Answered step by step

Verified Expert Solution

Question

1 Approved Answer

minicase 2 the capital-budgeting analysis department or are provided with remedial training. The memorandum you received outlining your assignment follows: To: New Financial Analysts From:

minicase 2

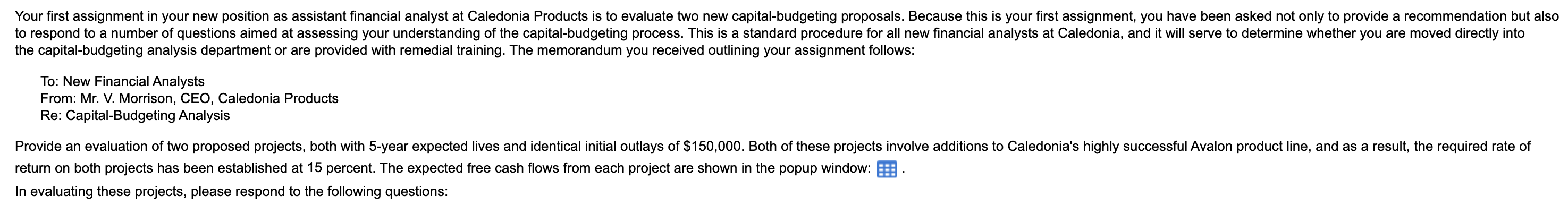

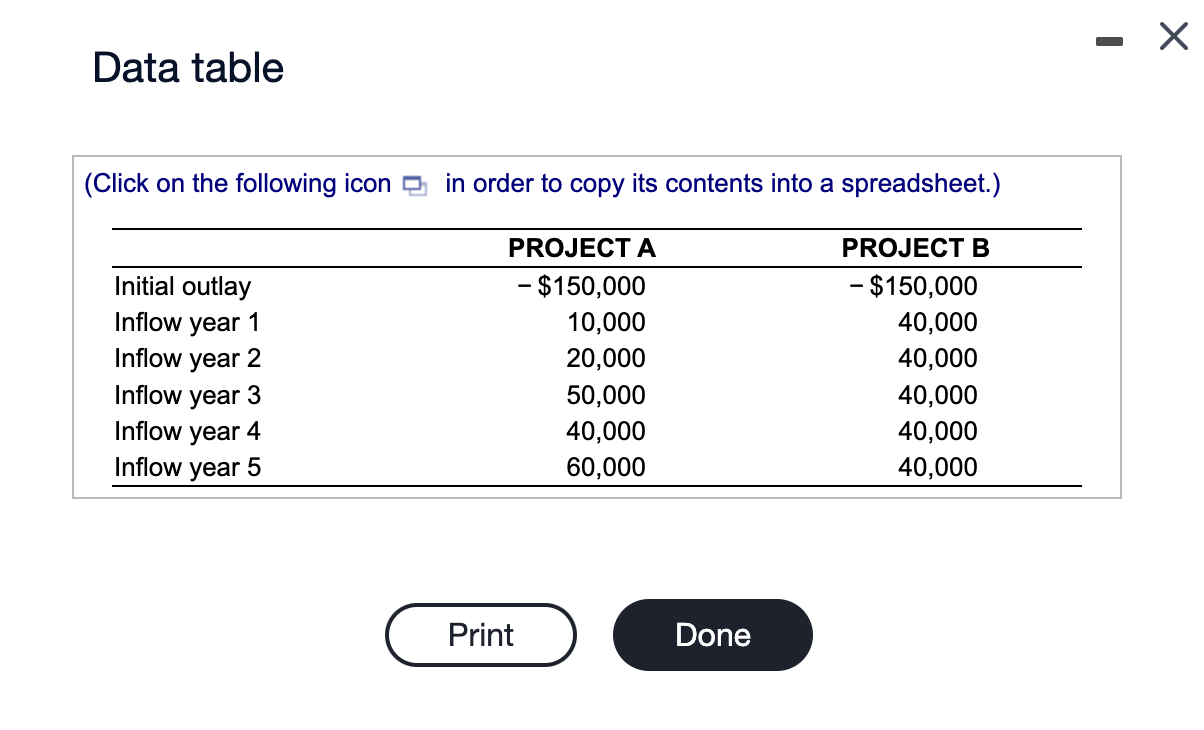

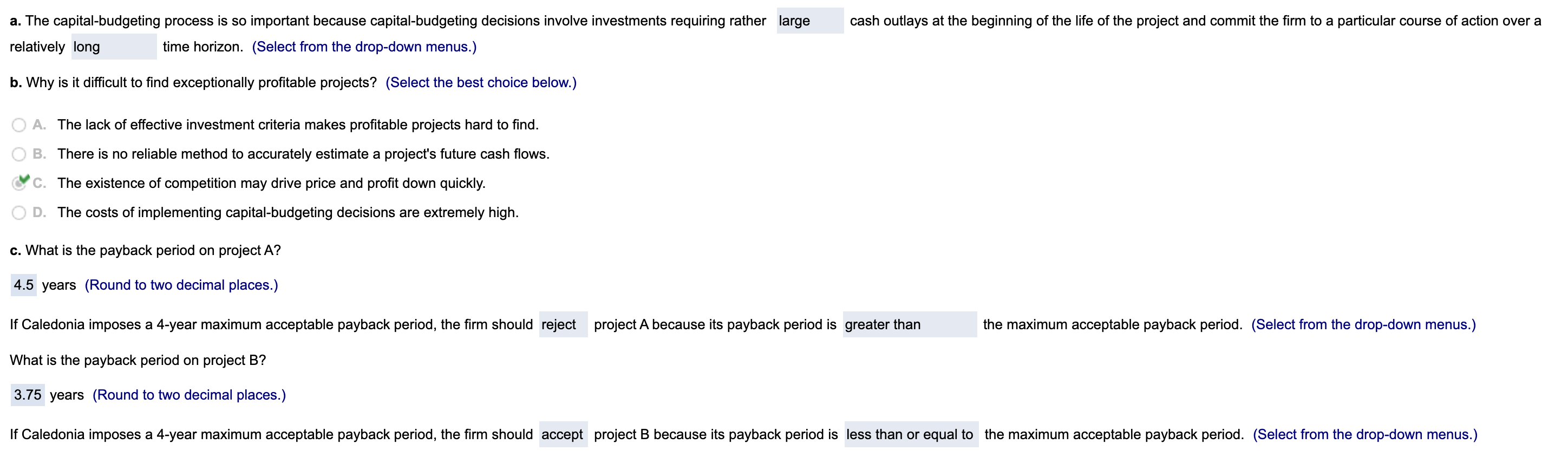

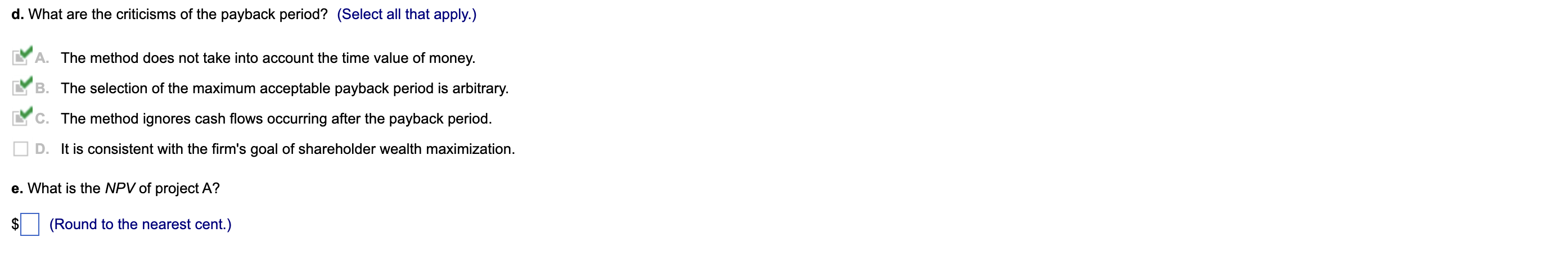

the capital-budgeting analysis department or are provided with remedial training. The memorandum you received outlining your assignment follows: To: New Financial Analysts From: Mr. V. Morrison, CEO, Caledonia Products Re: Capital-Budgeting Analysis return on both projects has been established at 15 percent. The expected free cash flows from each project are shown in the popup window: In evaluating these projects, please respond to the following questions: a. Why is the capital-budgeting process so important? b. Why is it difficult to find exceptionally profitable projects? c. What is the payback period on each project? If Caledonia imposes a 4-year maximum acceptable payback period, which of these projects should be accepted? d. What are the criticisms of the payback period? e. Determine the NPV for each of these projects. Should either project be accepted? f. Describe the logic behind the NPV. g. Determine the PI for each of these projects. Should either project be accepted? h. Would you expect the NPV and PI methods to give consistent accept/reject decisions? Why or why not? i. What would happen to the NPV and PI for each project if the required rate of return increased? If the required rate of return decreased? j. Determine the IRR for each project. Should either project be accepted? k. How does a change in the required rate of return affect the project's internal rate of return? I. What reinvestment rate assumptions are implicitly made by the NPV and IRR methods? Which one is better? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) a. The capital-budgeting process is so important because capital-budgeting decisions involve investments requiring rather relatively time horizon. (Select from the drop-down menus.) b. Why is it difficult to find exceptionally profitable projects? (Select the best choice below.) A. The lack of effective investment criteria makes profitable projects hard to find. B. There is no reliable method to accurately estimate a project's future cash flows. C. The existence of competition may drive price and profit down quickly. D. The costs of implementing capital-budgeting decisions are extremely high. c. What is the payback period on project A? 4.5 years (Round to two decimal places.) If Caledonia imposes a 4-year maximum acceptable payback period, the firm should What is the payback period on project B? 3.75 years (Round to two decimal places.) cash outlays at the beginning of the life of the project and commit the firm to a particular course of action over a project A because its payback period is the maximum acceptable payback period. (Select from the drop-down menus.) project B because its payback period is the maximum acceptable payback period. (Select from the drop-down menus.) d. What are the criticisms of the payback period? (Select all that apply.) 'A. The method does not take into account the time value of money. B. The selection of the maximum acceptable payback period is arbitrary. C. The method ignores cash flows occurring after the payback period. D. It is consistent with the firm's goal of shareholder wealth maximization. e. What is the NPV of project A ? the capital-budgeting analysis department or are provided with remedial training. The memorandum you received outlining your assignment follows: To: New Financial Analysts From: Mr. V. Morrison, CEO, Caledonia Products Re: Capital-Budgeting Analysis return on both projects has been established at 15 percent. The expected free cash flows from each project are shown in the popup window: In evaluating these projects, please respond to the following questions: a. Why is the capital-budgeting process so important? b. Why is it difficult to find exceptionally profitable projects? c. What is the payback period on each project? If Caledonia imposes a 4-year maximum acceptable payback period, which of these projects should be accepted? d. What are the criticisms of the payback period? e. Determine the NPV for each of these projects. Should either project be accepted? f. Describe the logic behind the NPV. g. Determine the PI for each of these projects. Should either project be accepted? h. Would you expect the NPV and PI methods to give consistent accept/reject decisions? Why or why not? i. What would happen to the NPV and PI for each project if the required rate of return increased? If the required rate of return decreased? j. Determine the IRR for each project. Should either project be accepted? k. How does a change in the required rate of return affect the project's internal rate of return? I. What reinvestment rate assumptions are implicitly made by the NPV and IRR methods? Which one is better? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) a. The capital-budgeting process is so important because capital-budgeting decisions involve investments requiring rather relatively time horizon. (Select from the drop-down menus.) b. Why is it difficult to find exceptionally profitable projects? (Select the best choice below.) A. The lack of effective investment criteria makes profitable projects hard to find. B. There is no reliable method to accurately estimate a project's future cash flows. C. The existence of competition may drive price and profit down quickly. D. The costs of implementing capital-budgeting decisions are extremely high. c. What is the payback period on project A? 4.5 years (Round to two decimal places.) If Caledonia imposes a 4-year maximum acceptable payback period, the firm should What is the payback period on project B? 3.75 years (Round to two decimal places.) cash outlays at the beginning of the life of the project and commit the firm to a particular course of action over a project A because its payback period is the maximum acceptable payback period. (Select from the drop-down menus.) project B because its payback period is the maximum acceptable payback period. (Select from the drop-down menus.) d. What are the criticisms of the payback period? (Select all that apply.) 'A. The method does not take into account the time value of money. B. The selection of the maximum acceptable payback period is arbitrary. C. The method ignores cash flows occurring after the payback period. D. It is consistent with the firm's goal of shareholder wealth maximization. e. What is the NPV of project A

the capital-budgeting analysis department or are provided with remedial training. The memorandum you received outlining your assignment follows: To: New Financial Analysts From: Mr. V. Morrison, CEO, Caledonia Products Re: Capital-Budgeting Analysis return on both projects has been established at 15 percent. The expected free cash flows from each project are shown in the popup window: In evaluating these projects, please respond to the following questions: a. Why is the capital-budgeting process so important? b. Why is it difficult to find exceptionally profitable projects? c. What is the payback period on each project? If Caledonia imposes a 4-year maximum acceptable payback period, which of these projects should be accepted? d. What are the criticisms of the payback period? e. Determine the NPV for each of these projects. Should either project be accepted? f. Describe the logic behind the NPV. g. Determine the PI for each of these projects. Should either project be accepted? h. Would you expect the NPV and PI methods to give consistent accept/reject decisions? Why or why not? i. What would happen to the NPV and PI for each project if the required rate of return increased? If the required rate of return decreased? j. Determine the IRR for each project. Should either project be accepted? k. How does a change in the required rate of return affect the project's internal rate of return? I. What reinvestment rate assumptions are implicitly made by the NPV and IRR methods? Which one is better? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) a. The capital-budgeting process is so important because capital-budgeting decisions involve investments requiring rather relatively time horizon. (Select from the drop-down menus.) b. Why is it difficult to find exceptionally profitable projects? (Select the best choice below.) A. The lack of effective investment criteria makes profitable projects hard to find. B. There is no reliable method to accurately estimate a project's future cash flows. C. The existence of competition may drive price and profit down quickly. D. The costs of implementing capital-budgeting decisions are extremely high. c. What is the payback period on project A? 4.5 years (Round to two decimal places.) If Caledonia imposes a 4-year maximum acceptable payback period, the firm should What is the payback period on project B? 3.75 years (Round to two decimal places.) cash outlays at the beginning of the life of the project and commit the firm to a particular course of action over a project A because its payback period is the maximum acceptable payback period. (Select from the drop-down menus.) project B because its payback period is the maximum acceptable payback period. (Select from the drop-down menus.) d. What are the criticisms of the payback period? (Select all that apply.) 'A. The method does not take into account the time value of money. B. The selection of the maximum acceptable payback period is arbitrary. C. The method ignores cash flows occurring after the payback period. D. It is consistent with the firm's goal of shareholder wealth maximization. e. What is the NPV of project A ? the capital-budgeting analysis department or are provided with remedial training. The memorandum you received outlining your assignment follows: To: New Financial Analysts From: Mr. V. Morrison, CEO, Caledonia Products Re: Capital-Budgeting Analysis return on both projects has been established at 15 percent. The expected free cash flows from each project are shown in the popup window: In evaluating these projects, please respond to the following questions: a. Why is the capital-budgeting process so important? b. Why is it difficult to find exceptionally profitable projects? c. What is the payback period on each project? If Caledonia imposes a 4-year maximum acceptable payback period, which of these projects should be accepted? d. What are the criticisms of the payback period? e. Determine the NPV for each of these projects. Should either project be accepted? f. Describe the logic behind the NPV. g. Determine the PI for each of these projects. Should either project be accepted? h. Would you expect the NPV and PI methods to give consistent accept/reject decisions? Why or why not? i. What would happen to the NPV and PI for each project if the required rate of return increased? If the required rate of return decreased? j. Determine the IRR for each project. Should either project be accepted? k. How does a change in the required rate of return affect the project's internal rate of return? I. What reinvestment rate assumptions are implicitly made by the NPV and IRR methods? Which one is better? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) a. The capital-budgeting process is so important because capital-budgeting decisions involve investments requiring rather relatively time horizon. (Select from the drop-down menus.) b. Why is it difficult to find exceptionally profitable projects? (Select the best choice below.) A. The lack of effective investment criteria makes profitable projects hard to find. B. There is no reliable method to accurately estimate a project's future cash flows. C. The existence of competition may drive price and profit down quickly. D. The costs of implementing capital-budgeting decisions are extremely high. c. What is the payback period on project A? 4.5 years (Round to two decimal places.) If Caledonia imposes a 4-year maximum acceptable payback period, the firm should What is the payback period on project B? 3.75 years (Round to two decimal places.) cash outlays at the beginning of the life of the project and commit the firm to a particular course of action over a project A because its payback period is the maximum acceptable payback period. (Select from the drop-down menus.) project B because its payback period is the maximum acceptable payback period. (Select from the drop-down menus.) d. What are the criticisms of the payback period? (Select all that apply.) 'A. The method does not take into account the time value of money. B. The selection of the maximum acceptable payback period is arbitrary. C. The method ignores cash flows occurring after the payback period. D. It is consistent with the firm's goal of shareholder wealth maximization. e. What is the NPV of project A Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started