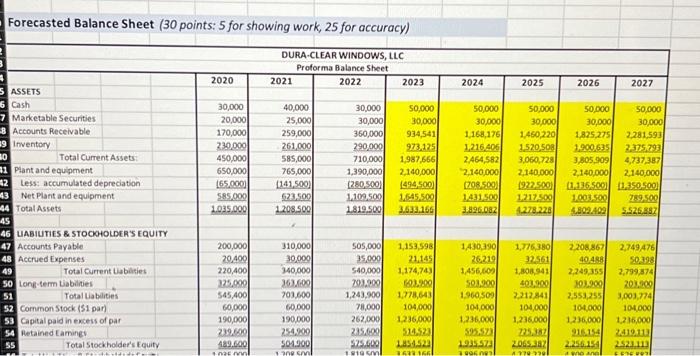

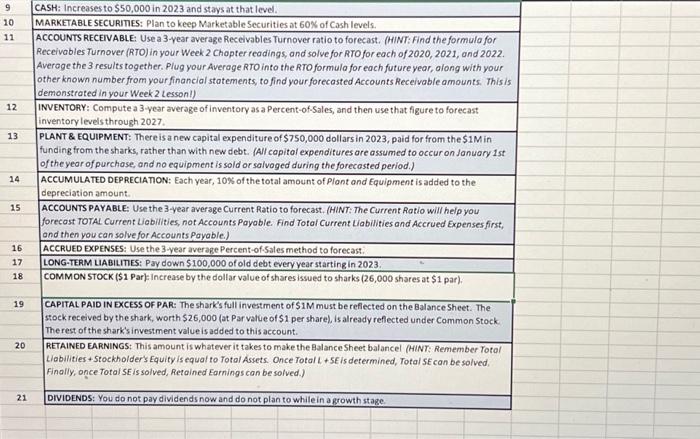

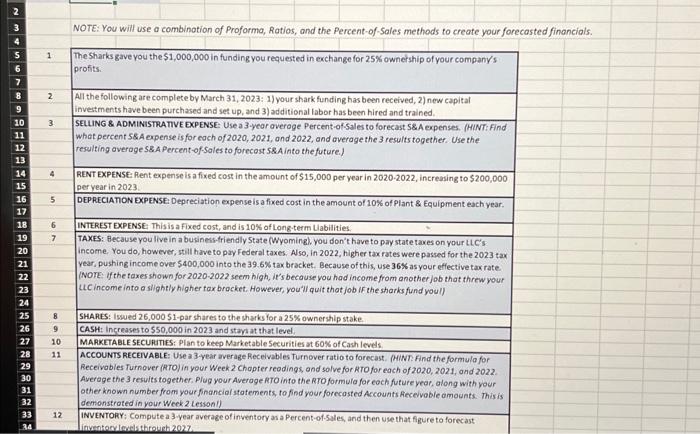

MILESTONE 2 FORECASTED FINANCIALS Fill in the yellow highlighted cells with your forecasted figures. SHOW ALL YOUR SUPPORTING CALCULATIONSI You may do this either within the cell by using formulas, out to the right, or both - clearly labeling your work. All your work must be shown on this sheet, not on a separate tab. Forecasted Income Statement (20 points: 5 for showing work, 15 for accuracy) DURA-CIEAR WINDONS, ILC Forecasted Balance Sheet (30 points: 5 for showing work, 25 for accurocy) DURA-CIEAR WINOOWS, IIC Foterma Bative sheet Required New Funds (RNF) (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. You asked the sharks for $1M. Looking at your RNF results, is it enough? How do you know? b. Regardless of your answer to 2a, where you could pull funds from if you needed extra funds? (HiNT: Look ot your Assumptions to see where you could change a decision and free up funds.) Forecasted Balance Sheet ( 30 points: 5 for showing work, 25 for accuracy) DURA-CLEAR WINDOWS, LLC Proforma Balance Sheet 9 CASH: Increases to $50,000 in 2023 and stays at that level. 10 11 MARKETABLE SECURITIES: Plan to keep Marketable Securities at 60K of Cash levels. ACCOUNTS RECEIVABLE: Usea 3-year average Receivables Turnover ratio to forecast. (HINT: Find the formula for Receivables Turnover (RTO) in your Week 2 Chopter readings, and solve for RTO for each of 2020, 2021, and 2022. Average the 3 results together. Plug your Average RTO into the RTO formula for each future year, olong with your other known number from your financial statements, to find your forecasted Accounts Receivable amounts. This is demonstroted in your Week 2 (essonl) 12 13 INVENTORY: Compute a 3 -year average of inventory as a Percent-of-Sales, and then use that figure to forecast inventory levels through 2027. PLANT \& EQUIPMENT: There is a new capital expenditure of $750,000 dollars in 2023 , paid for from the $1M in funding from the sharks, rather than with new debt. (All copitol expendifures ore assumed to occur on Januory 1 st of the year of purchose, and no equipment is sold or salvoged during the forecasted period.) 14 15 16 17 18 19 20 depreciation amount. ACCOUNTS PAYABLE: Use the 3 -year average Current Ratio to forecast. (HINT: The Current Rotio will help you forecast TOTAL Current Liabilities, not Accounts Payable. Find Total Current Liabilities and Accrued Expenses first, and then you can solve for Accounts Payable.) stock received by the shark, worth $26,000 (at Par value of $1 per share), is already reflected under Common Stock. The rest of the shark's investment value is added to this account. RETAINED EARNINGS: This amount is whatever it takes to make the Balance Sheet balancel (HINT: Remember Total Llabilities + Stockholder's Equity is equal to Total Assets. Once Total L+5E is determined, Total SE can be solved; Finally, once Total SE is solved, Retoined Earnings can be solved.) 21 DIVIOENDS: You do not pay dividends now and do not plan to while in a growth stage. a. Are your profitability ratios bester or worse than the industry Averages shown on your Milestone 2 Metrics worksheer? b. Are the sharks likely to chalien ee vout figures? Why or why not? (5 points- 1 pt for grammer/ipelling, 4 pts for thought-out, correct answers) c. Are your liquidity ratior better or worse than the industry Averages shown on your Milestone 2 Metrics worksheet? d. Regardless of your answer to question 1C, what can happen to a company with pooe liquidity? (S points 1 pt for grammar/spelling, 4 pts for thought-out, carrect answers) e. Are your debt utilization ratios better or worse than the industry Averages shown on your Milestone 2 Metrica workacet? 1. What is the diffefence between what a debt utilization ratio measures and what a liquidity ratio mearure? Required New Funds (RNF) (5 points i peforgrammar/spelling, 4 pts for thought-out, correct answers) Youphed the sharksfor 51M Looking at your HWF results, is it enough? How do you know