Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Milk Ltd has the following financial instrument issued: 1) On 1 April 2018 an 8% 30 million convertible loan note was issued at par.

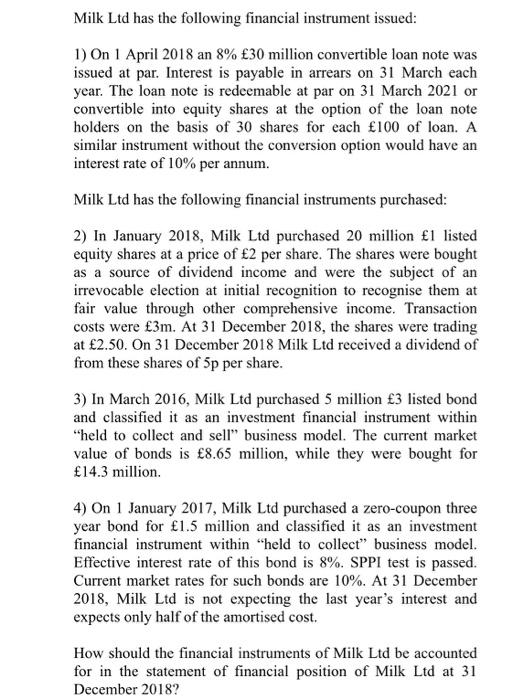

Milk Ltd has the following financial instrument issued: 1) On 1 April 2018 an 8% 30 million convertible loan note was issued at par. Interest is payable in arrears on 31 March each year. The loan note is redeemable at par on 31 March 2021 or convertible into equity shares at the option of the loan note holders on the basis of 30 shares for each 100 of loan. A similar instrument without the conversion option would have an interest rate of 10% per annum. Milk Ltd has the following financial instruments purchased: 2) In January 2018, Milk Ltd purchased 20 million 1 listed equity shares at a price of 2 per share. The shares were bought as a source of dividend income and were the subject of an irrevocable election at initial recognition to recognise them at fair value through other comprehensive income. Transaction costs were 3m. At 31 December 2018, the shares were trading at 2.50. On 31 December 2018 Milk Ltd reccived a dividend of from these shares of 5p per share. 3) In March 2016, Milk Ltd purchased 5 million 3 listed bond and classified it as an investment financial instrument within "held to collect and sell" business model. The current market value of bonds is 8.65 million, while they were bought for 14.3 million. 4) On 1 January 2017, Milk Ltd purchased a zero-coupon three year bond for 1.5 million and classified it as an investment financial instrument within "held to collect" business model. Effective interest rate of this bond is 8%. SPPI test is passed. Current market rates for such bonds are 10%. At 31 December 2018, Milk Ltd is not expecting the last year's interest and expects only half of the amortised cost. How should the financial instruments of Milk Ltd be accounted for in the statement of financial position of Milk Ltd at 31 December 2018?

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Stock of milk at end of year as c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started