Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mills Corporation acquired as an investment $260 million of 5% bonds, dated July 1, on July 1, 2024. Company management is holding the bonds

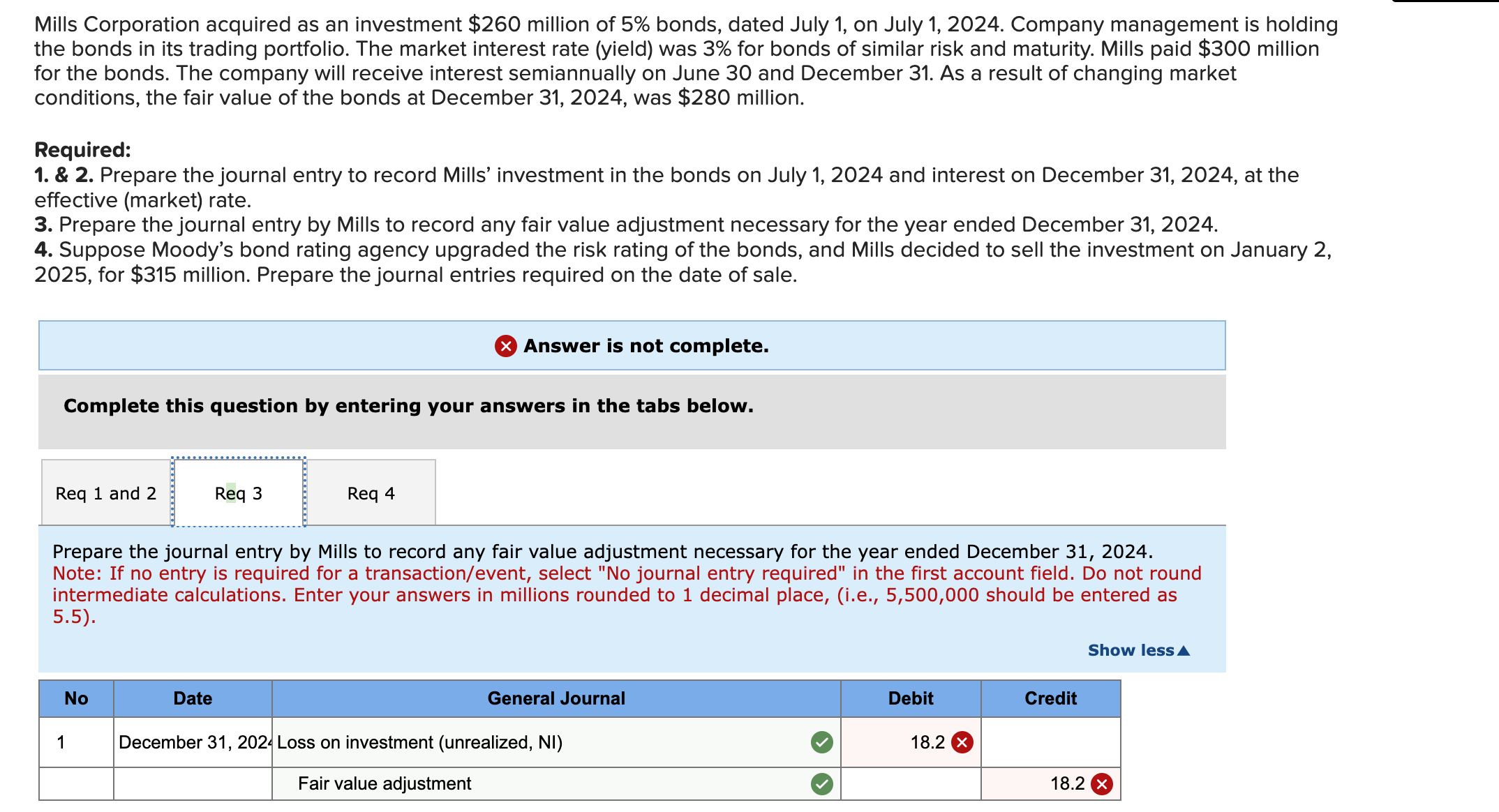

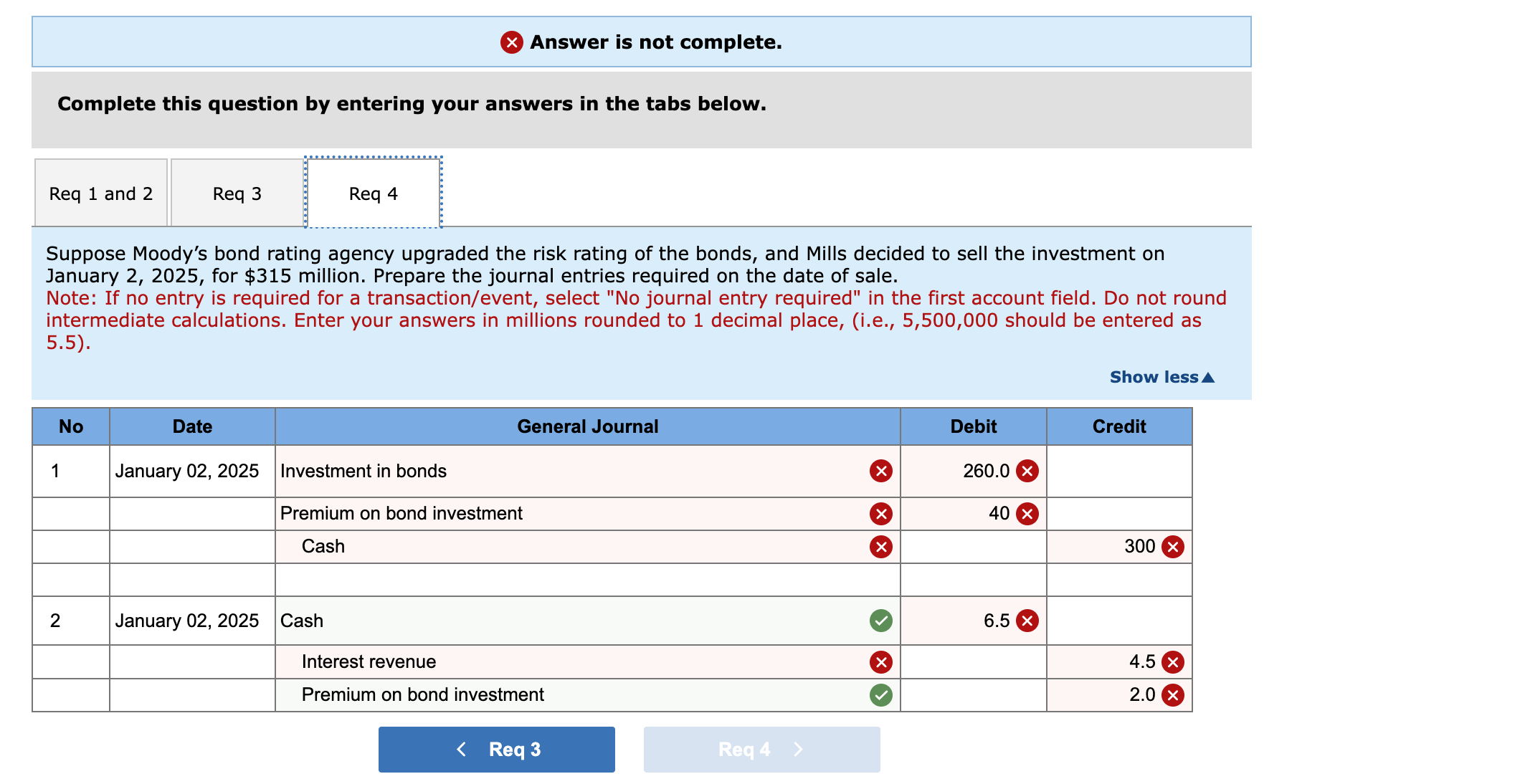

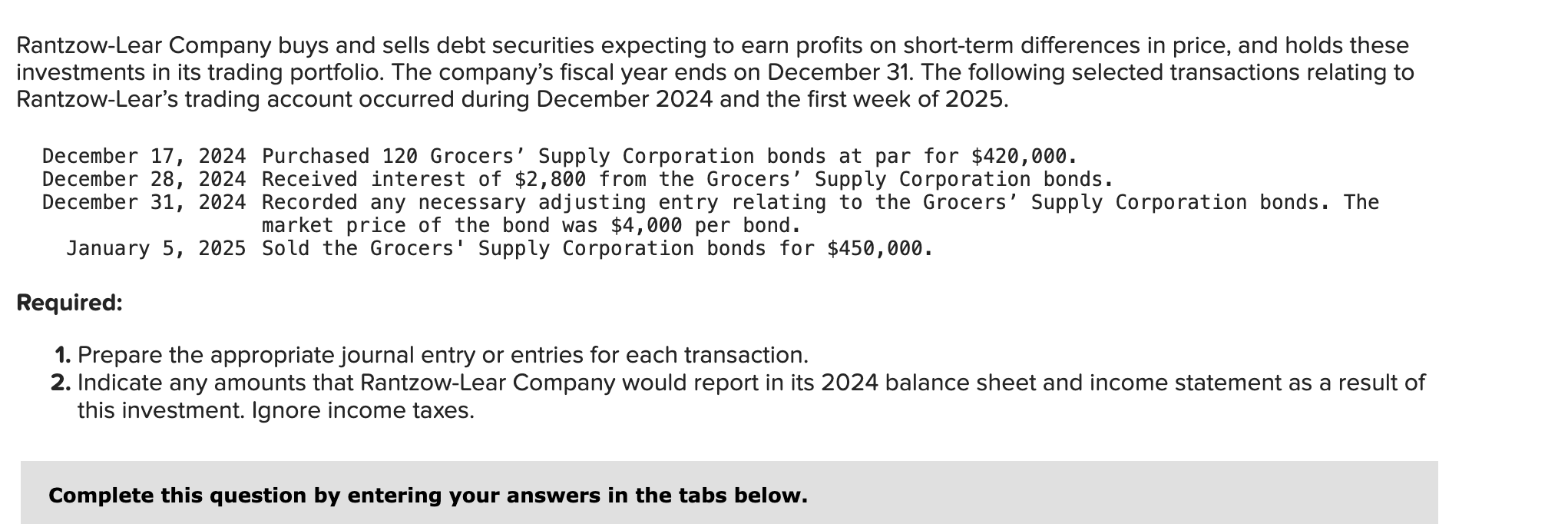

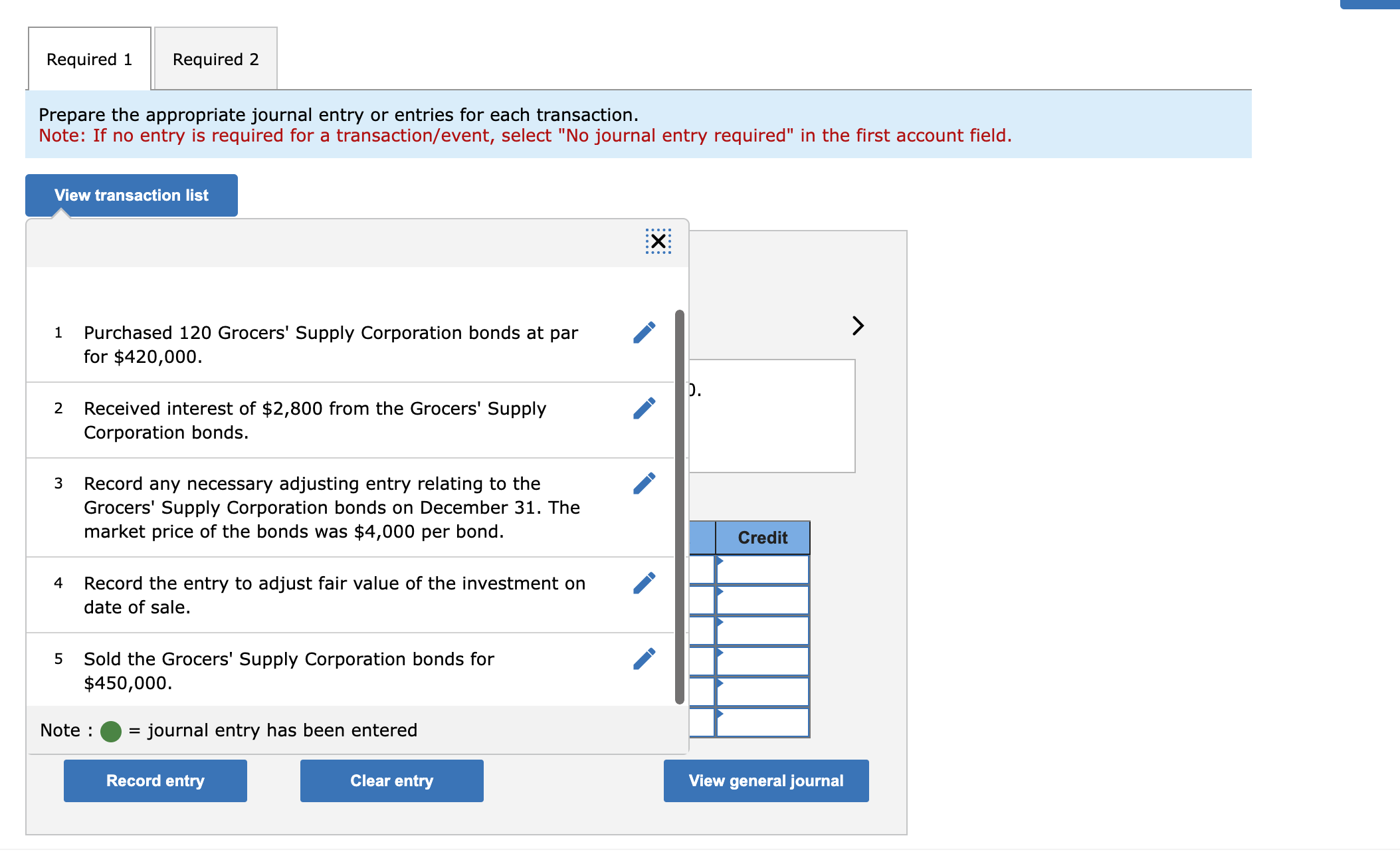

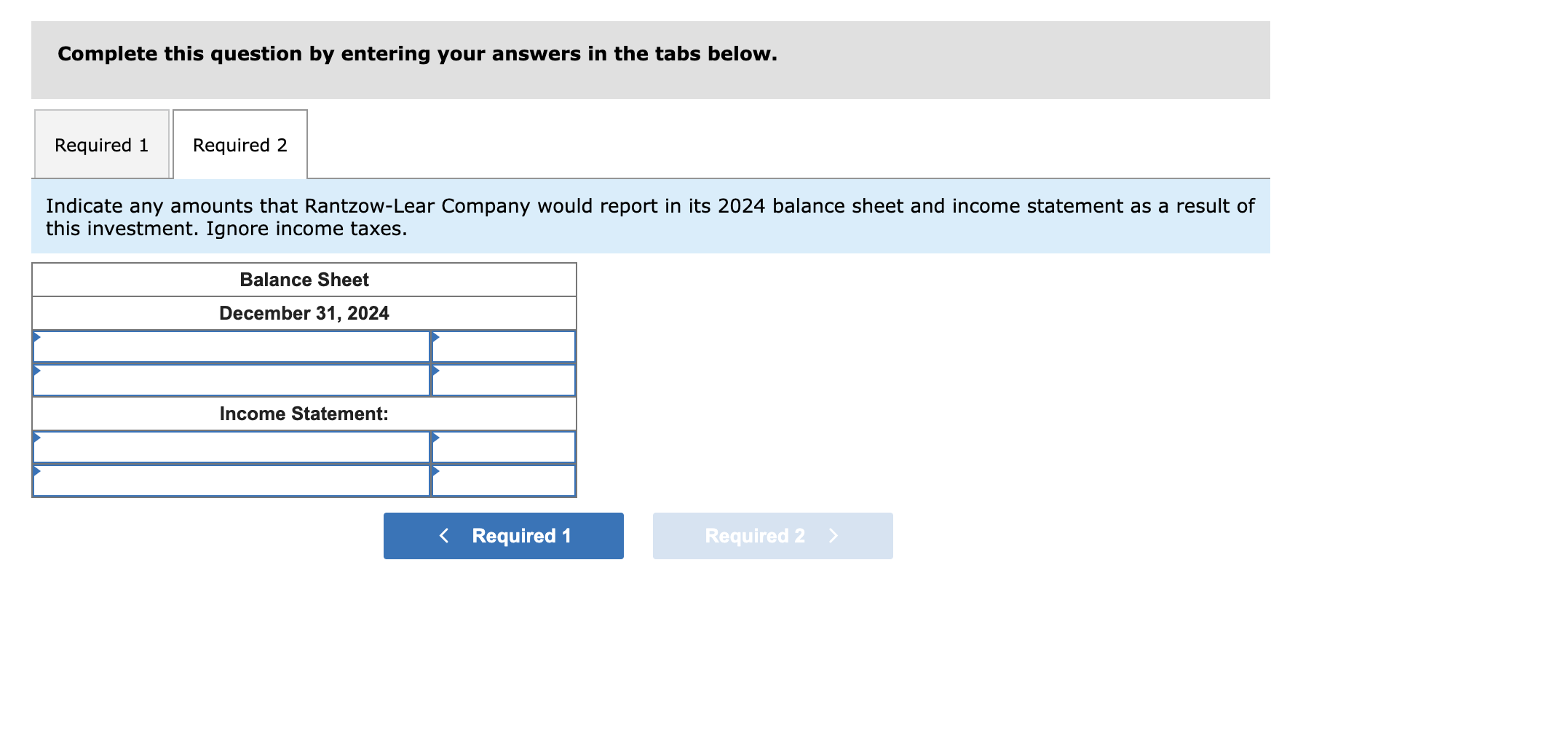

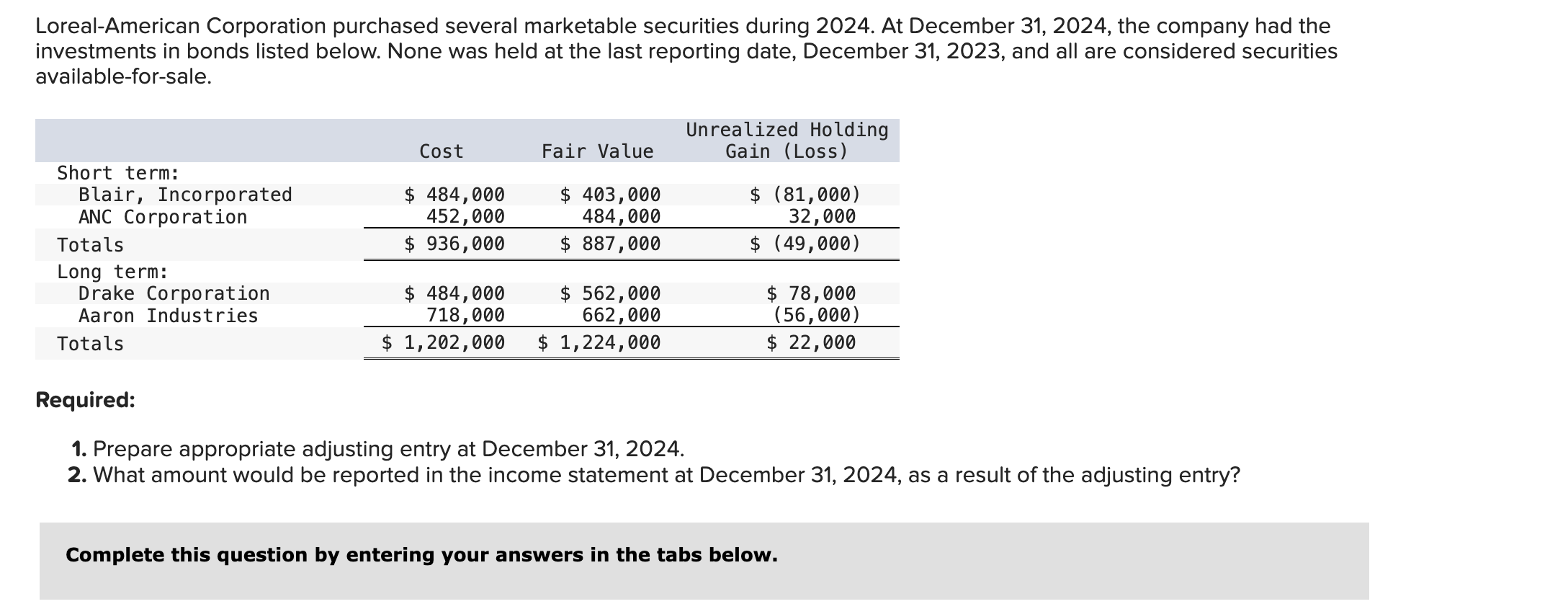

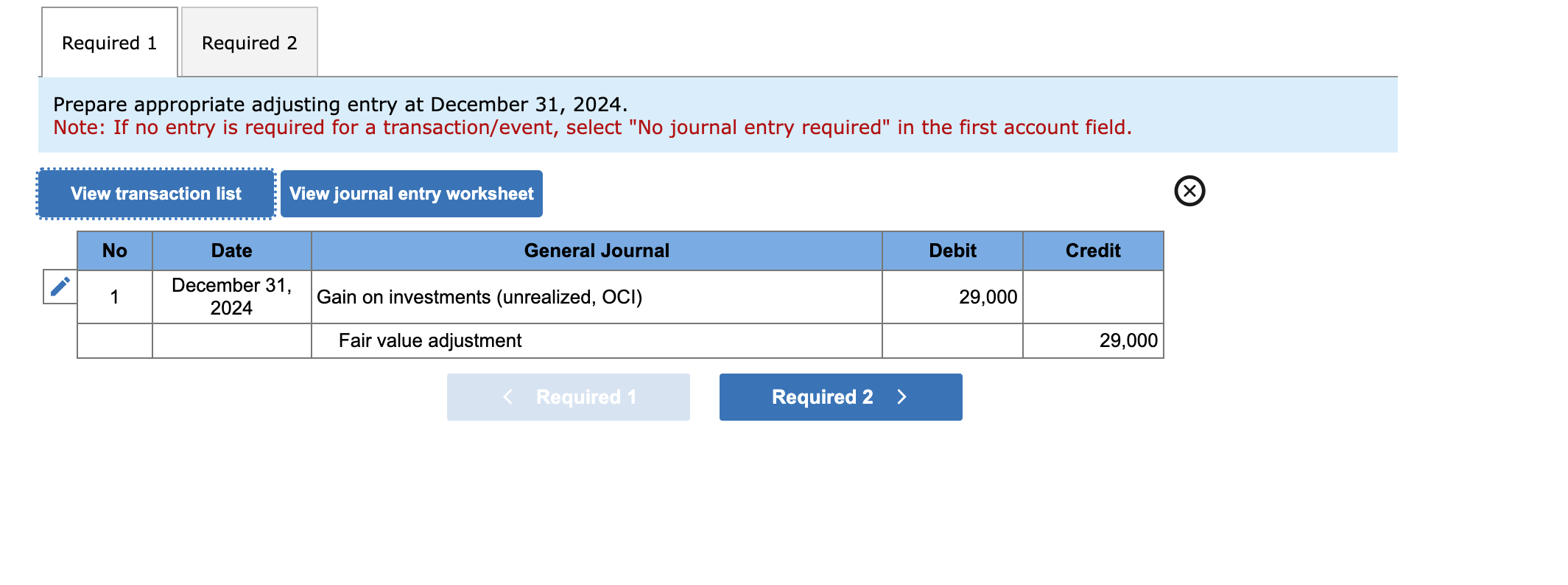

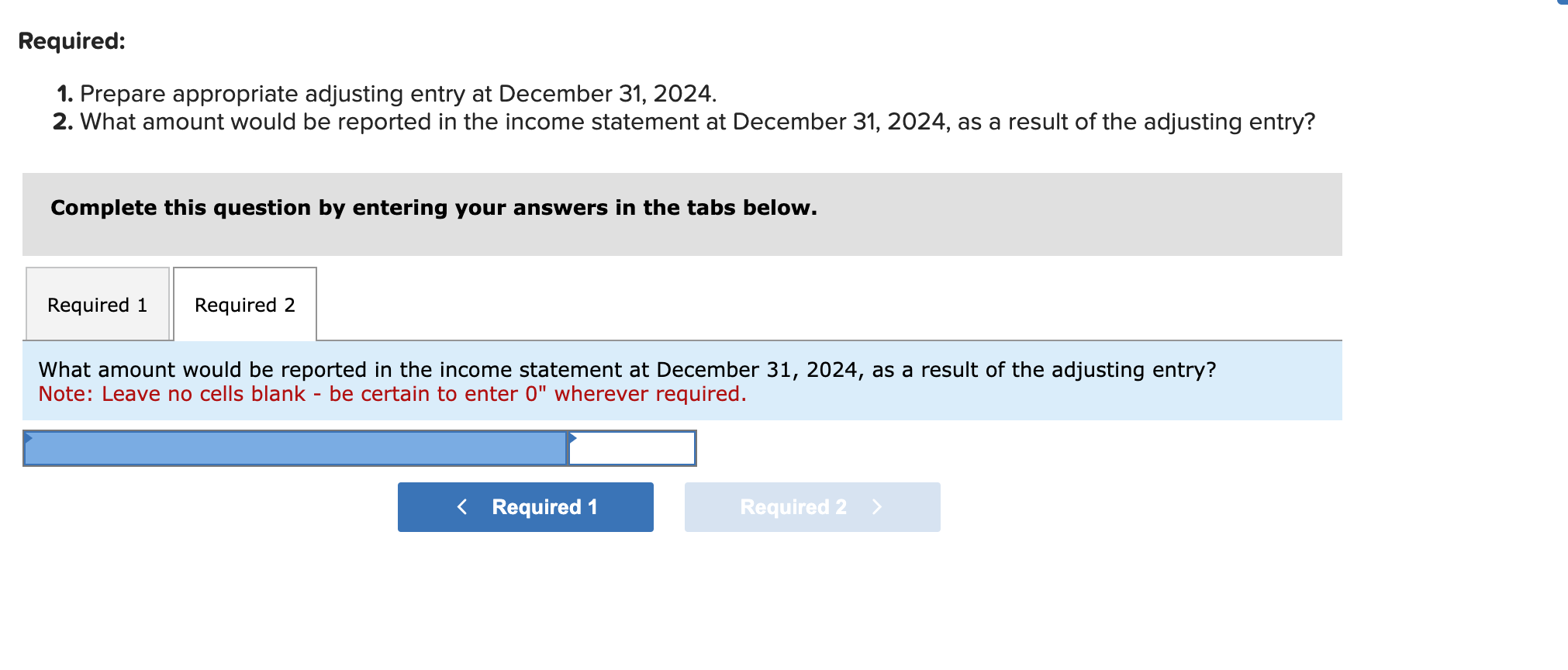

Mills Corporation acquired as an investment $260 million of 5% bonds, dated July 1, on July 1, 2024. Company management is holding the bonds in its trading portfolio. The market interest rate (yield) was 3% for bonds of similar risk and maturity. Mills paid $300 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $280 million. Required: 1. & 2. Prepare the journal entry to record Mills' investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the effective (market) rate. 3. Prepare the journal entry by Mills to record any fair value adjustment necessary for the year ended December 31, 2024. 4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2025, for $315 million. Prepare the journal entries required on the date of sale. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Prepare the journal entry by Mills to record any fair value adjustment necessary for the year ended December 31, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5). No 1 Date General Journal December 31, 2024 Loss on investment (unrealized, NI) Fair value adjustment Show less Debit Credit 18.2 18.2 Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2025, for $315 million. Prepare the journal entries required on the date of sale. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5). No 1 Date January 02, 2025 Investment in bonds General Journal Premium on bond investment Cash 2 January 02, 2025 Cash Interest revenue Premium on bond investment < Req 3 Req 4 Show less Debit Credit 260.0 40 300 X 6.5 4.5 2.0 Rantzow-Lear Company buys and sells debt securities expecting to earn profits on short-term differences in price, and holds these investments in its trading portfolio. The company's fiscal year ends on December 31. The following selected transactions relating to Rantzow-Lear's trading account occurred during December 2024 and the first week of 2025. December 17, 2024 Purchased 120 Grocers' Supply Corporation bonds at par for $420,000. December 28, 2024 Received interest of $2,800 from the Grocers' Supply Corporation bonds. December 31, 2024 Recorded any necessary adjusting entry relating to the Grocers' Supply Corporation bonds. The market price of the bond was $4,000 per bond. January 5, 2025 Sold the Grocers' Supply Corporation bonds for $450,000. Required: 1. Prepare the appropriate journal entry or entries for each transaction. 2. Indicate any amounts that Rantzow-Lear Company would report in its 2024 balance sheet and income statement as a result of this investment. Ignore income taxes. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the appropriate journal entry or entries for each transaction. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list 1 Purchased 120 Grocers' Supply Corporation bonds at par for $420,000. D. 2 Received interest of $2,800 from the Grocers' Supply Corporation bonds. 3 Record any necessary adjusting entry relating to the Grocers' Supply Corporation bonds on December 31. The market price of the bonds was $4,000 per bond. Credit 4 Record the entry to adjust fair value of the investment on date of sale. 5 Sold the Grocers' Supply Corporation bonds for $450,000. Note : = journal entry has been entered Record entry Clear entry View general journal > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Indicate any amounts that Rantzow-Lear Company would report in its 2024 balance sheet and income statement as a result of this investment. Ignore income taxes. Balance Sheet December 31, 2024 Income Statement: < Required 1 Required 2 > Loreal-American Corporation purchased several marketable securities during 2024. At December 31, 2024, the company had the investments in bonds listed below. None was held at the last reporting date, December 31, 2023, and all are considered securities available-for-sale. Cost Fair Value Blair, Incorporated $ 484,000 452,000 $ 403,000 484,000 $ 936,000 $ 887,000 $ 484,000 718,000 $ 562,000 662,000 $ 1,202,000 Short term: ANC Corporation Totals Long term: Drake Corporation Aaron Industries Totals $ 1,224,000 Unrealized Holding Gain (Loss) $ (81,000) 32,000 $ (49,000) $ 78,000 (56,000) $ 22,000 Required: 1. Prepare appropriate adjusting entry at December 31, 2024. 2. What amount would be reported in the income statement at December 31, 2024, as a result of the adjusting entry? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare appropriate adjusting entry at December 31, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list View journal entry worksheet No Date General Journal December 31, 1 Gain on investments (unrealized, OCI) 2024 Fair value adjustment < Required 1 Required 2 > Debit Credit 29,000 29,000 Required: 1. Prepare appropriate adjusting entry at December 31, 2024. 2. What amount would be reported in the income statement at December 31, 2024, as a result of the adjusting entry? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What amount would be reported in the income statement at December 31, 2024, as a result of the adjusting entry? Note: Leave no cells blank - be certain to enter 0" wherever required. < Required 1 Required 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started