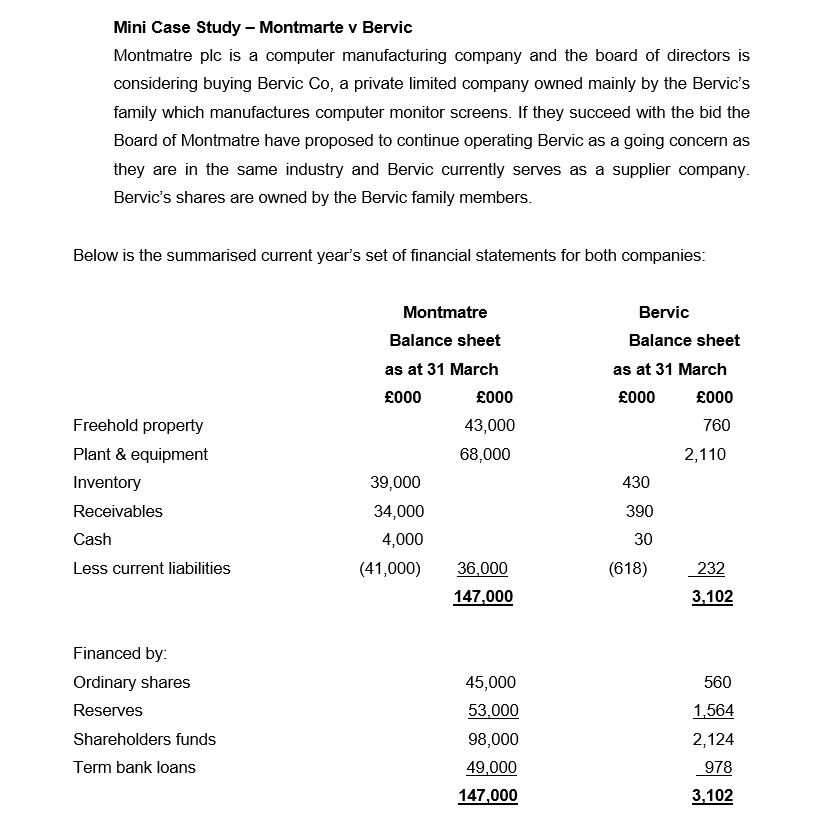

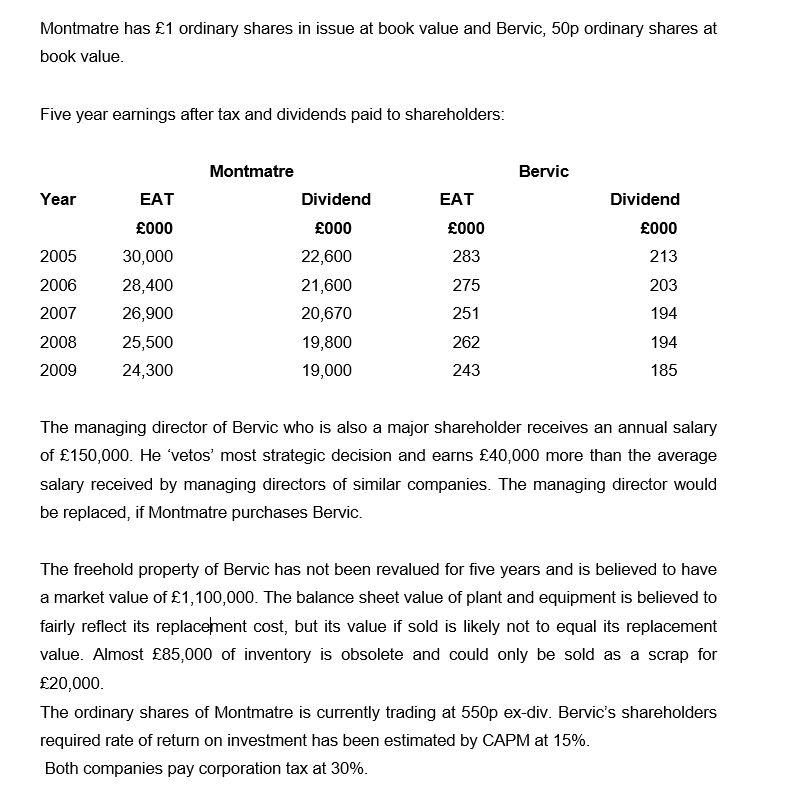

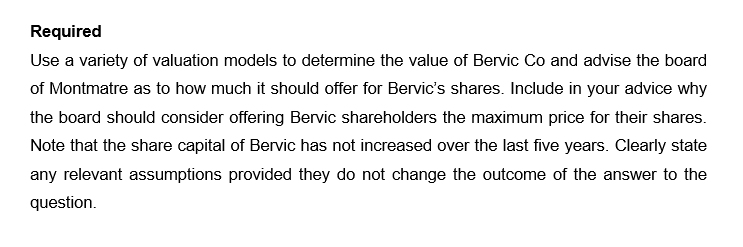

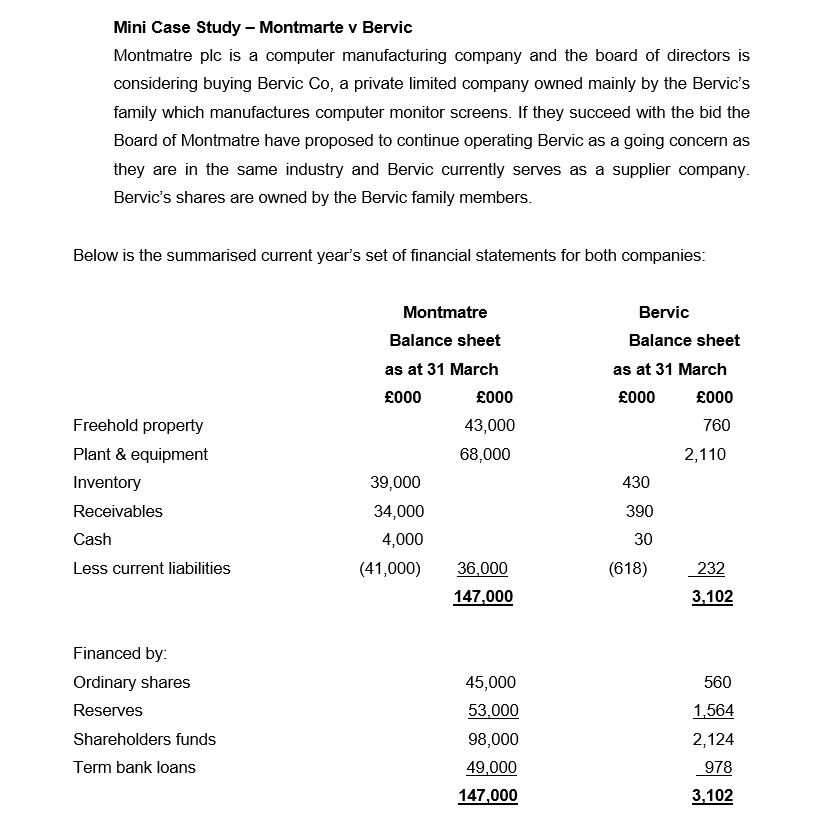

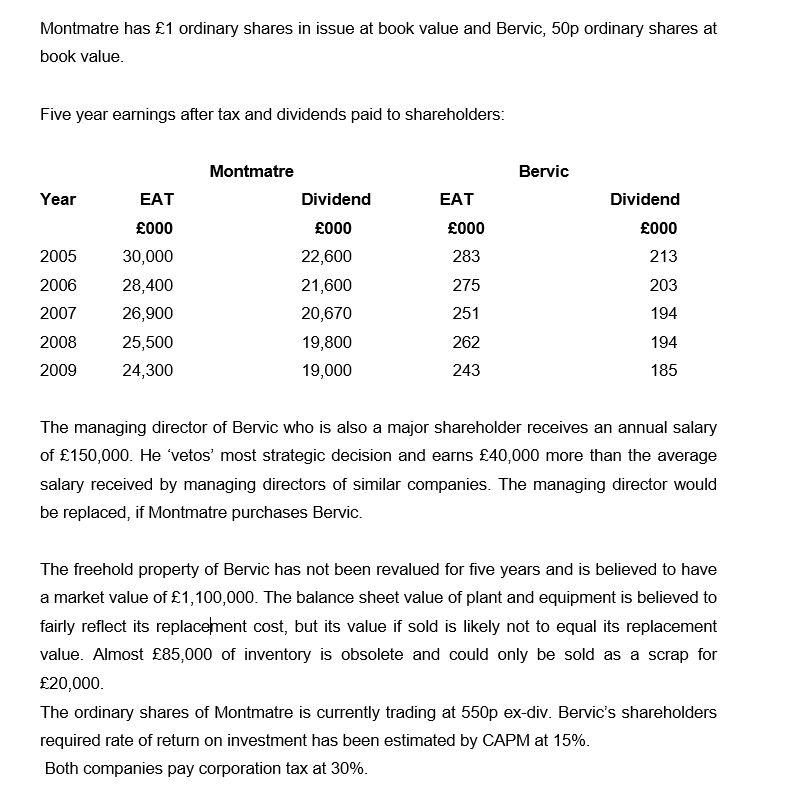

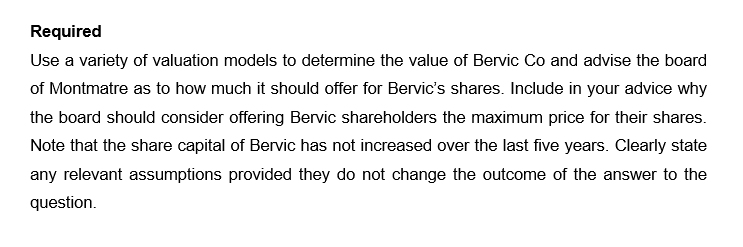

Mini Case Study - Montmarte v Bervic Montmatre plc is a computer manufacturing company and the board of directors is considering buying Bervic Co, a private limited company owned mainly by the Bervic's family which manufactures computer monitor screens. If they succeed with the bid the Board of Montmatre have proposed to continue operating Bervic as a going concern as they are in the same industry and Bervic currently serves as a supplier company. Bervic's shares are owned by the Bervic family members. Below is the summarised current year's set of financial statements for both companies: Montmatre has 1 ordinary shares in issue at book value and Bervic, 50p ordinary shares at book value. Five year earnings after tax and dividends paid to shareholders: The managing director of Bervic who is also a major shareholder receives an annual salary of 150,000. He 'vetos' most strategic decision and earns 40,000 more than the average salary received by managing directors of similar companies. The managing director would be replaced, if Montmatre purchases Bervic. The freehold property of Bervic has not been revalued for five years and is believed to have a market value of 1,100,000. The balance sheet value of plant and equipment is believed to fairly reflect its replacement cost, but its value if sold is likely not to equal its replacement value. Almost 85,000 of inventory is obsolete and could only be sold as a scrap for 20,000. The ordinary shares of Montmatre is currently trading at 550p ex-div. Bervic's shareholders required rate of return on investment has been estimated by CAPM at 15%. Both companies pay corporation tax at 30%. Required Use a variety of valuation models to determine the value of Bervic Co and advise the board of Montmatre as to how much it should offer for Bervic's shares. Include in your advice why the board should consider offering Bervic shareholders the maximum price for their shares. Note that the share capital of Bervic has not increased over the last five years. Clearly state any relevant assumptions provided they do not change the outcome of the answer to the