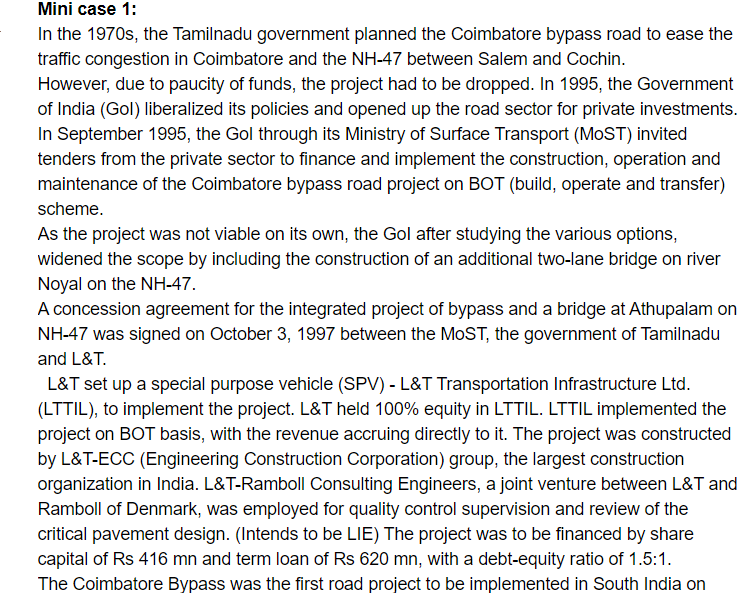

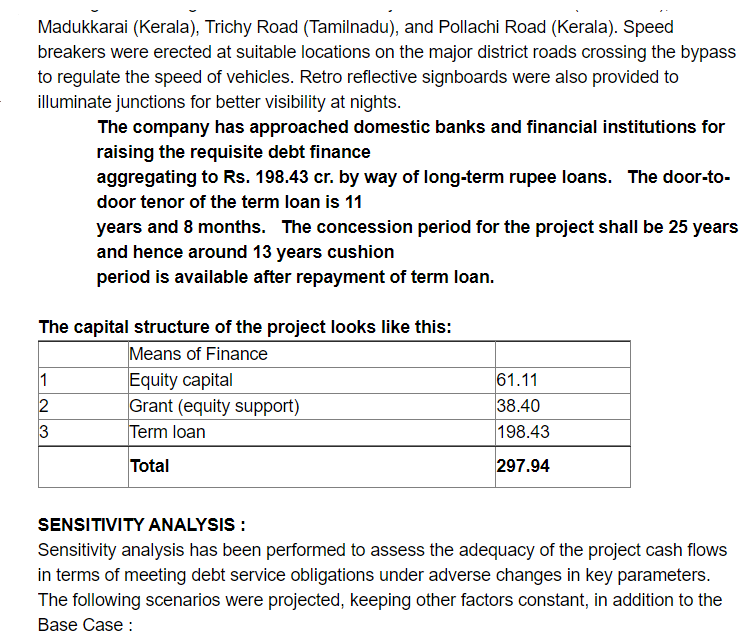

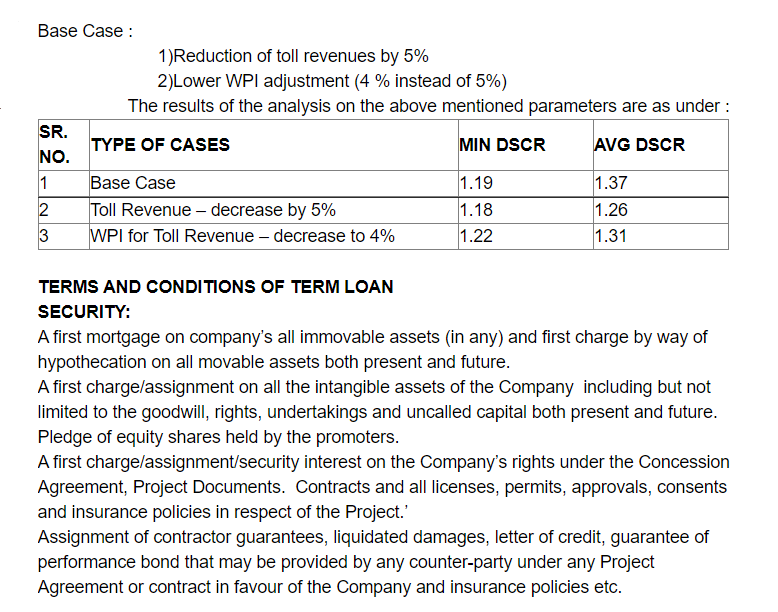

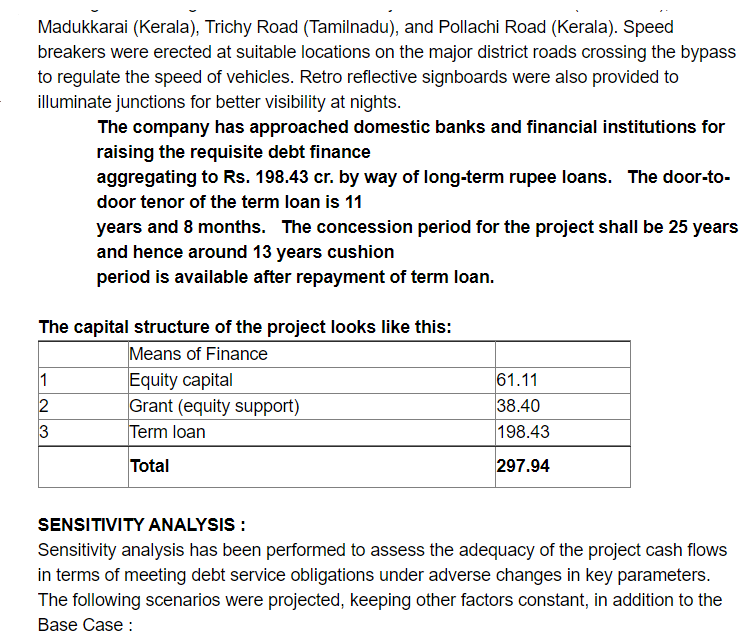

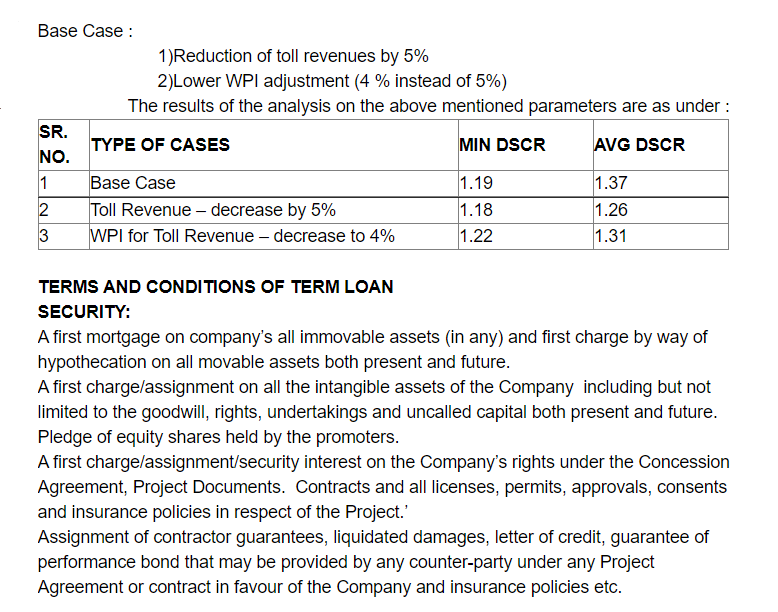

Mini case 1: In the 1970s, the Tamilnadu government planned the Coimbatore bypass road to ease the traffic congestion in Coimbatore and the NH-47 between Salem and Cochin. However, due to paucity of funds, the project had to be dropped. In 1995, the Government of India (Gol) liberalized its policies and opened up the road sector for private investments. In September 1995, the Gol through its Ministry of Surface Transport (MOST) invited tenders from the private sector to finance and implement the construction, operation and maintenance of the Coimbatore bypass road project on BOT (build, operate and transfer) scheme. As the project was not viable on its own, the Gol after studying the various options, widened the scope by including the construction of an additional two-lane bridge on river Noyal on the NH-47. A concession agreement for the integrated project of bypass and a bridge at Athupalam on NH-47 was signed on October 3, 1997 between the MOST, the government of Tamilnadu and L&T L&T set up a special purpose vehicle (SPV) - L&T Transportation Infrastructure Ltd. (LTTIL), to implement the project. L&T held 100% equity in LTTIL. LTTIL implemented the project on BOT basis, with the revenue accruing directly to it. The project was constructed by L&T-ECC (Engineering Construction Corporation) group, the largest construction organization in India. L&T-Ramboll Consulting Engineers, a joint venture between L&T and Ramboll of Denmark, was employed for quality control supervision and review of the critical pavement design. (Intends to be LIE) The project was to be financed by share capital of Rs 416 mn and term loan of Rs 620 mn, with a debt-equity ratio of 1.5:1. The Coimbatore Bypass was the first road project to be implemented in South India on Madukkarai (Kerala), Trichy Road (Tamilnadu), and Pollachi Road (Kerala). Speed breakers were erected at suitable locations on the major district roads crossing the bypass to regulate the speed of vehicles. Retro reflective signboards were also provided to illuminate junctions for better visibility at nights. The company has approached domestic banks and financial institutions for raising the requisite debt finance aggregating to Rs. 198.43 cr. by way of long-term rupee loans. The door-to- door tenor of the term loan is 11 years and 8 months. The concession period for the project shall be 25 years and hence around 13 years cushion period is available after repayment of term loan. The capital structure of the project looks like this: Means of Finance 1 Equity capital 2 Grant (equity support) 3 Term loan 61.11 38.40 198.43 Total 297.94 SENSITIVITY ANALYSIS : Sensitivity analysis has been performed to assess the adequacy of the project cash flows in terms of meeting debt service obligations under adverse changes in key parameters. The following scenarios were projected, keeping other factors constant, in addition to the Base Case : Base Case : 1) Reduction of toll revenues by 5% 2)Lower WPI adjustment (4 % instead of 5%) The results of the analysis on the above mentioned parameters are as under : SR. TYPE OF CASES MIN DSCR AVG DSCR NO. 1 Base Case 1.19 1.37 2 Toll Revenue - decrease by 5% 1.18 1.26 3 WPI for Toll Revenue - decrease to 4% 1.22 1.31 TERMS AND CONDITIONS OF TERM LOAN SECURITY: A first mortgage on company's all immovable assets (in any) and first charge by way of hypothecation on all movable assets both present and future. A first charge/assignment on all the intangible assets of the Company including but not limited to the goodwill, rights, undertakings and uncalled capital both present and future. Pledge of equity shares held by the promoters. A first charge/assignment/security interest on the Company's rights under the Concession Agreement, Project Documents. Contracts and all licenses, permits, approvals, consents and insurance policies in respect of the Project.' Assignment of contractor guarantees, liquidated damages, letter of credit, guarantee of performance bond that may be provided by any counter-party under any Project Agreement or contract in favour of the Company and insurance policies etc. 4. Can you explain a Risk Mitigation strategy and Matrix that you would create around the project ? (8 marks) 5. If you were a MLA, what is the best syndication strategy ,( Best Efforts or Fully Underwritten) you would choose and why? Mini case 1: In the 1970s, the Tamilnadu government planned the Coimbatore bypass road to ease the traffic congestion in Coimbatore and the NH-47 between Salem and Cochin. However, due to paucity of funds, the project had to be dropped. In 1995, the Government of India (Gol) liberalized its policies and opened up the road sector for private investments. In September 1995, the Gol through its Ministry of Surface Transport (MOST) invited tenders from the private sector to finance and implement the construction, operation and maintenance of the Coimbatore bypass road project on BOT (build, operate and transfer) scheme. As the project was not viable on its own, the Gol after studying the various options, widened the scope by including the construction of an additional two-lane bridge on river Noyal on the NH-47. A concession agreement for the integrated project of bypass and a bridge at Athupalam on NH-47 was signed on October 3, 1997 between the MOST, the government of Tamilnadu and L&T L&T set up a special purpose vehicle (SPV) - L&T Transportation Infrastructure Ltd. (LTTIL), to implement the project. L&T held 100% equity in LTTIL. LTTIL implemented the project on BOT basis, with the revenue accruing directly to it. The project was constructed by L&T-ECC (Engineering Construction Corporation) group, the largest construction organization in India. L&T-Ramboll Consulting Engineers, a joint venture between L&T and Ramboll of Denmark, was employed for quality control supervision and review of the critical pavement design. (Intends to be LIE) The project was to be financed by share capital of Rs 416 mn and term loan of Rs 620 mn, with a debt-equity ratio of 1.5:1. The Coimbatore Bypass was the first road project to be implemented in South India on Madukkarai (Kerala), Trichy Road (Tamilnadu), and Pollachi Road (Kerala). Speed breakers were erected at suitable locations on the major district roads crossing the bypass to regulate the speed of vehicles. Retro reflective signboards were also provided to illuminate junctions for better visibility at nights. The company has approached domestic banks and financial institutions for raising the requisite debt finance aggregating to Rs. 198.43 cr. by way of long-term rupee loans. The door-to- door tenor of the term loan is 11 years and 8 months. The concession period for the project shall be 25 years and hence around 13 years cushion period is available after repayment of term loan. The capital structure of the project looks like this: Means of Finance 1 Equity capital 2 Grant (equity support) 3 Term loan 61.11 38.40 198.43 Total 297.94 SENSITIVITY ANALYSIS : Sensitivity analysis has been performed to assess the adequacy of the project cash flows in terms of meeting debt service obligations under adverse changes in key parameters. The following scenarios were projected, keeping other factors constant, in addition to the Base Case : Base Case : 1) Reduction of toll revenues by 5% 2)Lower WPI adjustment (4 % instead of 5%) The results of the analysis on the above mentioned parameters are as under : SR. TYPE OF CASES MIN DSCR AVG DSCR NO. 1 Base Case 1.19 1.37 2 Toll Revenue - decrease by 5% 1.18 1.26 3 WPI for Toll Revenue - decrease to 4% 1.22 1.31 TERMS AND CONDITIONS OF TERM LOAN SECURITY: A first mortgage on company's all immovable assets (in any) and first charge by way of hypothecation on all movable assets both present and future. A first charge/assignment on all the intangible assets of the Company including but not limited to the goodwill, rights, undertakings and uncalled capital both present and future. Pledge of equity shares held by the promoters. A first charge/assignment/security interest on the Company's rights under the Concession Agreement, Project Documents. Contracts and all licenses, permits, approvals, consents and insurance policies in respect of the Project.' Assignment of contractor guarantees, liquidated damages, letter of credit, guarantee of performance bond that may be provided by any counter-party under any Project Agreement or contract in favour of the Company and insurance policies etc. 4. Can you explain a Risk Mitigation strategy and Matrix that you would create around the project ? (8 marks) 5. If you were a MLA, what is the best syndication strategy ,( Best Efforts or Fully Underwritten) you would choose and why