Answered step by step

Verified Expert Solution

Question

1 Approved Answer

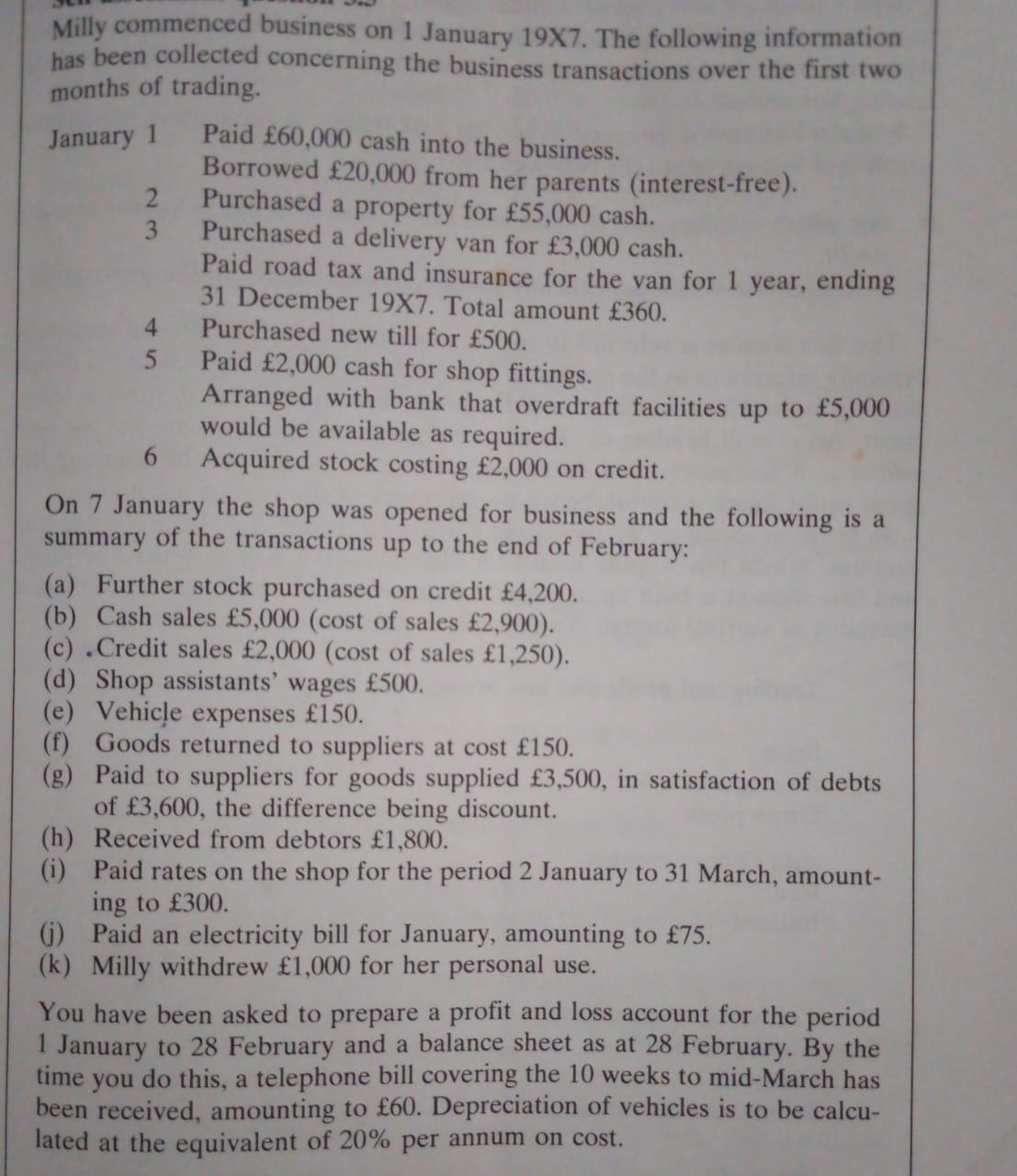

Milly commenced business on 1 January 19X7. The following information has been collected concerning the business transactions over the first two months of trading.

Milly commenced business on 1 January 19X7. The following information has been collected concerning the business transactions over the first two months of trading. January 1 2 3 4 5 Paid 60,000 cash into the business. Borrowed 20,000 from her parents (interest-free). Purchased a property for 55,000 cash. Purchased a delivery van for 3,000 cash. Paid road tax and insurance for the van for 1 year, ending 31 December 19X7. Total amount 360. Purchased new till for 500. Paid 2,000 cash for shop fittings. Arranged with bank that overdraft facilities up to 5,000 would be available as required. Acquired stock costing 2,000 on credit. 6 On 7 January the shop was opened for business and the following is a summary of the transactions up to the end of February: (a) Further stock purchased on credit 4,200. (b) Cash sales 5,000 (cost of sales 2,900). (c) .Credit sales 2,000 (cost of sales 1,250). (d) Shop assistants' wages 500. (e) Vehicle expenses 150. (f) Goods returned to suppliers at cost 150. (g) Paid to suppliers for goods supplied 3,500, in satisfaction of debts of 3,600, the difference being discount. (h) Received from debtors 1,800. (i) Paid rates on the shop for the period 2 January to 31 March, amount- ing to 300. (j) Paid an electricity bill for January, amounting to 75. (k) Milly withdrew 1,000 for her personal use. You have been asked to prepare a profit and loss account for the period 1 January to 28 February and a balance sheet as at 28 February. By the time you do this, a telephone bill covering the 10 weeks to mid-March has been received, amounting to 60. Depreciation of vehicles is to be calcu- lated at the equivalent of 20% per annum on cost.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started