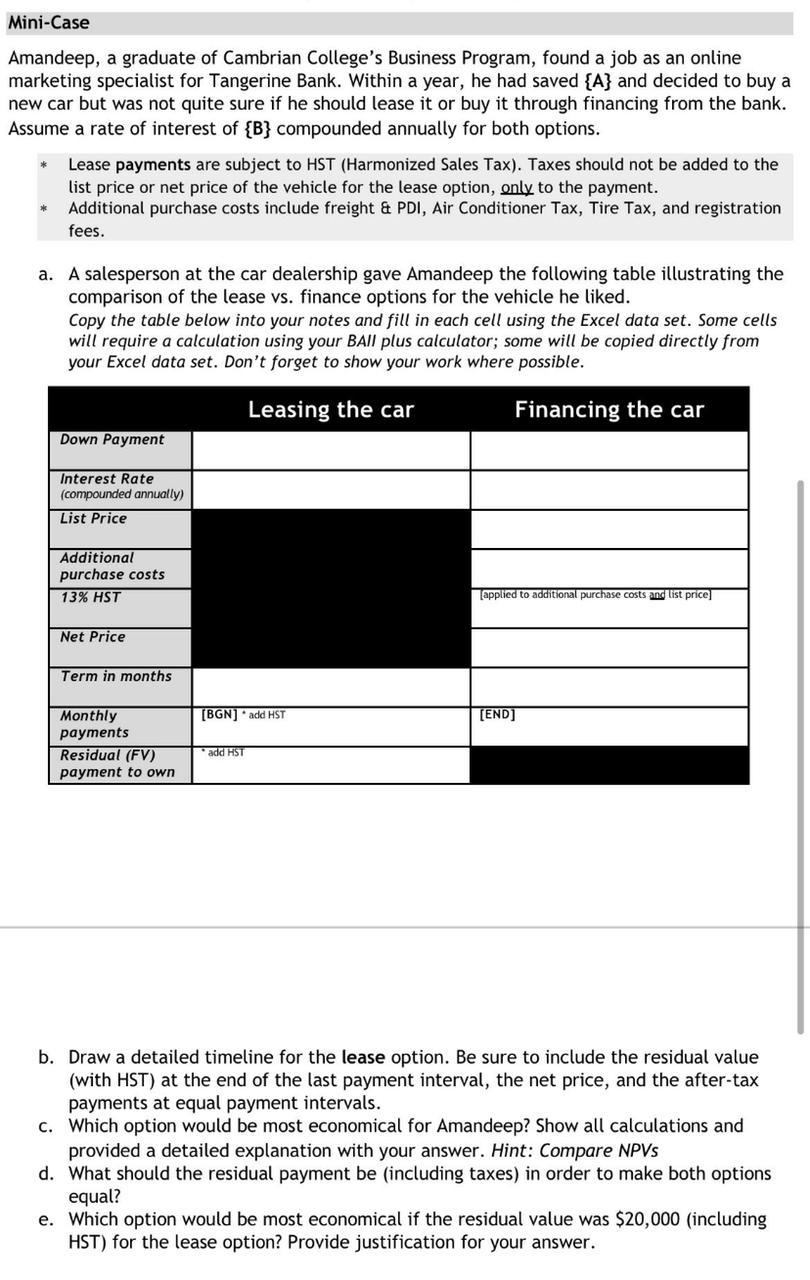

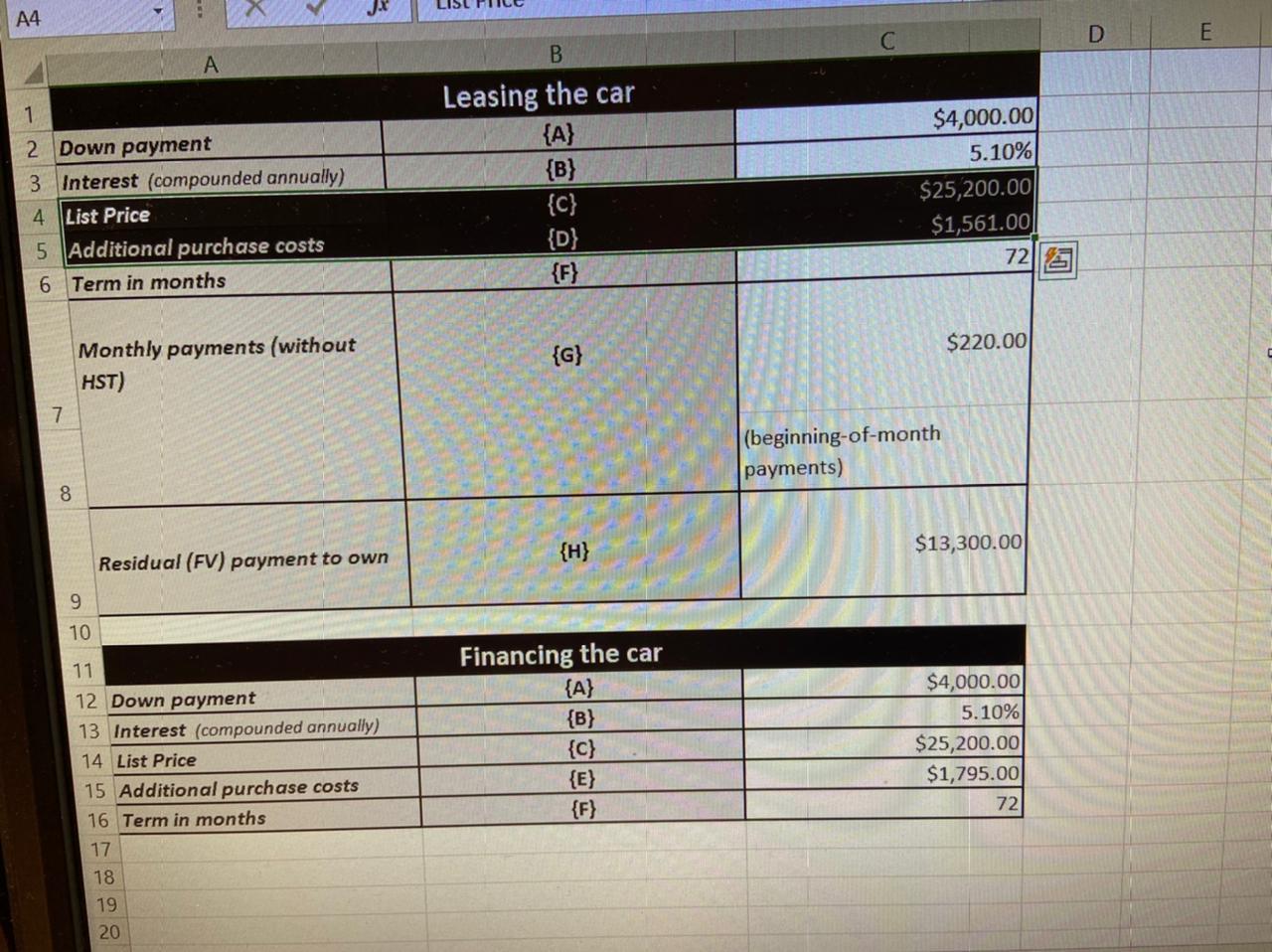

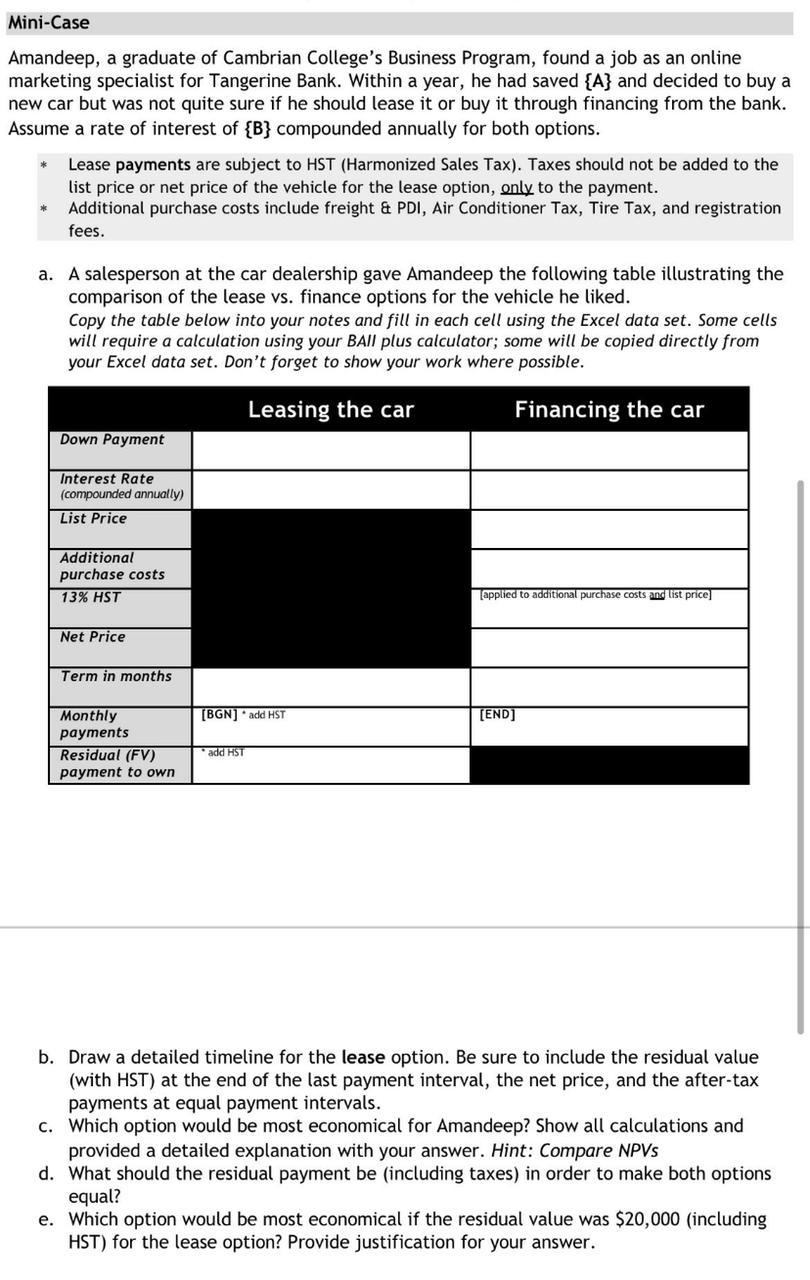

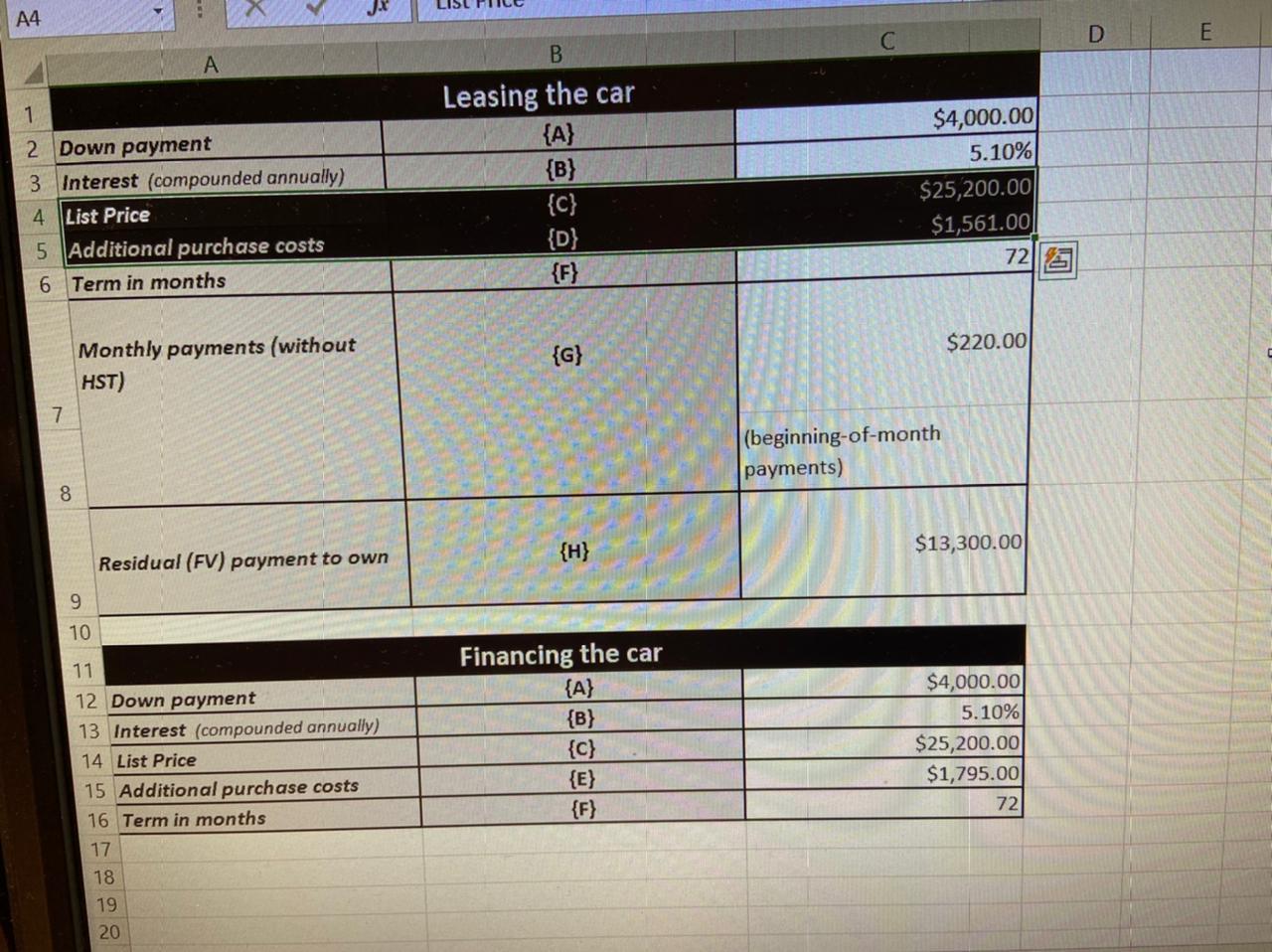

Mini-Case Amandeep, a graduate of Cambrian College's Business Program, found a job as an online marketing specialist for Tangerine Bank. Within a year, he had saved {A} and decided to buy a new car but was not quite sure if he should lease it or buy it through financing from the bank. Assume a rate of interest of {B} compounded annually for both options. Lease payments are subject to HST (Harmonized Sales Tax). Taxes should not be added to the list price or net price of the vehicle for the lease option, only to the payment. Additional purchase costs include freight & PDI, Air Conditioner Tax, Tire Tax, and registration fees. a. A salesperson at the car dealership gave Amandeep the following table illustrating the comparison of the lease vs. finance options for the vehicle he liked. Copy the table below into your notes and fill in each cell using the Excel data set. Some cells will require a calculation using your BAll plus calculator; some will be copied directly from your Excel data set. Don't forget to show your work where possible. Leasing the car Financing the car Down Payment Interest Rate (compounded annually) List Price Additional purchase costs 13% HST applied to additional purchase costs and list price Net Price Term in months (BGN) add HST [END] Monthly payments Residual (FV) payment to own add HST b. Draw a detailed timeline for the lease option. Be sure to include the residual value (with HST) at the end of the last payment interval, the net price, and the after-tax payments at equal payment intervals. c. Which option would be most economical for Amandeep? Show all calculations and provided a detailed explanation with your answer. Hint: Compare NPVS d. What should the residual payment be (including taxes) in order to make both options equal? e. Which option would be most economical if the residual value was $20,000 (including HST) for the lease option? Provide justification for your answer. LISL A4 D E 1 2 Down payment 3 Interest (compounded annually) 4 List Price 5 Additional purchase costs 6 Term in months B Leasing the car {A} {B} {C} {D} {F} $4,000.00 5.10% $25,200.00 $1,561.00) 72|| $220.00 Monthly payments (without HST) {G} 7 (beginning-of-month payments) 8 {H} $13,300.00 Residual (FV) payment to own 9 10 11 12 Down payment 13 Interest (compounded annually) 14 List Price 15 Additional purchase costs 16 Term in months Financing the car {A} {B} {C} {E} $4,000.00 5.10% $25,200.00 $1,795.00 72 17 18 19 20