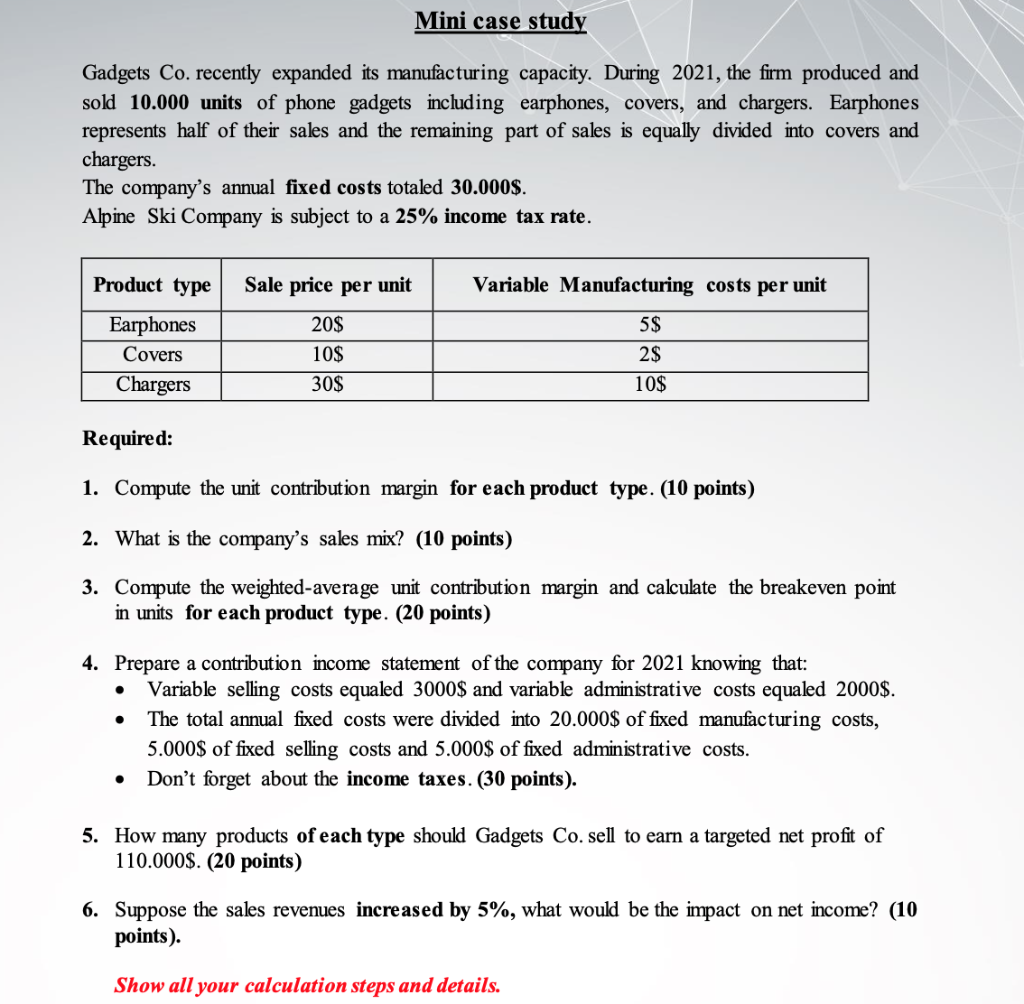

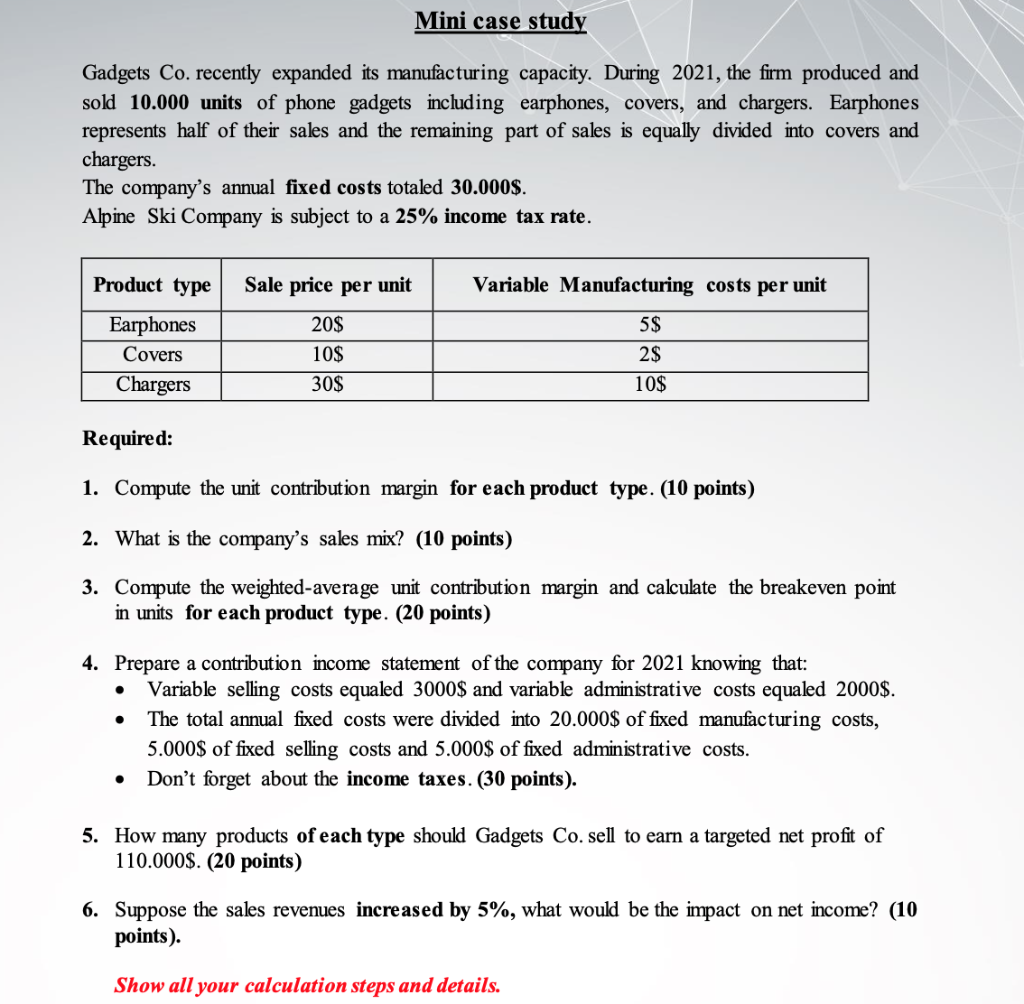

Mini case study Gadgets Co. recently expanded its manufacturing capacity. During 2021, the firm produced and sold 10.000 units of phone gadgets including earphones, covers, and chargers. Earphones represents half of their sales and the remaining part of sales is equally divided into covers and chargers. The company's annual fixed costs totaled 30.000$. Alpine Ski Company is subject to a 25% income tax rate. Product type Sale price per unit Variable Manufacturing costs per unit Earphones Covers Chargers 20$ 10$ 5$ 2$ 10$ 30$ Required: 1. Compute the unit contribution margin for each product type. (10 points) 2. What is the company's sales mix? (10 points) 3. Compute the weighted-average unit contribution margin and calculate the breakeven point in units for each product type. (20 points) 4. Prepare a contribution income statement of the company for 2021 knowing that: Variable selling costs equaled 3000$ and variable administrative costs equaled 2000$. The total annual fixed costs were divided into 20.000$ of fixed manufacturing costs, 5.000$ of fixed selling costs and 5.000$ of fixed administrative costs. Don't forget about the income taxes. (30 points). . O 5. How many products of each type should Gadgets Co. sell to earn a targeted net profit of 110.000$. (20 points) 6. Suppose the sales revenues increased by 5%, what would be the impact on net income? (10 points). Show all your calculation steps and details. Mini case study Gadgets Co. recently expanded its manufacturing capacity. During 2021, the firm produced and sold 10.000 units of phone gadgets including earphones, covers, and chargers. Earphones represents half of their sales and the remaining part of sales is equally divided into covers and chargers. The company's annual fixed costs totaled 30.000$. Alpine Ski Company is subject to a 25% income tax rate. Product type Sale price per unit Variable Manufacturing costs per unit Earphones Covers Chargers 20$ 10$ 5$ 2$ 10$ 30$ Required: 1. Compute the unit contribution margin for each product type. (10 points) 2. What is the company's sales mix? (10 points) 3. Compute the weighted-average unit contribution margin and calculate the breakeven point in units for each product type. (20 points) 4. Prepare a contribution income statement of the company for 2021 knowing that: Variable selling costs equaled 3000$ and variable administrative costs equaled 2000$. The total annual fixed costs were divided into 20.000$ of fixed manufacturing costs, 5.000$ of fixed selling costs and 5.000$ of fixed administrative costs. Don't forget about the income taxes. (30 points). . O 5. How many products of each type should Gadgets Co. sell to earn a targeted net profit of 110.000$. (20 points) 6. Suppose the sales revenues increased by 5%, what would be the impact on net income? (10 points). Show all your calculation steps and details