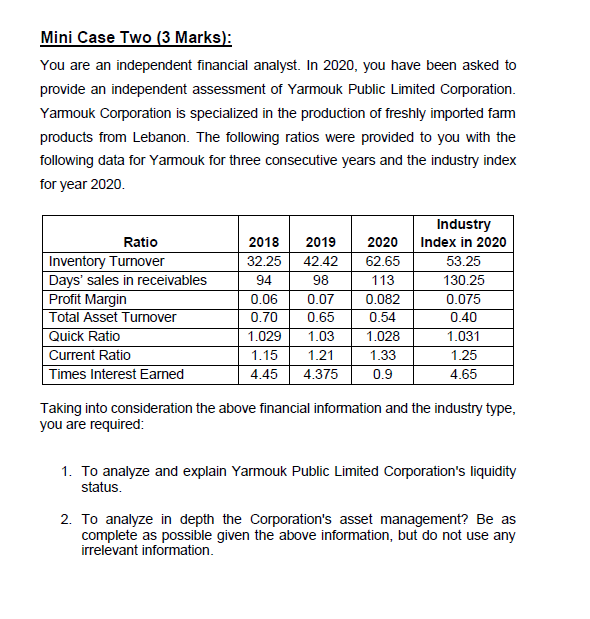

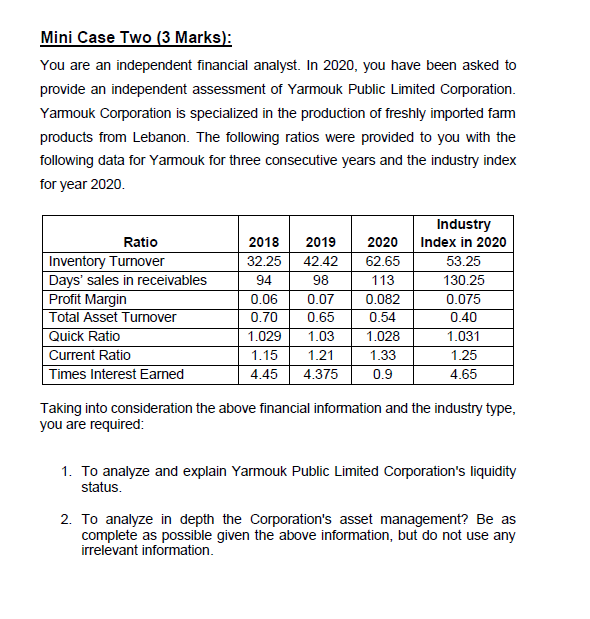

Mini Case Two (3 Marks): You are an independent financial analyst. In 2020, you have been asked to provide an independent assessment of Yarmouk Public Limited Corporation. Yarmouk Corporation is specialized in the production of freshly imported farm products from Lebanon. The following ratios were provided to you with the following data for Yarmouk for three consecutive years and the industry index for year 2020 Ratio Inventory Turnover Days' sales in receivables Profit Margin Total Asset Turnover Quick Ratio Current Ratio Times Interest Earned 2018 32.25 94 0.06 0.70 1.029 1.15 4.45 2019 42.42 98 0.07 0.65 1.03 1.21 4.375 2020 62.65 113 0.082 0.54 1.028 1.33 0.9 Industry Index in 2020 53.25 130.25 0.075 0.40 1.031 1.25 4.65 Taking into consideration the above financial information and the industry type, you are required: 1. To analyze and explain Yarmouk Public Limited Corporation's liquidity status. 2. To analyze in depth the Corporation's asset management? Be as complete as possible given the above information, but do not use any irrelevant information Mini Case Two (3 Marks): You are an independent financial analyst. In 2020, you have been asked to provide an independent assessment of Yarmouk Public Limited Corporation. Yarmouk Corporation is specialized in the production of freshly imported farm products from Lebanon. The following ratios were provided to you with the following data for Yarmouk for three consecutive years and the industry index for year 2020 Ratio Inventory Turnover Days' sales in receivables Profit Margin Total Asset Turnover Quick Ratio Current Ratio Times Interest Earned 2018 32.25 94 0.06 0.70 1.029 1.15 4.45 2019 42.42 98 0.07 0.65 1.03 1.21 4.375 2020 62.65 113 0.082 0.54 1.028 1.33 0.9 Industry Index in 2020 53.25 130.25 0.075 0.40 1.031 1.25 4.65 Taking into consideration the above financial information and the industry type, you are required: 1. To analyze and explain Yarmouk Public Limited Corporation's liquidity status. 2. To analyze in depth the Corporation's asset management? Be as complete as possible given the above information, but do not use any irrelevant information