Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Minion is a nutrition company based in the United Kingdom that specialises in manufacturing and exporting high-quality nutrition products to the United States. In addition,

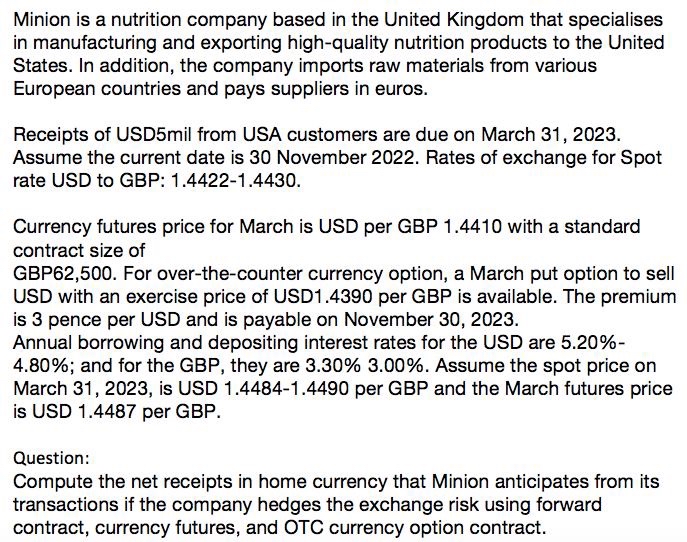

Minion is a nutrition company based in the United Kingdom that specialises in manufacturing and exporting high-quality nutrition products to the United States. In addition, the company imports raw materials from various European countries and pays suppliers in euros. Receipts of USD5mil from USA customers are due on March 31, 2023. Assume the current date is 30 November 2022. Rates of exchange for Spot rate USD to GBP: 1.44221.4430. Currency futures price for March is USD per GBP 1.4410 with a standard contract size of GBP62,500. For over-the-counter currency option, a March put option to sell USD with an exercise price of USD1.4390 per GBP is available. The premium is 3 pence per USD and is payable on November 30,2023. Annual borrowing and depositing interest rates for the USD are 5.20% 4.80%; and for the GBP, they are 3.30%3.00%. Assume the spot price on March 31,2023 , is USD 1.4484-1.4490 per GBP and the March futures price is USD 1.4487 per GBP. Question: Compute the net receipts in home currency that Minion anticipates from its transactions if the company hedges the exchange risk using forward contract, currency futures, and OTC currency option contract. Minion is a nutrition company based in the United Kingdom that specialises in manufacturing and exporting high-quality nutrition products to the United States. In addition, the company imports raw materials from various European countries and pays suppliers in euros. Receipts of USD5mil from USA customers are due on March 31, 2023. Assume the current date is 30 November 2022. Rates of exchange for Spot rate USD to GBP: 1.44221.4430. Currency futures price for March is USD per GBP 1.4410 with a standard contract size of GBP62,500. For over-the-counter currency option, a March put option to sell USD with an exercise price of USD1.4390 per GBP is available. The premium is 3 pence per USD and is payable on November 30,2023. Annual borrowing and depositing interest rates for the USD are 5.20% 4.80%; and for the GBP, they are 3.30%3.00%. Assume the spot price on March 31,2023 , is USD 1.4484-1.4490 per GBP and the March futures price is USD 1.4487 per GBP. Question: Compute the net receipts in home currency that Minion anticipates from its transactions if the company hedges the exchange risk using forward contract, currency futures, and OTC currency option contract

Minion is a nutrition company based in the United Kingdom that specialises in manufacturing and exporting high-quality nutrition products to the United States. In addition, the company imports raw materials from various European countries and pays suppliers in euros. Receipts of USD5mil from USA customers are due on March 31, 2023. Assume the current date is 30 November 2022. Rates of exchange for Spot rate USD to GBP: 1.44221.4430. Currency futures price for March is USD per GBP 1.4410 with a standard contract size of GBP62,500. For over-the-counter currency option, a March put option to sell USD with an exercise price of USD1.4390 per GBP is available. The premium is 3 pence per USD and is payable on November 30,2023. Annual borrowing and depositing interest rates for the USD are 5.20% 4.80%; and for the GBP, they are 3.30%3.00%. Assume the spot price on March 31,2023 , is USD 1.4484-1.4490 per GBP and the March futures price is USD 1.4487 per GBP. Question: Compute the net receipts in home currency that Minion anticipates from its transactions if the company hedges the exchange risk using forward contract, currency futures, and OTC currency option contract. Minion is a nutrition company based in the United Kingdom that specialises in manufacturing and exporting high-quality nutrition products to the United States. In addition, the company imports raw materials from various European countries and pays suppliers in euros. Receipts of USD5mil from USA customers are due on March 31, 2023. Assume the current date is 30 November 2022. Rates of exchange for Spot rate USD to GBP: 1.44221.4430. Currency futures price for March is USD per GBP 1.4410 with a standard contract size of GBP62,500. For over-the-counter currency option, a March put option to sell USD with an exercise price of USD1.4390 per GBP is available. The premium is 3 pence per USD and is payable on November 30,2023. Annual borrowing and depositing interest rates for the USD are 5.20% 4.80%; and for the GBP, they are 3.30%3.00%. Assume the spot price on March 31,2023 , is USD 1.4484-1.4490 per GBP and the March futures price is USD 1.4487 per GBP. Question: Compute the net receipts in home currency that Minion anticipates from its transactions if the company hedges the exchange risk using forward contract, currency futures, and OTC currency option contract Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started