Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Millie Industries manufactures two products, Monogram and Signature, for industrial use. Millie's manufacturing facility is highly automated, with very little direct labour being involved

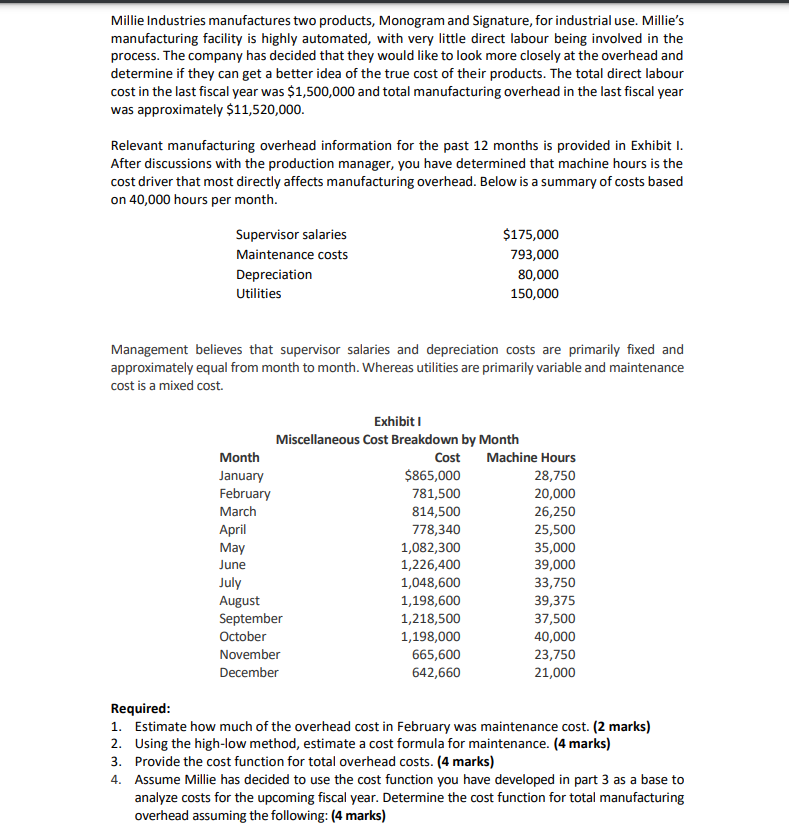

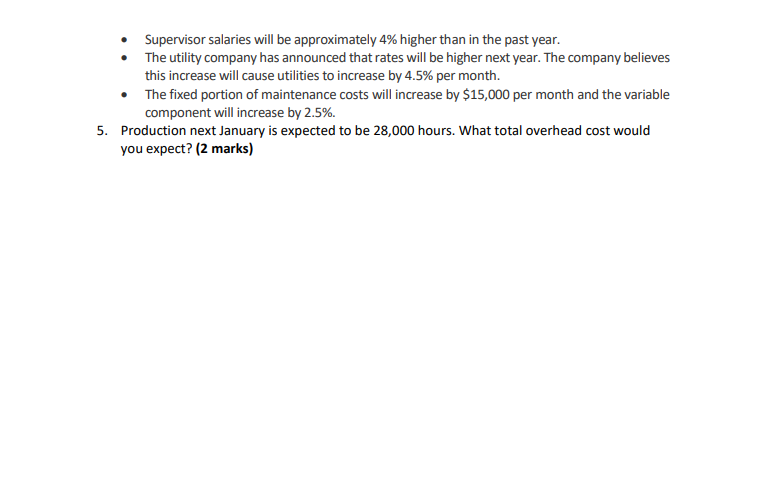

Millie Industries manufactures two products, Monogram and Signature, for industrial use. Millie's manufacturing facility is highly automated, with very little direct labour being involved in the process. The company has decided that they would like to look more closely at the overhead and determine if they can get a better idea of the true cost of their products. The total direct labour cost in the last fiscal year was $1,500,000 and total manufacturing overhead in the last fiscal year was approximately $11,520,000. Relevant manufacturing overhead information for the past 12 months is provided in Exhibit I. After discussions with the production manager, you have determined that machine hours is the cost driver that most directly affects manufacturing overhead. Below is a summary of costs based on 40,000 hours per month. Supervisor salaries Maintenance costs Depreciation Utilities $175,000 793,000 80,000 150,000 Management believes that supervisor salaries and depreciation costs are primarily fixed and approximately equal from month to month. Whereas utilities are primarily variable and maintenance cost is a mixed cost. Required: Exhibit I Miscellaneous Cost Breakdown by Month Month Cost Machine Hours January $865,000 28,750 February 781,500 20,000 March 814,500 26,250 April 778,340 25,500 May 1,082,300 35,000 June 1,226,400 39,000 July 1,048,600 33,750 August 1,198,600 39,375 September 1,218,500 37,500 October 1,198,000 40,000 November 665,600 23,750 December 642,660 21,000 1. Estimate how much of the overhead cost in February was maintenance cost. (2 marks) 2. Using the high-low method, estimate a cost formula for maintenance. (4 marks) 3. Provide the cost function for total overhead costs. (4 marks) 4. Assume Millie has decided to use the cost function you have developed in part 3 as a base to analyze costs for the upcoming fiscal year. Determine the cost function for total manufacturing overhead assuming the following: (4 marks) Supervisor salaries will be approximately 4% higher than in the past year. The utility company has announced that rates will be higher next year. The company believes this increase will cause utilities to increase by 4.5% per month. The fixed portion of maintenance costs will increase by $15,000 per month and the variable component will increase by 2.5%. 5. Production next January is expected to be 28,000 hours. What total overhead cost would you expect? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To estimate the maintenance cost in February we need to determine the variable portion of the maintenance cost First lets identify the high and low months based on machine hours High Month June 3900...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started