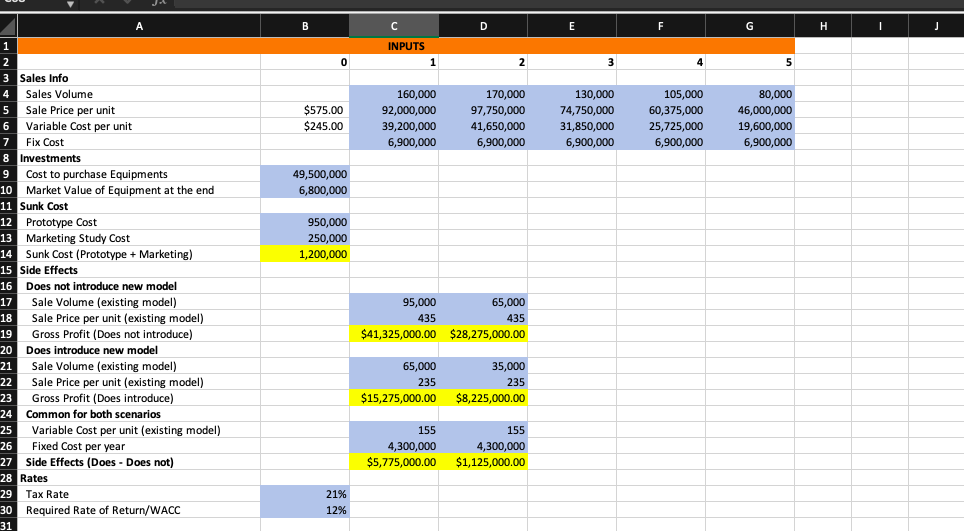

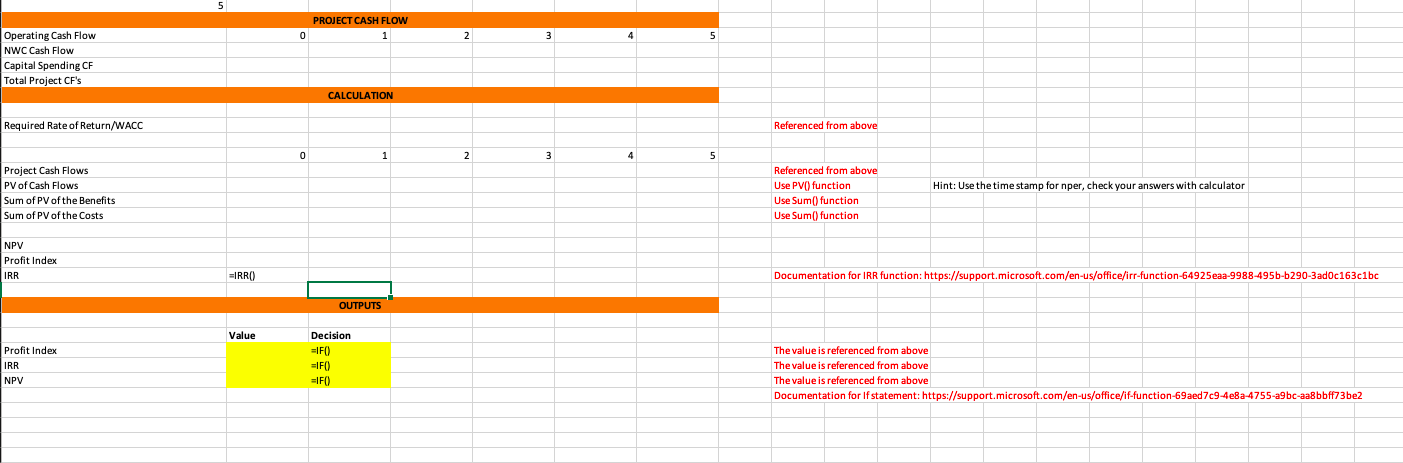

MINICASE Conch Republic Electronics, Part 1 need help with parts of spreadsheet that aren't completed - cash flows, NWC, NPV, etc...

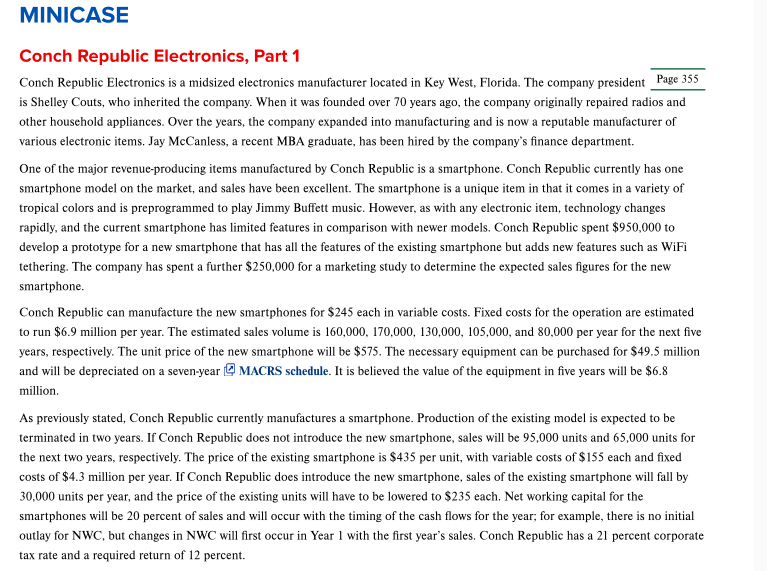

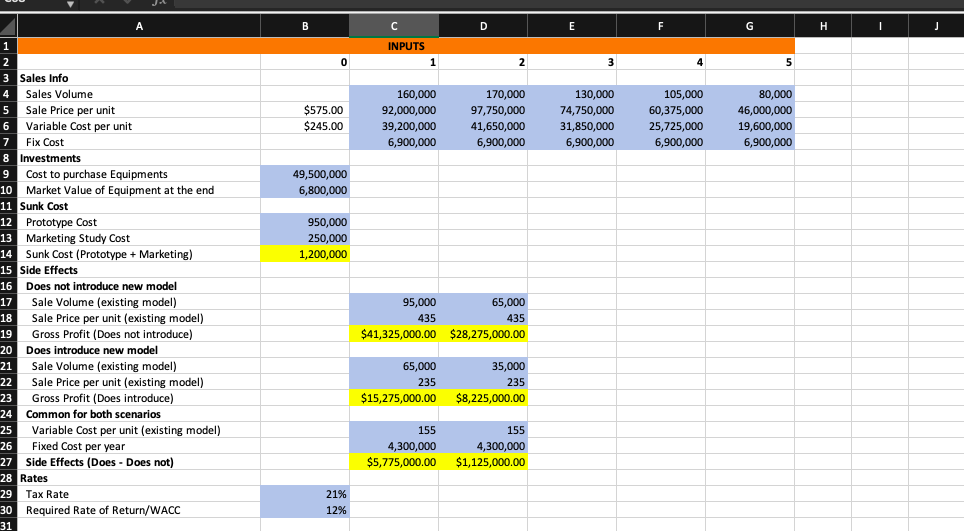

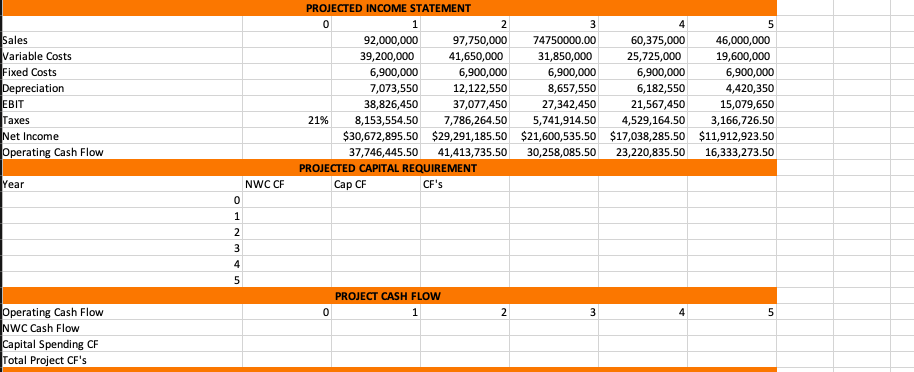

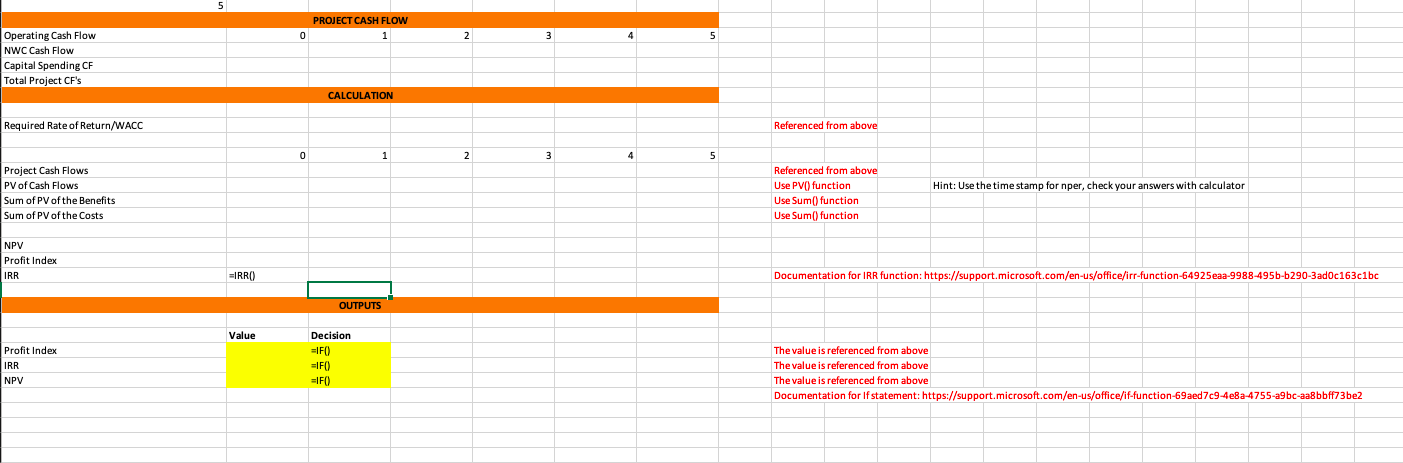

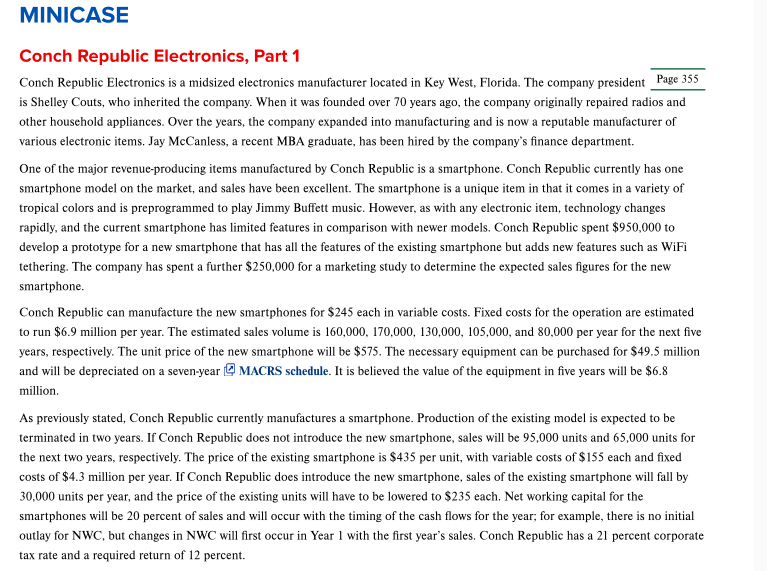

MINICASE Conch Republic Electronics, Part 1 Conch Republic Electronics is a midsized electronics manufacturer located in Key West, Florida. The company president Page 355 is Shelley Couts, who inherited the company. When it was founded over 70 years ago, the company originally repaired radios and other household appliances. Over the years, the company expanded into manufacturing and is now a reputable manufacturer of various electronic items. Jay McCanless, a recent MBA graduate, has been hired by the company's finance department. One of the major revenue-producing items manufactured by Conch Republic is a smartphone. Conch Republic currently has one smartphone model on the market, and sales have been excellent. The smartphone is a unique item in that it comes in a variety of tropical colors and is preprogrammed to play Jimmy Buffett music. However, as with any electronic item, technology changes rapidly, and the current smartphone has limited features in comparison with newer models. Conch Republic spent $950,000 to develop a prototype for a new smartphone that has all the features of the existing smartphone but adds new features such as WiFi tethering. The company has spent a further $250,000 for a marketing study to determine the expected sales figures for the new smartphone. Conch Republic can manufacture the new smartphones for $245 each in variable costs. Fixed costs for the operation are estimated to run $6.9 million per year. The estimated sales volume is 160,000, 170,000, 130,000, 105,000, and 80,000 per year for the next five years, respectively. The unit price of the new smartphone will be $575. The necessary equipment can be purchased for $49.5 million and will be depreciated on a seven-year @ MACRS schedule. It is believed the value of the equipment in five years will be $6.8 million. As previously stated, Conch Republic currently manufactures a smartphone. Production of the existing model is expected to be terminated in two years. If Conch Republic does not introduce the new smartphone, sales will be 95,000 units and 65,000 units for the next two years, respectively. The price of the existing smartphone is $435 per unit, with variable costs of $155 each and fixed costs of $4.3 million per year. If Conch Republic does introduce the new smartphone, sales of the existing smartphone will fall by 30,000 units per year, and the price of the existing units will have to be lowered to $235 each. Net working capital for the smartphones will be 20 percent of sales and will occur with the timing of the cash flows for the year, for example, there is no initial outlay for NWC, but changes in NWC will first occur in Year 1 with the first year's sales. Conch Republic has a 21 percent corporate tax rate and a required return of 12 percent. B D E F G H H I J J INPUTS 1 0 2 3 4 5 $575.00 $245.00 160,000 92,000,000 39,200,000 6,900,000 170,000 97,750,000 41,650,000 6,900,000 130,000 74,750,000 31,850,000 6,900,000 105,000 60,375,000 25,725,000 6,900,000 80,000 46,000,000 19,600,000 6,900,000 49,500,000 6,800,000 950,000 250,000 1,200,000 1 2 3 Sales Info 4 Sales Volume 5 Sale Price per unit 6 Variable Cost per unit 7 Fix Cost 8 Investments vese 9 Cost to purchase Equipments 10 Market Value of Equipment at the end 11 Sunk Cost 12 Prototype Cost 13 Marketing Study Cost 14 Sunk Cost (Prototype + Marketing) 15 Side Effects de che 16 Does not introduce new model so 17 Sale Volume (existing model) ) 18 Sale Price per unit (existing model) 19 Gross Profit (Does not introduce) ) 20 Does introduce new model 21 Sale Volume (existing model) 22 Sale Price per unit (existing model) 23 Gross Profit (Does introduce) ) 24 Common for both scenarios 25 Variable Cost per unit (existing model) 26 Fixed Cost per year 27 Side Effects (Does - Does not) 28 Rates 29 Tax Rate 30 Required Rate of Return/WACC 31 95,000 65,000 435 435 $41,325,000.00 $28,275,000.00 65,000 35,000 235 235 $15,275,000.00 $8,225,000.00 155 4,300,000 $5,775,000.00 155 4,300,000 $1,125,000.00 21% 12% Sales Variable Costs Fixed Costs Depreciation EBIT Taxes Net Income Operating Cash Flow PROJECTED INCOME STATEMENT 0 1 2 3 5 92,000,000 97,750,000 74750000.00 60,375,000 46,000,000 39,200,000 41,650,000 31,850,000 25,725,000 19,600,000 6,900,000 6,900,000 6,900,000 6,900,000 6,900,000 7,073,550 12,122,550 8,657,550 6,182,550 4,420,350 38,826,450 37,077,450 27,342,450 21,567,450 15,079,650 21% 8,153,554.50 7,786,264.50 5,741,914.50 4,529,164.50 3,166,726.50 $30,672,895.50 $29,291,185.50 $21,600,535.50 $17,038,285.50 $11,912,923.50 37,746,445.50 41,413,735.50 30,258,085.50 23,220,835.50 16,333,273.50 PROJECTED CAPITAL REQUIREMENT CF CF's Year NWC CF 0 1 2 3 4 5 PROJECT CASH FLOW 1 0 2 3 4 5 Operating Cash Flow NWC Cash Flow Capital Spending CF Total Project CF's PROJECT CASH FLOW 0 Operating Cash Flow NWC Cash Flow Capital Spending CF Total Project CF's CALCULATION Required Rate of Return/WACC Referenced from above 0 2 4 5 Hint: Use the timestamp for nper, check your answers with calculator Project Cash Flows PV of Cash Flows Sum of PV of the Benefits Sum of PV of the Costs Referenced from above Use PV() function Use Sum() function Use Sum() function NPV Profit Index IRR =IRRO) Documentation for IRR function: https://support.microsoft.com/en-us/office/irr-function-64925eaa-9988-495b-b290-3ad0c163c1bc OUTPUTS Value Profit Index IRR NPV Decision =IF0) =IF0) =IF0 The value is referenced from above The value is referenced from above The value is referenced from above Documentation for If statement: https://support.microsoft.com/en-us/office/if-function-69aed7c9-4e8a-4755-a9bc-aa8bbff73be2 MINICASE Conch Republic Electronics, Part 1 Conch Republic Electronics is a midsized electronics manufacturer located in Key West, Florida. The company president Page 355 is Shelley Couts, who inherited the company. When it was founded over 70 years ago, the company originally repaired radios and other household appliances. Over the years, the company expanded into manufacturing and is now a reputable manufacturer of various electronic items. Jay McCanless, a recent MBA graduate, has been hired by the company's finance department. One of the major revenue-producing items manufactured by Conch Republic is a smartphone. Conch Republic currently has one smartphone model on the market, and sales have been excellent. The smartphone is a unique item in that it comes in a variety of tropical colors and is preprogrammed to play Jimmy Buffett music. However, as with any electronic item, technology changes rapidly, and the current smartphone has limited features in comparison with newer models. Conch Republic spent $950,000 to develop a prototype for a new smartphone that has all the features of the existing smartphone but adds new features such as WiFi tethering. The company has spent a further $250,000 for a marketing study to determine the expected sales figures for the new smartphone. Conch Republic can manufacture the new smartphones for $245 each in variable costs. Fixed costs for the operation are estimated to run $6.9 million per year. The estimated sales volume is 160,000, 170,000, 130,000, 105,000, and 80,000 per year for the next five years, respectively. The unit price of the new smartphone will be $575. The necessary equipment can be purchased for $49.5 million and will be depreciated on a seven-year @ MACRS schedule. It is believed the value of the equipment in five years will be $6.8 million. As previously stated, Conch Republic currently manufactures a smartphone. Production of the existing model is expected to be terminated in two years. If Conch Republic does not introduce the new smartphone, sales will be 95,000 units and 65,000 units for the next two years, respectively. The price of the existing smartphone is $435 per unit, with variable costs of $155 each and fixed costs of $4.3 million per year. If Conch Republic does introduce the new smartphone, sales of the existing smartphone will fall by 30,000 units per year, and the price of the existing units will have to be lowered to $235 each. Net working capital for the smartphones will be 20 percent of sales and will occur with the timing of the cash flows for the year, for example, there is no initial outlay for NWC, but changes in NWC will first occur in Year 1 with the first year's sales. Conch Republic has a 21 percent corporate tax rate and a required return of 12 percent. B D E F G H H I J J INPUTS 1 0 2 3 4 5 $575.00 $245.00 160,000 92,000,000 39,200,000 6,900,000 170,000 97,750,000 41,650,000 6,900,000 130,000 74,750,000 31,850,000 6,900,000 105,000 60,375,000 25,725,000 6,900,000 80,000 46,000,000 19,600,000 6,900,000 49,500,000 6,800,000 950,000 250,000 1,200,000 1 2 3 Sales Info 4 Sales Volume 5 Sale Price per unit 6 Variable Cost per unit 7 Fix Cost 8 Investments vese 9 Cost to purchase Equipments 10 Market Value of Equipment at the end 11 Sunk Cost 12 Prototype Cost 13 Marketing Study Cost 14 Sunk Cost (Prototype + Marketing) 15 Side Effects de che 16 Does not introduce new model so 17 Sale Volume (existing model) ) 18 Sale Price per unit (existing model) 19 Gross Profit (Does not introduce) ) 20 Does introduce new model 21 Sale Volume (existing model) 22 Sale Price per unit (existing model) 23 Gross Profit (Does introduce) ) 24 Common for both scenarios 25 Variable Cost per unit (existing model) 26 Fixed Cost per year 27 Side Effects (Does - Does not) 28 Rates 29 Tax Rate 30 Required Rate of Return/WACC 31 95,000 65,000 435 435 $41,325,000.00 $28,275,000.00 65,000 35,000 235 235 $15,275,000.00 $8,225,000.00 155 4,300,000 $5,775,000.00 155 4,300,000 $1,125,000.00 21% 12% Sales Variable Costs Fixed Costs Depreciation EBIT Taxes Net Income Operating Cash Flow PROJECTED INCOME STATEMENT 0 1 2 3 5 92,000,000 97,750,000 74750000.00 60,375,000 46,000,000 39,200,000 41,650,000 31,850,000 25,725,000 19,600,000 6,900,000 6,900,000 6,900,000 6,900,000 6,900,000 7,073,550 12,122,550 8,657,550 6,182,550 4,420,350 38,826,450 37,077,450 27,342,450 21,567,450 15,079,650 21% 8,153,554.50 7,786,264.50 5,741,914.50 4,529,164.50 3,166,726.50 $30,672,895.50 $29,291,185.50 $21,600,535.50 $17,038,285.50 $11,912,923.50 37,746,445.50 41,413,735.50 30,258,085.50 23,220,835.50 16,333,273.50 PROJECTED CAPITAL REQUIREMENT CF CF's Year NWC CF 0 1 2 3 4 5 PROJECT CASH FLOW 1 0 2 3 4 5 Operating Cash Flow NWC Cash Flow Capital Spending CF Total Project CF's PROJECT CASH FLOW 0 Operating Cash Flow NWC Cash Flow Capital Spending CF Total Project CF's CALCULATION Required Rate of Return/WACC Referenced from above 0 2 4 5 Hint: Use the timestamp for nper, check your answers with calculator Project Cash Flows PV of Cash Flows Sum of PV of the Benefits Sum of PV of the Costs Referenced from above Use PV() function Use Sum() function Use Sum() function NPV Profit Index IRR =IRRO) Documentation for IRR function: https://support.microsoft.com/en-us/office/irr-function-64925eaa-9988-495b-b290-3ad0c163c1bc OUTPUTS Value Profit Index IRR NPV Decision =IF0) =IF0) =IF0 The value is referenced from above The value is referenced from above The value is referenced from above Documentation for If statement: https://support.microsoft.com/en-us/office/if-function-69aed7c9-4e8a-4755-a9bc-aa8bbff73be2