Question

Miller Hospital Case Suppose you are a new hire in the finance department of Miller Hospital, a not-for-profit hospital located in Southport. You are assigned

Miller Hospital Case

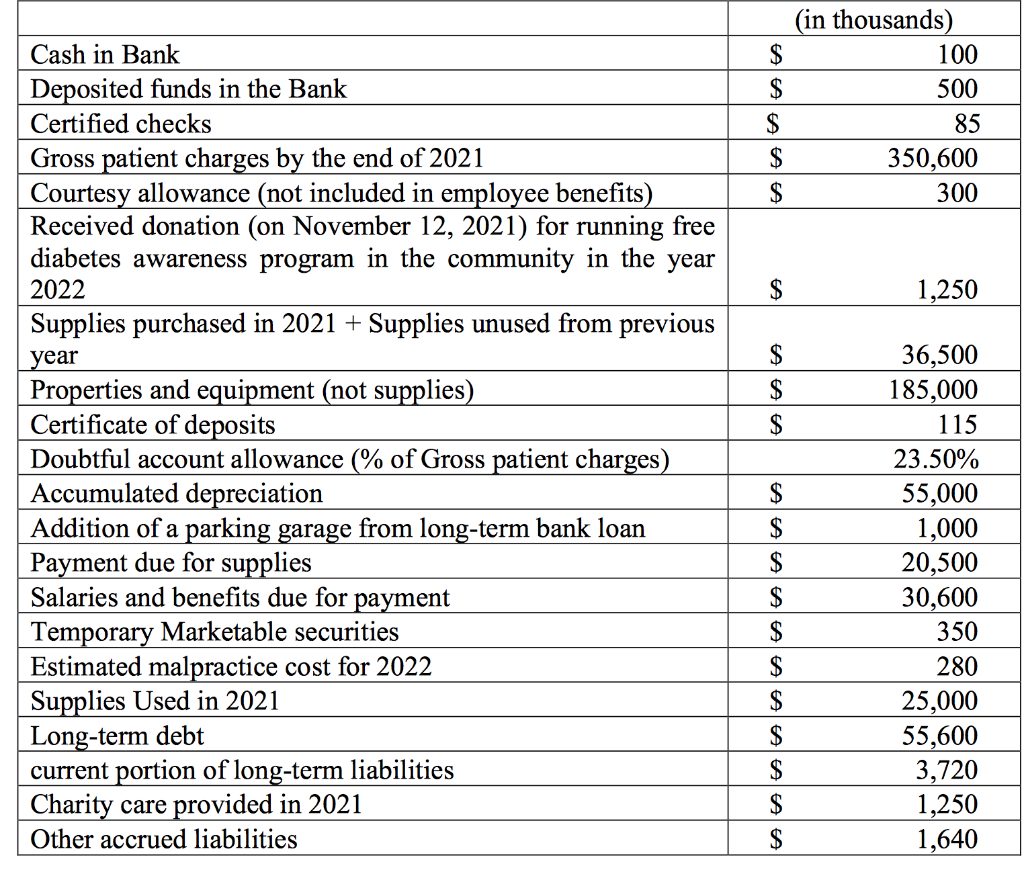

Suppose you are a new hire in the finance department of Miller Hospital, a not-for-profit hospital located in Southport. You are assigned to prepare a Balance Sheet for the year ending (December 31, 2021) using the following information. Please prepare a Balance Sheet for December 31, 2021, for Miller hospital on an Excel spreadsheet. Following are the transaction recorded on December 31, 2021

While you were preparing the Balance Sheet, you found that the following transaction was missing from the above information you received. Therefore, you updated the above information with the following information.

BMW is one of the major employers in Southport. The CEO of BMW plant donated $790,000 worth of medical supplies and $2,200,000 worth of Da Vinci Robotic Surgery System to the hospital in November 2021.

(PLEASE DO ON EXCEL SPREADSHEET WITH FORMULAS)

(in thousands) $ 100 $ 500 85 $ 350,600 $ 300 $ 1,250 $ $ $ Cash in Bank Deposited funds in the Bank Certified checks Gross patient charges by the end of 2021 Courtesy allowance (not included in employee benefits) Received donation (on November 12, 2021) for running free diabetes awareness program in the community in the year 2022 Supplies purchased in 2021 + Supplies unused from previous year Properties and equipment (not supplies) Certificate of deposits Doubtful account allowance (% of Gross patient charges) Accumulated depreciation Addition of a parking garage from long-term bank loan Payment due for supplies Salaries and benefits due for payment Temporary Marketable securities Estimated malpractice cost for 2022 Supplies Used in 2021 Long-term debt current portion of long-term liabilities Charity care provided in 2021 Other accrued liabilities $ $ $ $ $ 36,500 185,000 115 23.50% 55,000 1,000 20,500 30,600 350 280 25,000 55,600 3,720 1,250 1,640 $ $ $ $ $ $ (in thousands) $ 100 $ 500 85 $ 350,600 $ 300 $ 1,250 $ $ $ Cash in Bank Deposited funds in the Bank Certified checks Gross patient charges by the end of 2021 Courtesy allowance (not included in employee benefits) Received donation (on November 12, 2021) for running free diabetes awareness program in the community in the year 2022 Supplies purchased in 2021 + Supplies unused from previous year Properties and equipment (not supplies) Certificate of deposits Doubtful account allowance (% of Gross patient charges) Accumulated depreciation Addition of a parking garage from long-term bank loan Payment due for supplies Salaries and benefits due for payment Temporary Marketable securities Estimated malpractice cost for 2022 Supplies Used in 2021 Long-term debt current portion of long-term liabilities Charity care provided in 2021 Other accrued liabilities $ $ $ $ $ 36,500 185,000 115 23.50% 55,000 1,000 20,500 30,600 350 280 25,000 55,600 3,720 1,250 1,640 $ $ $ $ $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started