Question

Milo is purchasing a new refrigerator for $4700 using an in-store offer. The store is offering a 60 days same-as-cash loan. This means that at

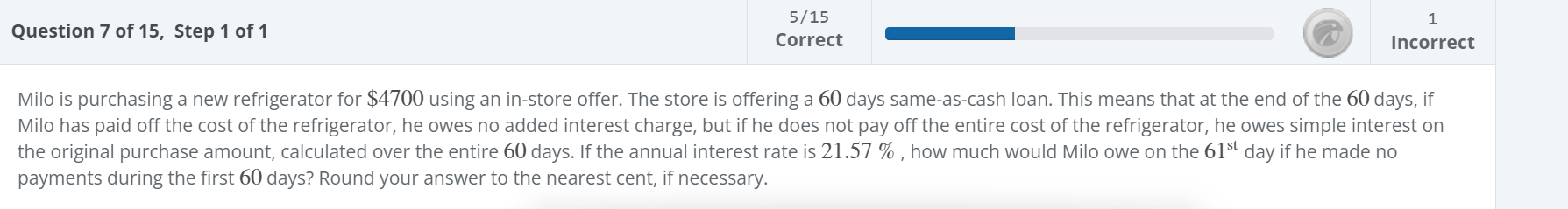

Milo is purchasing a new refrigerator for $4700 using an in-store offer. The store is offering a 60 days same-as-cash loan. This means that at the end of the 60 days, if Milo has paid off the cost of the refrigerator, he owes no added interest charge, but if he does not pay off the entire cost of the refrigerator, he owes simple interest on the original purchase amount, calculated over the entire 60 days. If the annual interest rate is 21.57% , how much would Milo owe on the 61st day if he made no payments during the first 60 days? Round your answer to the nearest cent, if necessary.

Milo is purchasing a new refrigerator for $4700 using an in-store offer. The store is offering a 60 days same-as-cash loan. This means that at the end of the 60 days, if Milo has paid off the cost of the refrigerator, he owes no added interest charge, but if he does not pay off the entire cost of the refrigerator, he owes simple interest on the original purchase amount, calculated over the entire 60 days. If the annual interest rate is 21.57%, how much would Milo owe on the 61st day if he made no payments during the first 60 days? Round your answer to the nearest cent, if necessary

Milo is purchasing a new refrigerator for $4700 using an in-store offer. The store is offering a 60 days same-as-cash loan. This means that at the end of the 60 days, if Milo has paid off the cost of the refrigerator, he owes no added interest charge, but if he does not pay off the entire cost of the refrigerator, he owes simple interest on the original purchase amount, calculated over the entire 60 days. If the annual interest rate is 21.57%, how much would Milo owe on the 61st day if he made no payments during the first 60 days? Round your answer to the nearest cent, if necessary Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started