Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Minerva, single but head of the family, a resident of Cagayan de Oro City, died, leaving the following properties and obligations: 5,500,000 2,200,000 House

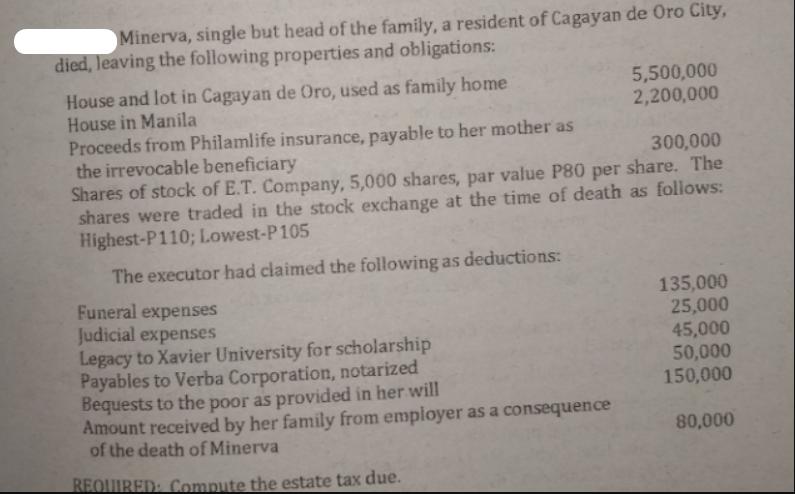

Minerva, single but head of the family, a resident of Cagayan de Oro City, died, leaving the following properties and obligations: 5,500,000 2,200,000 House and lot in Cagayan de Oro, used as family home House in Manila Proceeds from Philamlife insurance, payable to her mother as the irrevocable beneficiary 300,000 Shares of stock of E.T. Company, 5,000 shares, par value P80 per share. The shares were traded in the stock exchange at the time of death as follows: Highest-P110; Lowest-P105 The executor had claimed the following as deductions: Funeral expenses Judicial expenses Legacy to Xavier University for scholarship Payables to Verba Corporation, notarized Bequests to the poor as provided in her will Amount received by her family from employer as a consequence of the death of Minerva REQUIRED: Compute the estate tax due. 135,000 25,000 45,000 50,000 150,000 80,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Given the information provided lets calculate the net estate step by step 1 Gross Estate House and l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started