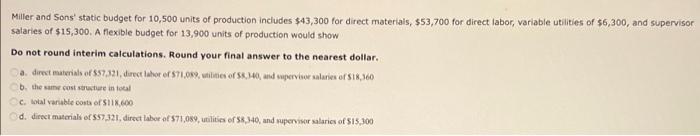

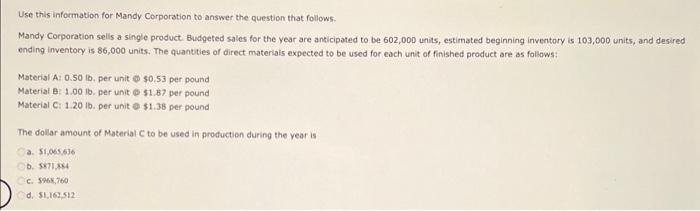

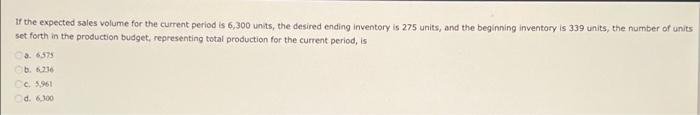

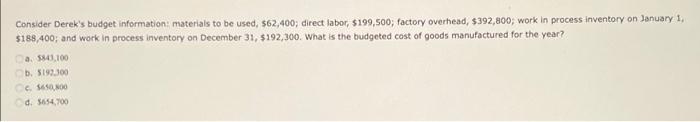

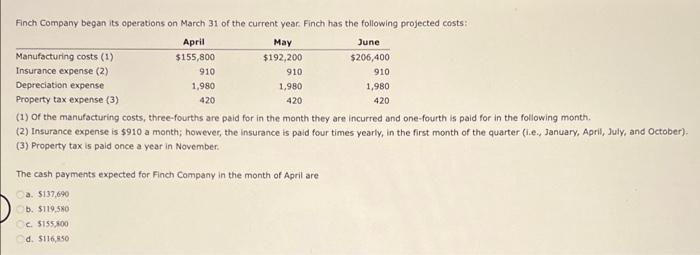

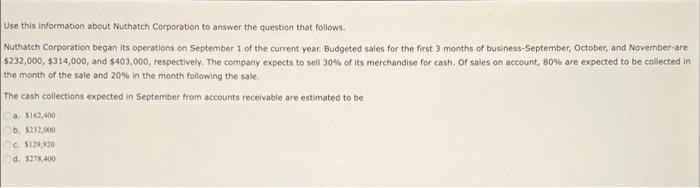

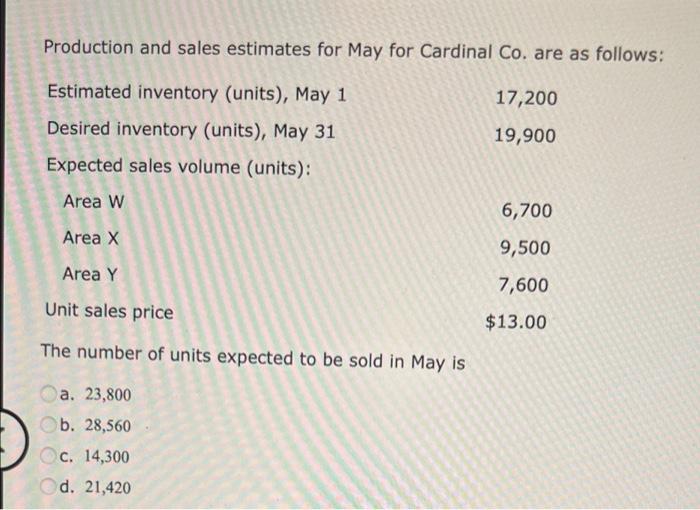

Miller and Sons' static budget for 10,500 units of production includes $43,300 for direct materials, $53,700 for direct labor, variable utilities of $6,300, and supervisor salaries of $15,300. A flexible budget for 13,900 units of production would show Do not round interim calculations. Round your final answer to the nearest dotlar. a direct materials of $37,331, direct later of 571,089, nilities of $8.340, and supervisor salaries of $13,160 b. the same costructure in total c. total variable costs of SHIX 600 d. direct materials of 557,321, direct labor of S71,089, utilities of 58.340, and supervisor salaries of 515,300 Use this information for Mandy Corporation to answer the question that follows Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 602,000 units, estimated beginning inventory is 103,000 units, and desired ending Inventory is 86,000 units. The quantities or direct materiais expected to be used for each unit of finished product are as follows: Material A: 0.50 lb, per unit $0,53 per pound Material: 1.00 ib. per unit $1.87 per pound Material C: 1.20 ib. per unit $1.38 per pound The dollar amount of Material to be used in production during the years a 31,065,636 b. 587134 c. 5963,700 d. 31.10.512 If the expected sales volume for the current period is 6,300 units, the desired ending Inventory is 275 units, and the beginning inventory is 339 units, the number of units set forth in the production budget, representing total production for the current period, is b36 c. 5,961 d. 6.300 Consider Derek's budget information materials to be used, $62,400; direct labor, $199,500; factory overhead, $392,800, work in process inventory on January 1, $188,400; and work in process inventory on December 31, $ 192,300. What is the budgeted cost of goods manufactured for the year? a. 5841.100 b. 5193.300 c. $SONO d. 5654.700 Finch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June Manufacturing costs (1) $155,800 $192,200 $206,400 Insurance expense (2) 910 910 910 Depreciation expense 1,980 1,980 1,980 Property tax expense (3) 420 420 420 (1) of the manufacturing costs, three-fourths are paid for in the month they are incurred and one-fourth is paid for in the following month. (2) Insurance expense is $910 a month; however, the insurance is paid four times yearly, in the first month of the quarter (1.e., January, April, July, and October). (3) Property tax is paid once a year in November The cash payments expected for Finch Company in the month of April are a. 5137,690 b. $119.50 C. 5155.00 d. $116.850 Use this information about Nuthatch Corporation to answer the question that follows. Nuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first 3 months of business-September, October, and November are $232,000, $314,000, and $403,000, respectively. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are expected to be collected in the month of the sale and 20% in the month following the sale. The cash collections expected in September from accounts receivable are estimated to be wa 5163.000 b. 5212.000 C5129.990 d. 5278.400 Production and sales estimates for May for Cardinal Co. are as follows: Estimated inventory (units), May 1 17,200 19,900 Desired inventory (units), May 31 Expected sales volume (units): Area W 6,700 Area X 9,500 Area Y 7,600 Unit sales price $13.00 The number of units expected to be sold in May is a. 23,800 b. 28,560 c. 14,300 d. 21,420