Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mini - Case: Capital Budgeting Processes AND TECHNIQUES Durango Cereal Company is considering adding two new kinds of cereal to its product line - one

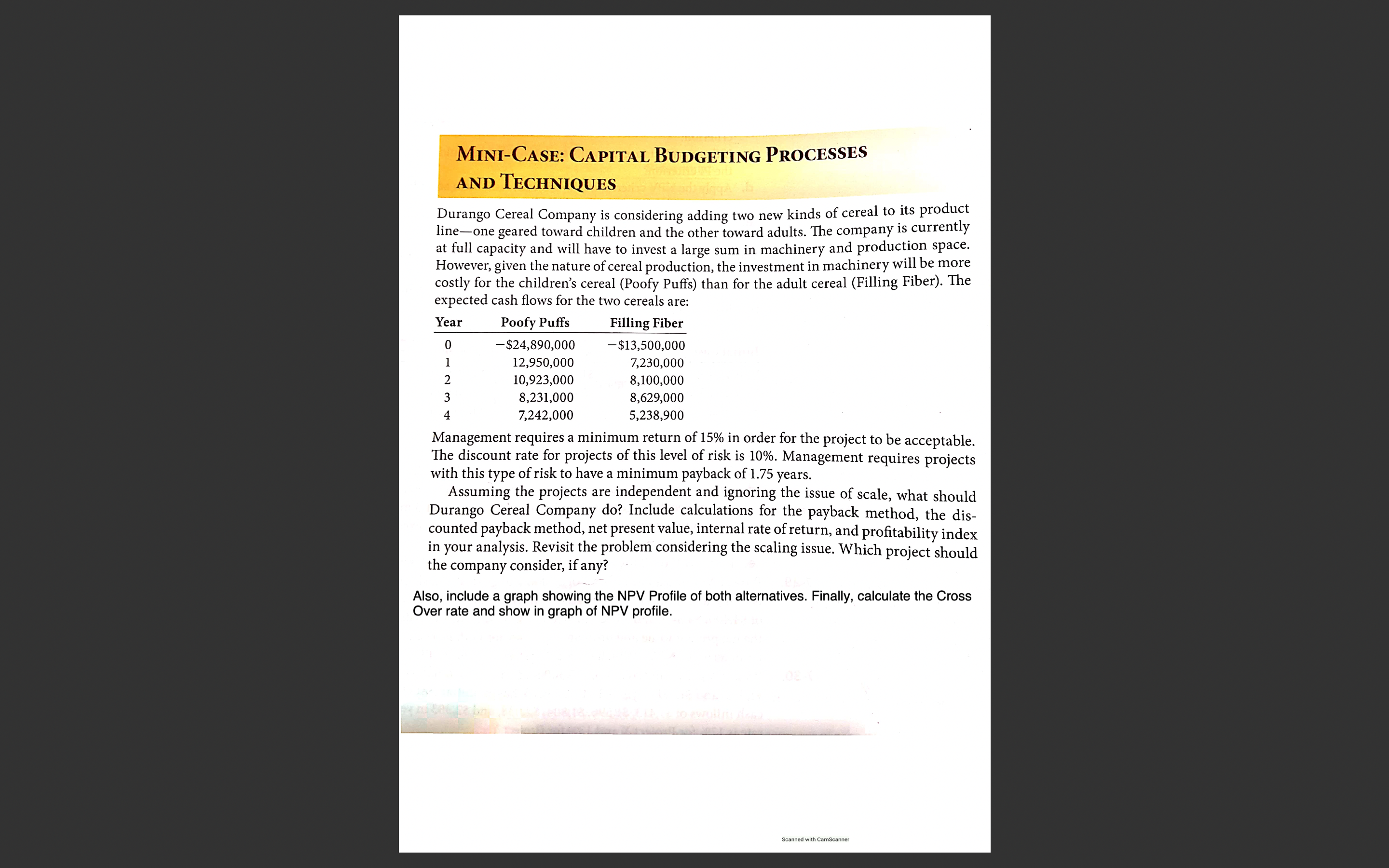

MiniCase: Capital Budgeting Processes

AND TECHNIQUES

Durango Cereal Company is considering adding two new kinds of cereal to its product

lineone geared toward children and the other toward adults. The company is currently

at full capacity and will have to invest a large sum in machinery and production space.

However, given the nature of cereal production, the investment in machinery will be more

costly for the children's cereal Poofy Puffs than for the adult cereal Filling Fiber The

expected cash flows for the two cereals are:

Management requires a minimum return of in order for the project to be acceptable.

The discount rate for projects of this level of risk is Management requires projects

with this type of risk to have a minimum payback of years.

Assuming the projects are independent and ignoring the issue of scale, what should

Durango Cereal Company do Include calculations for the payback method, the dis

counted payback method, net present value, internal rate of return, and profitability index

in your analysis. Revisit the problem considering the scaling issue. Which project should

the company consider, if any?

Also, include a graph showing the NPV Profile of both alternatives. Finally, calculate the Cross

Over rate and show in graph of NPV profile.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started