Question

Miller Manufacturing Company buys zeon for $.80 a liter. At the end of processing in Department 1, zeon splits off into products A, B, and

Miller Manufacturing Company buys zeon for $.80 a liter.

At the end of processing in Department 1, zeon splits off into products A, B, and C.

Product A is sold at the split-off point, with no further processing.

Products B and C require further processing before they can be sold; product B is processed in Department 2 and product C is processed in Department 3.

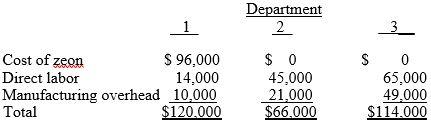

Following is a summary of costs and other related data for the year ended March 31, 2020:

There was no beginning or ending inventory of zeon.

Miller uses the Net-Realizable-Value method of allocating joint costs.

NOTE: A, B, C are Joint Products.

I need every answer you can get that why i did not put question

Department 2 3 Cost of zeon $ 96,000 Direct labor 14,000 Manufacturing overhead 10,000 Total $120.000 $ 0 45,000 21,000 $66,000 $ 0 65,000 49.000 $114.000 Department 2 3 Cost of zeon $ 96,000 Direct labor 14,000 Manufacturing overhead 10,000 Total $120.000 $ 0 45,000 21,000 $66,000 $ 0 65,000 49.000 $114.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started