Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Miller with corporate and personal taxes ____________. Answer options are displayed below it. After Modigliani and Miller's (MM) original no-tax theory, they went on to

Miller with corporate and personal taxes ____________.

Answer options are displayed below it.

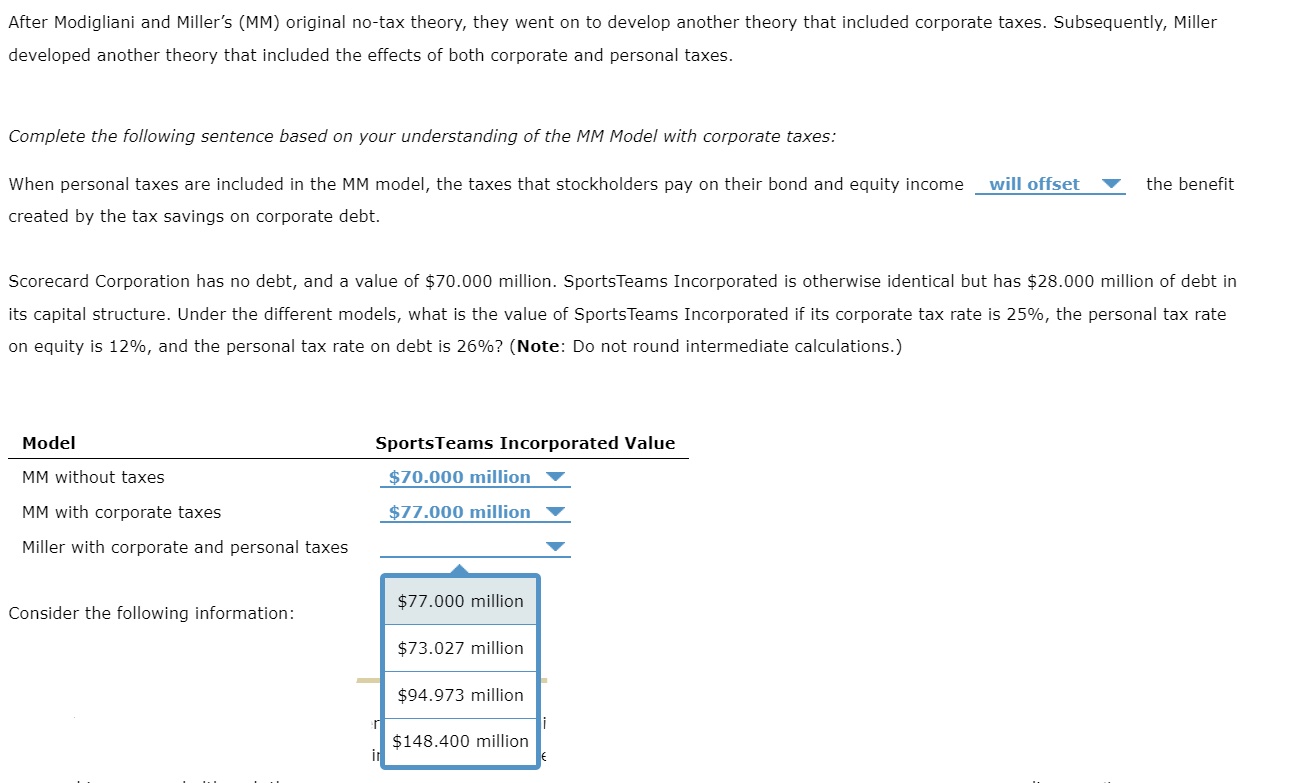

After Modigliani and Miller's (MM) original no-tax theory, they went on to develop another theory that included corporate taxes. Subsequently, Miller developed another theory that included the effects of both corporate and personal taxes. Complete the following sentence based on your understanding of the MM Model with corporate taxes: When personal taxes are included in the MM model, the taxes that stockholders pay on their bond and equity income will offset created by the tax savings on corporate debt. Scorecard Corporation has no debt, and a value of $70.000 million. Sports Teams Incorporated is otherwise identical but has $28.000 million of debt in its capital structure. Under the different models, what is the value of Sports Teams Incorporated if its corporate tax rate is 25%, the personal tax rate on equity is 12%, and the personal tax rate on debt is 26%? (Note: Do not round intermediate calculations.) Model MM without taxes MM with corporate taxes Miller with corporate and personal taxes Consider the following information: Sports Teams Incorporated Value $70.000 million $77.000 million $77.000 million $73.027 million $94.973 million the benefit $148.400 million

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To find the value of SportsTeams Incorporated under Millers model with corporate and personal taxes we can use the information provided MM without taxes 70000 million MM with corporate taxes 77000 mil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started