Answered step by step

Verified Expert Solution

Question

1 Approved Answer

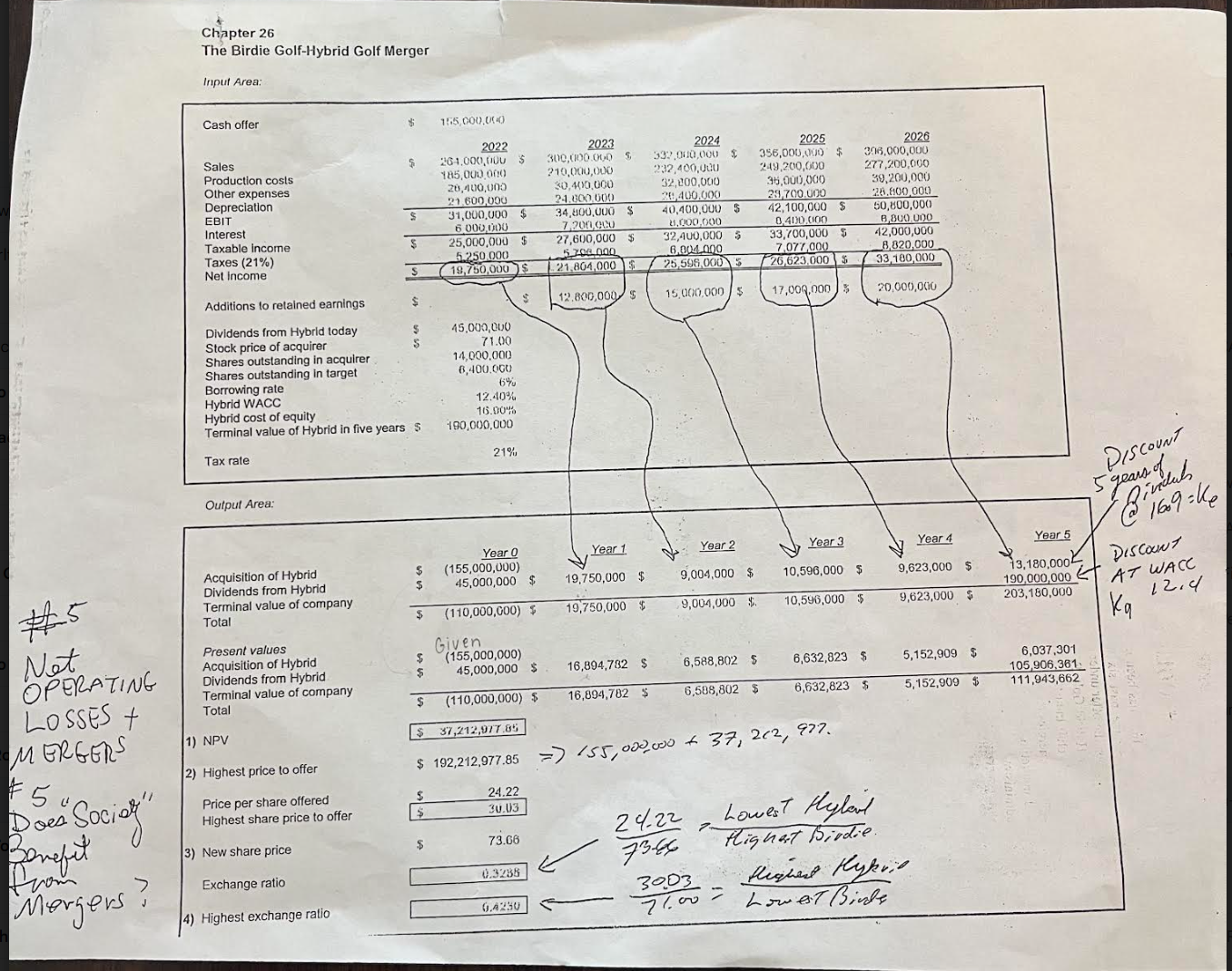

MINICASE THE BIRDIE GOLF - HYBRID GOLF MERGER Birtie Golf, Inc, has been in merger talks with Hybrid Golf Company for the past six mooths.

MINICASE

THE BIRDIE GOLFHYBRID GOLF MERGER

Birtie Golf, Inc, has been in merger talks with Hybrid Golf

Company for the past six mooths. After several rounds o

million for Hybrid Golf. Both comparies have niche markets

in the golf club industry, and both belicve thot a mers

result in synergies due to economies of scale in manufacturing

administrative expenses.

If Birdie Golf bays Hybrid Golf, an immediate dividend of

$ million would be paid from Hybrid Golf to Birdie. Stock in

Birdie Golf currently sells for $ per share, and the company

has million shares of stock outstanding. Hybrid Golf has

million shares of stock outstanding. Both companies can

borrow at an percent interest rate. Bryce believes the curreal

cost of capital for Birdie Golf is percent. The cost of capita

for Hybrid Golf is percent, and the cost of equity is

percent. In five years, the value of Hybrid Golf is expected to

Bryce $ million.

Bryce has asked you to analyze the financial aspects of the

potential merger. Sp following questions.

QUESTIONS

Suppose Hybrid shareholders will agree to a merger

price of $ per share. Should Birdie proceed with the

merger?

What is the highest price per share that Birdie should be

willing to pay for Hybrid?

Suppose Birdie is tinwilling to pay cash for the merger but

will consider a stock exchange. What exchange ratio would

make the merger terms equivalent to the original merger

price of $ per share?

What is the bighest exchange retio Birdie should be willing

to pay and still undertake the mierger?

Help Me calculate cost of equity, Wacc, NPV and PV I am going to use a TI BAII Plus claculator. Help me how to do the calculation step by step. Chapter

The Birdie GolfHybrid Golf Merger

Input Area:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started