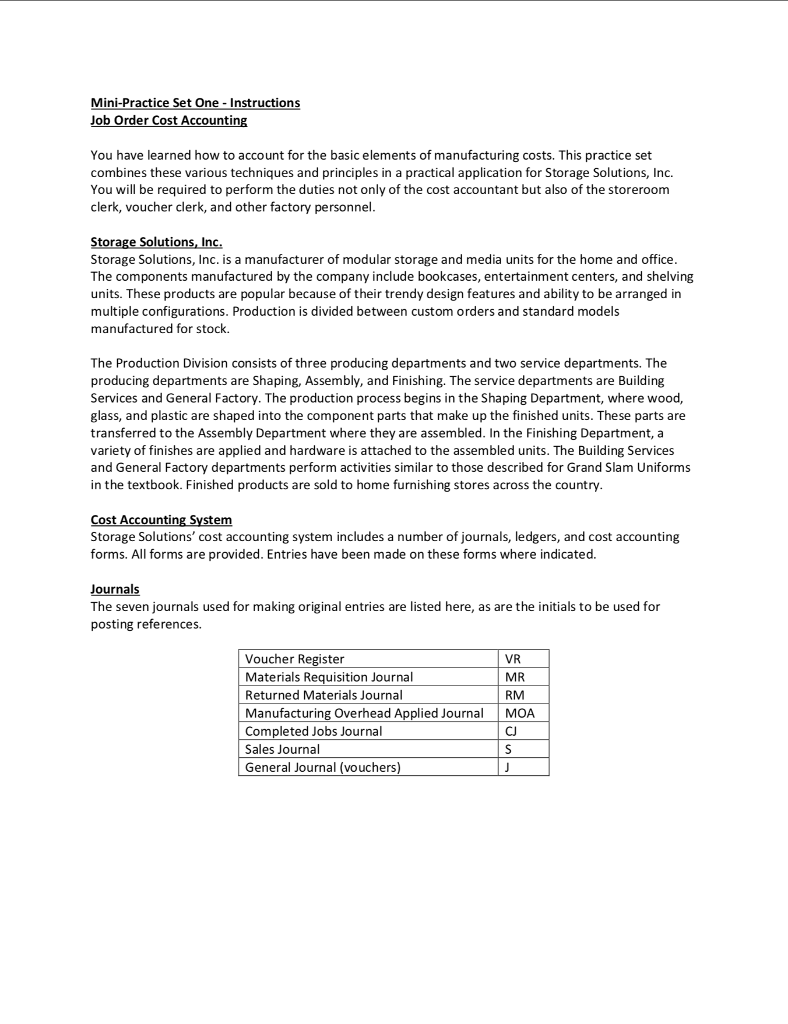

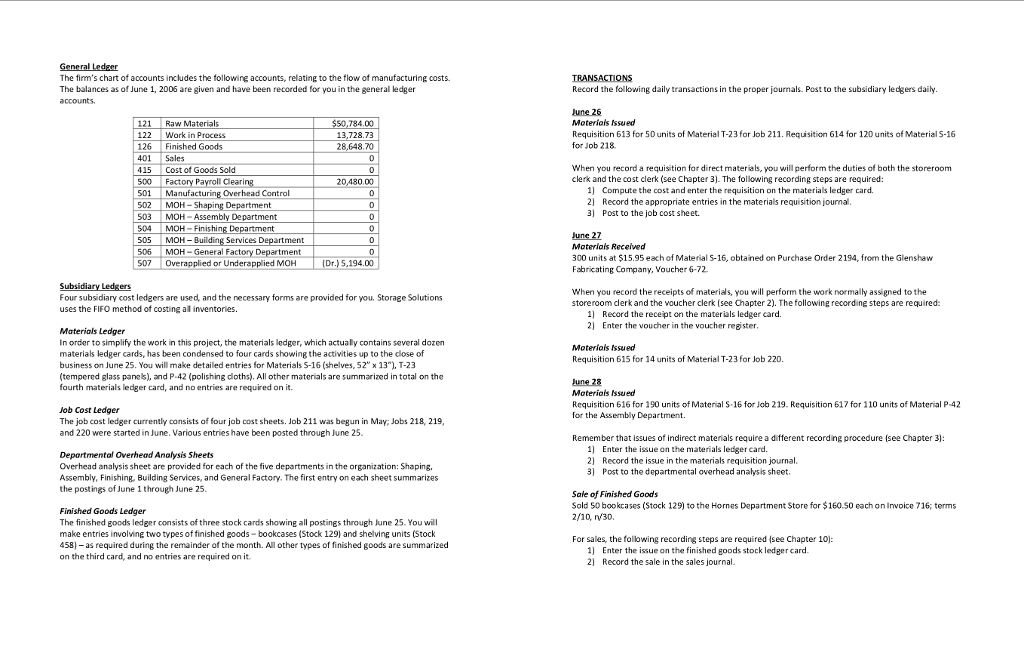

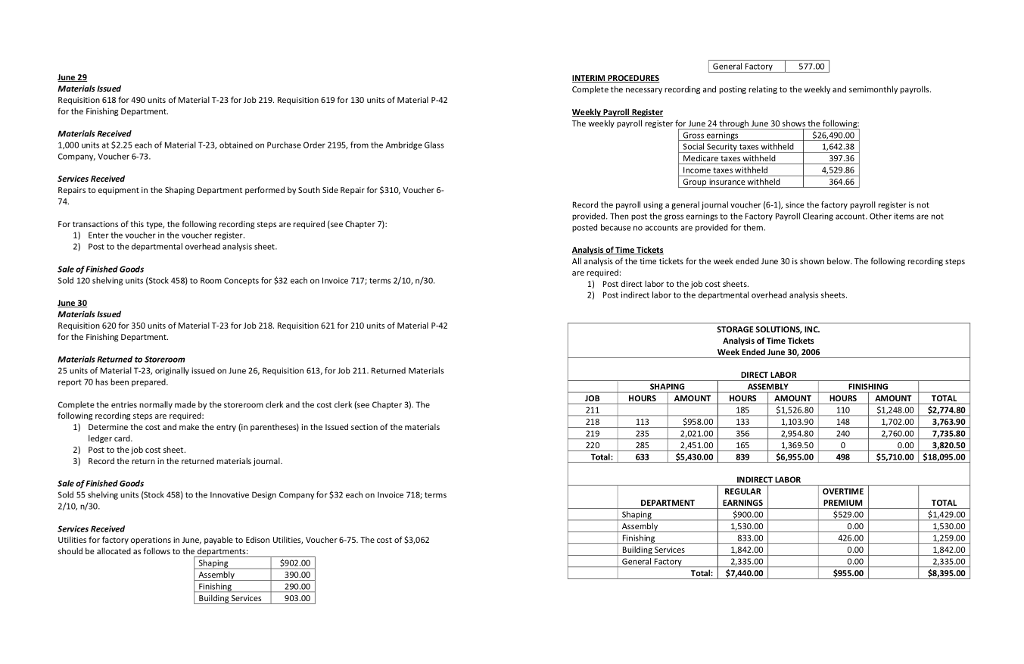

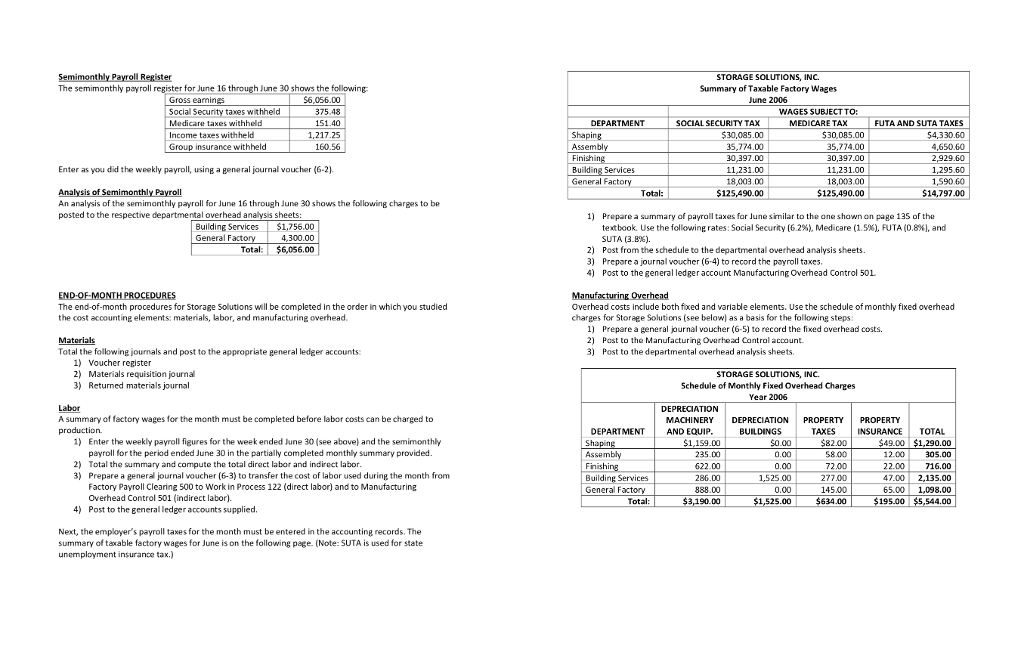

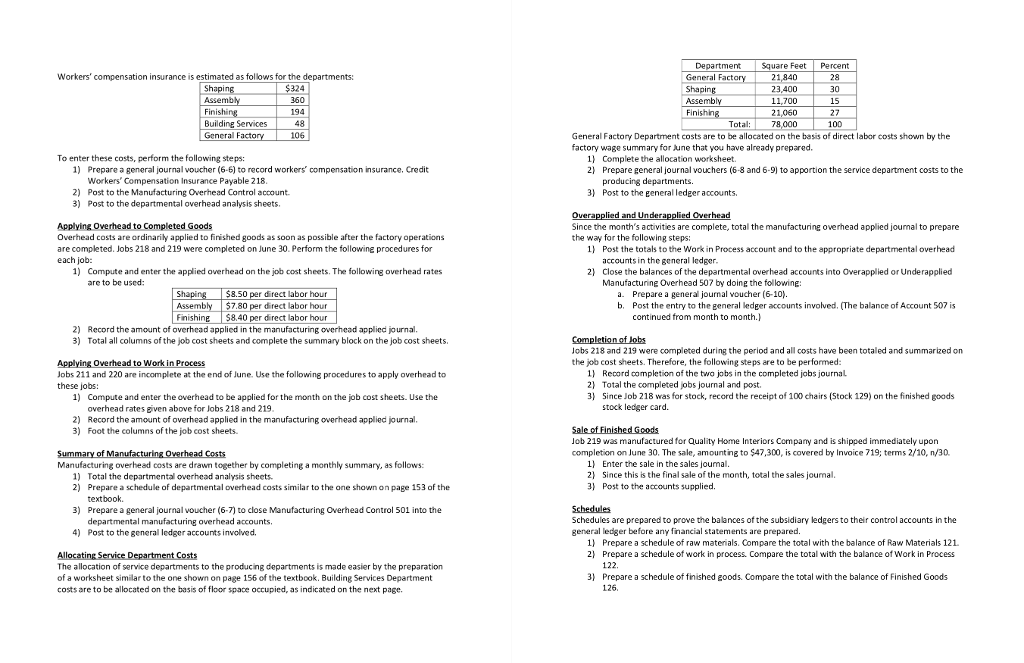

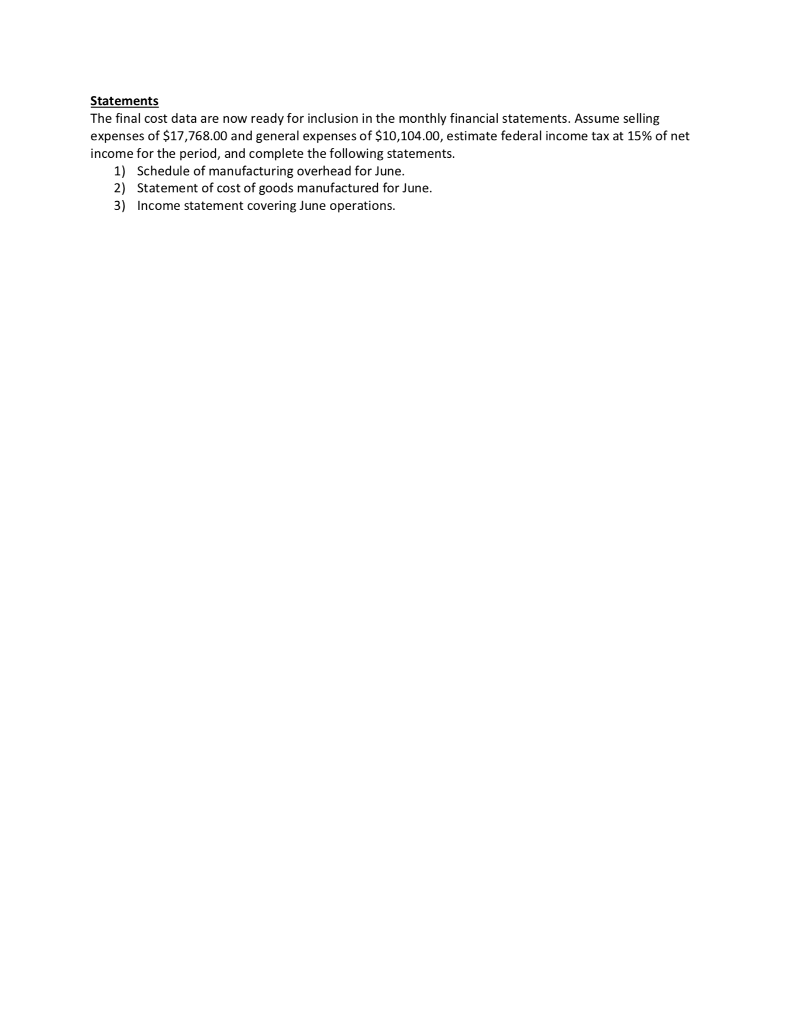

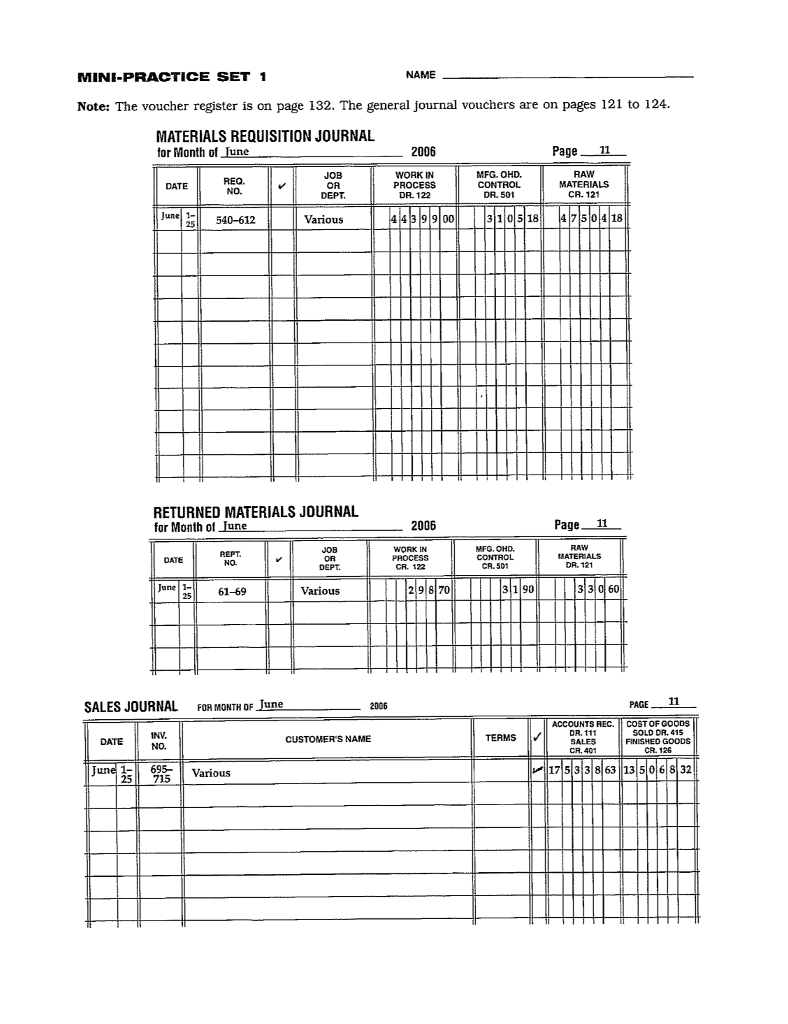

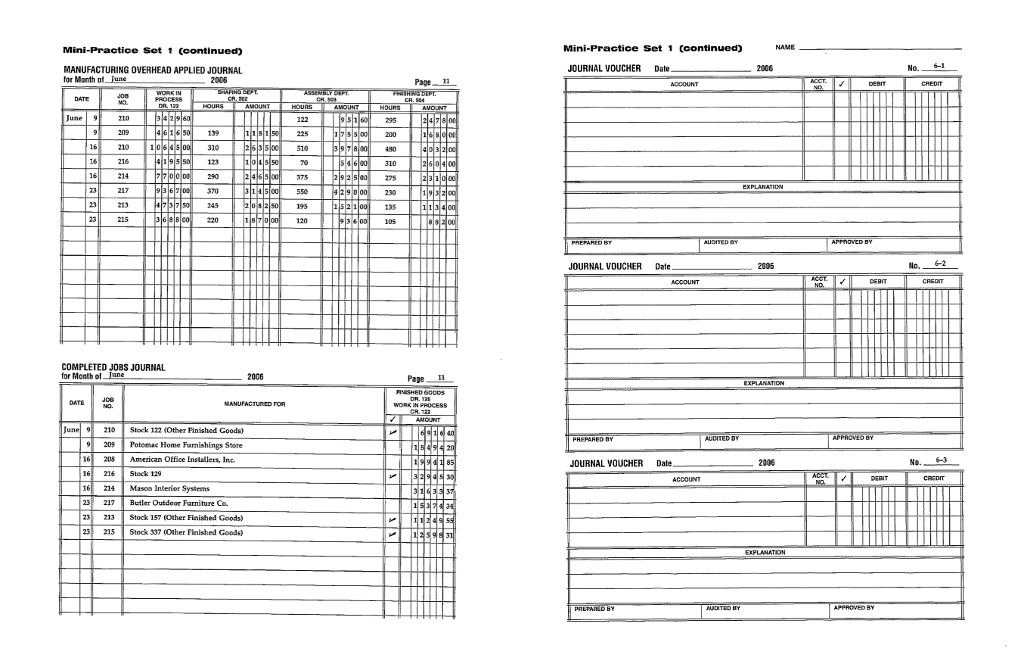

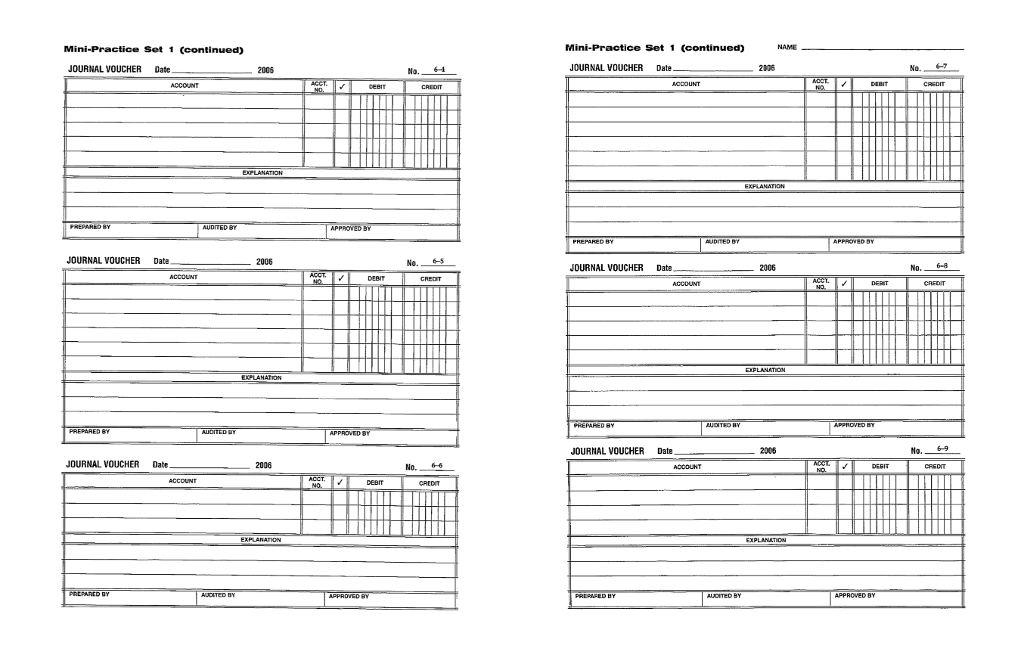

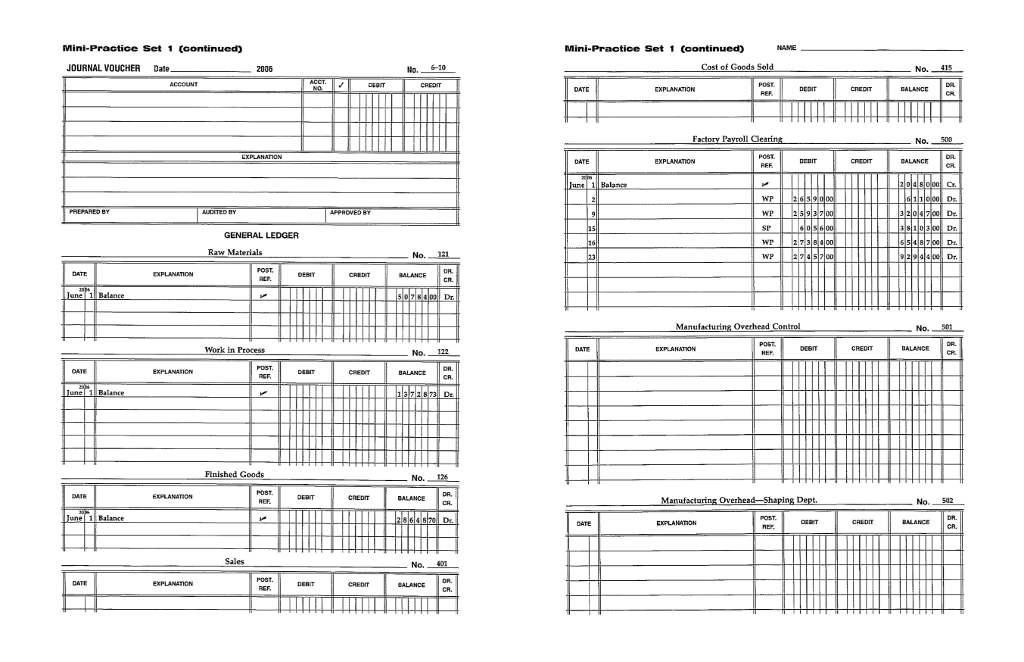

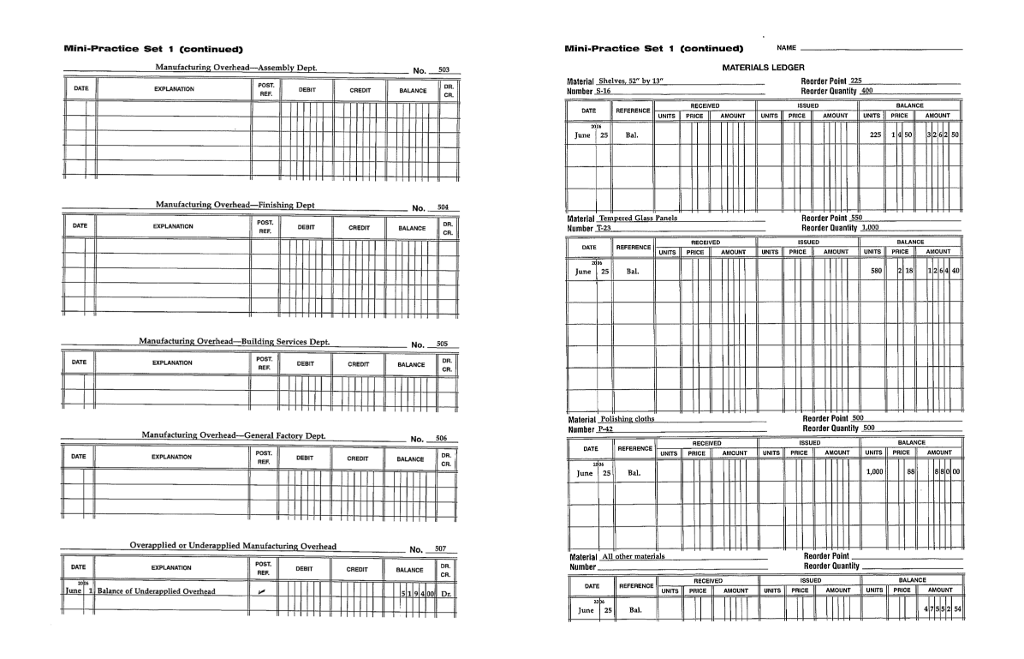

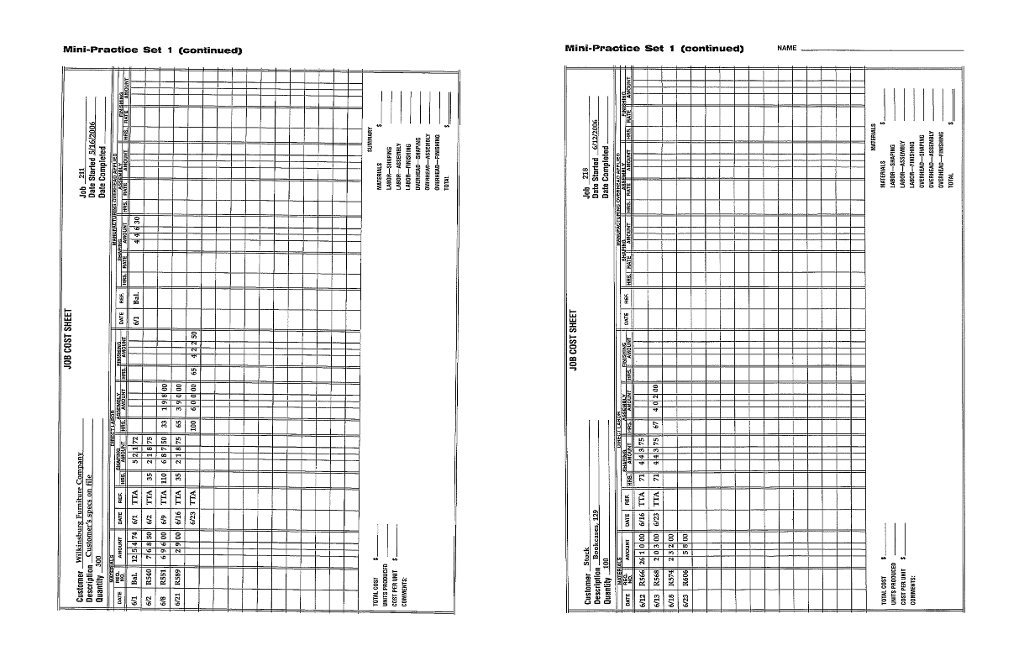

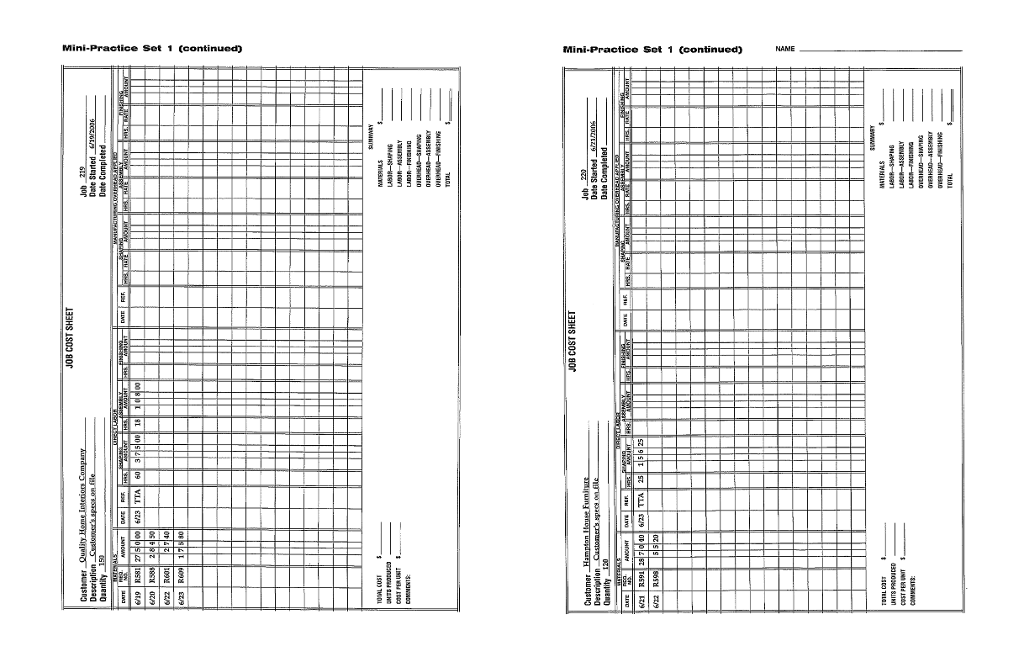

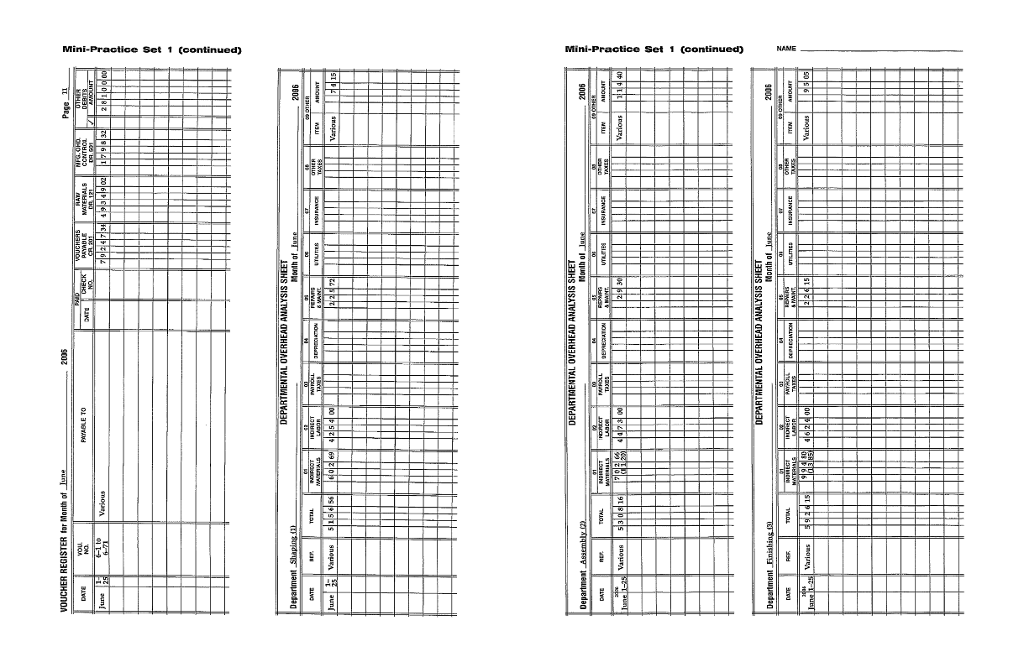

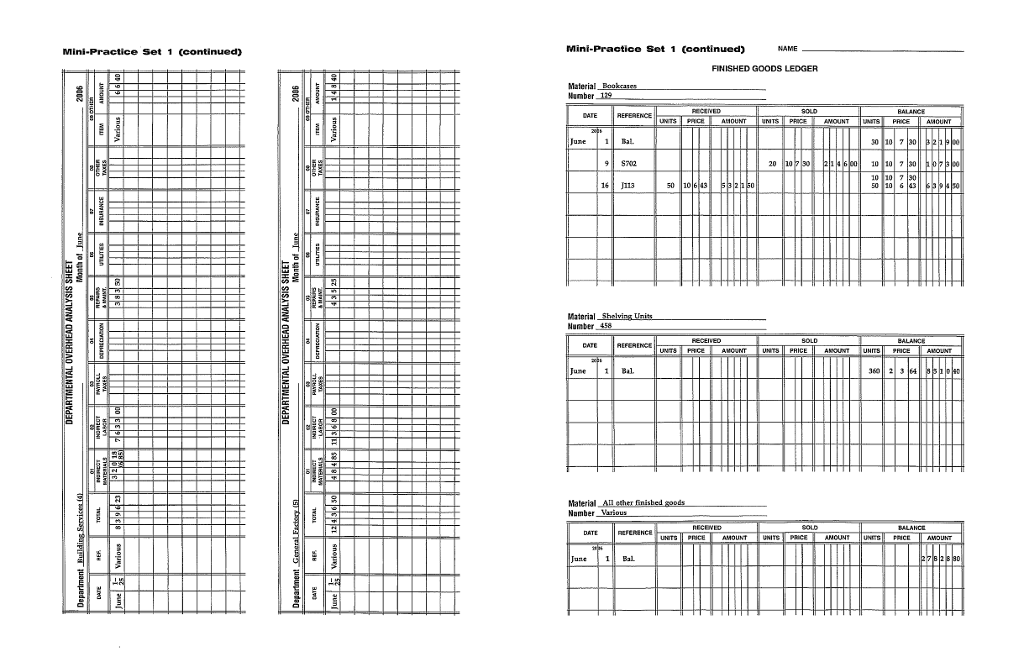

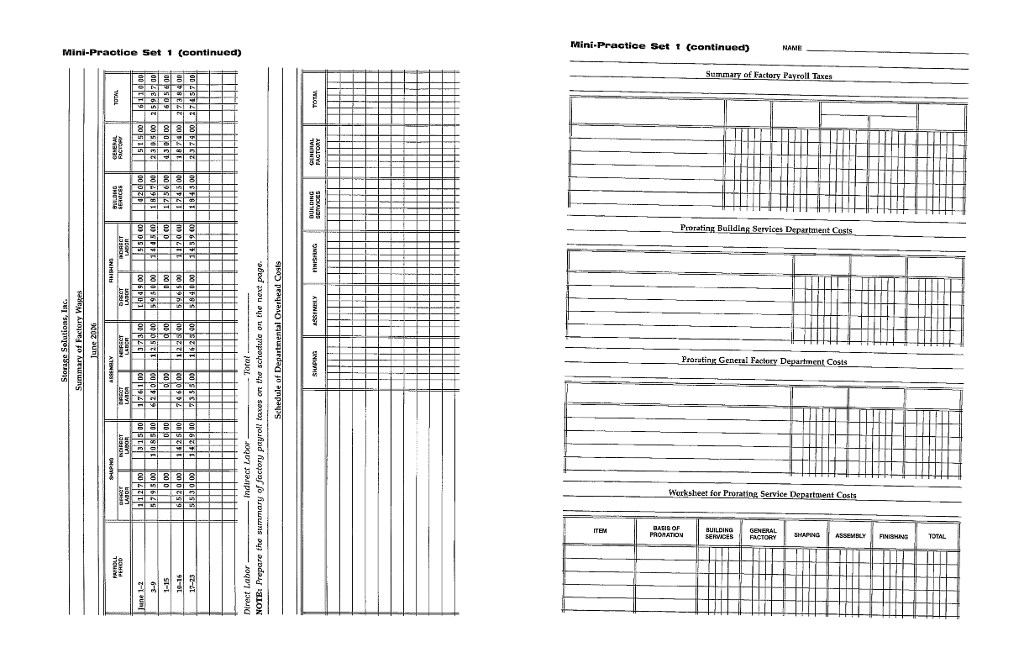

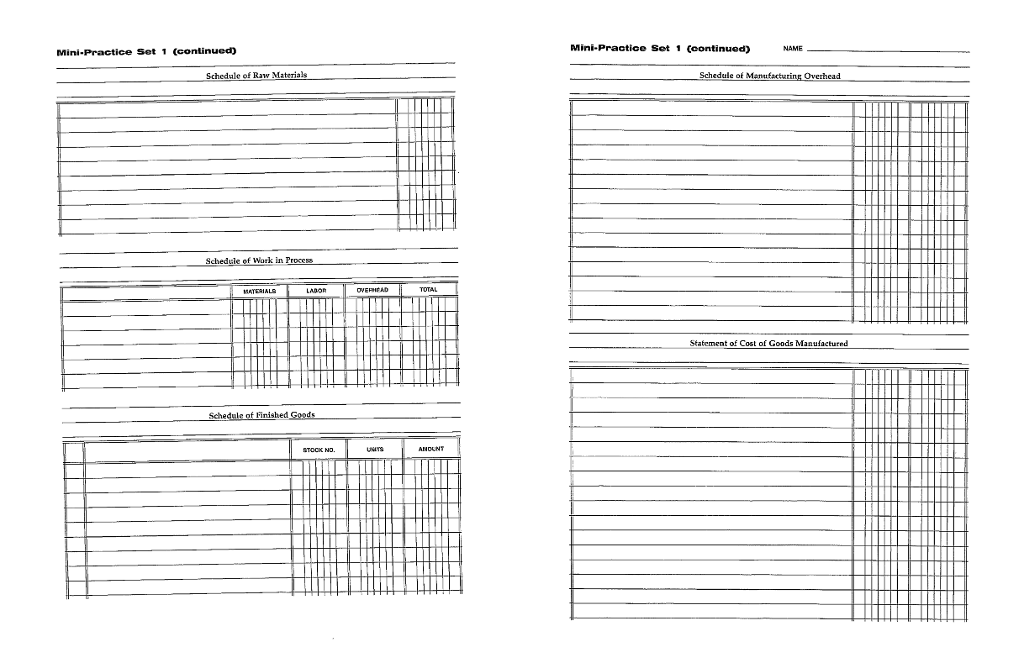

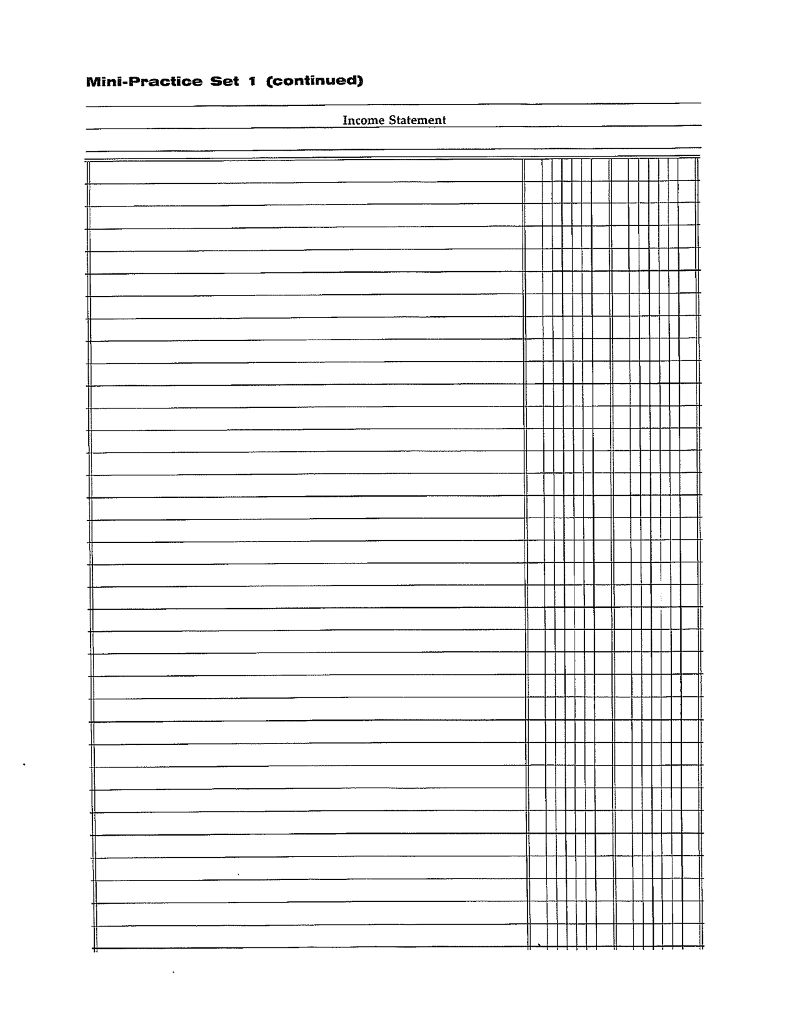

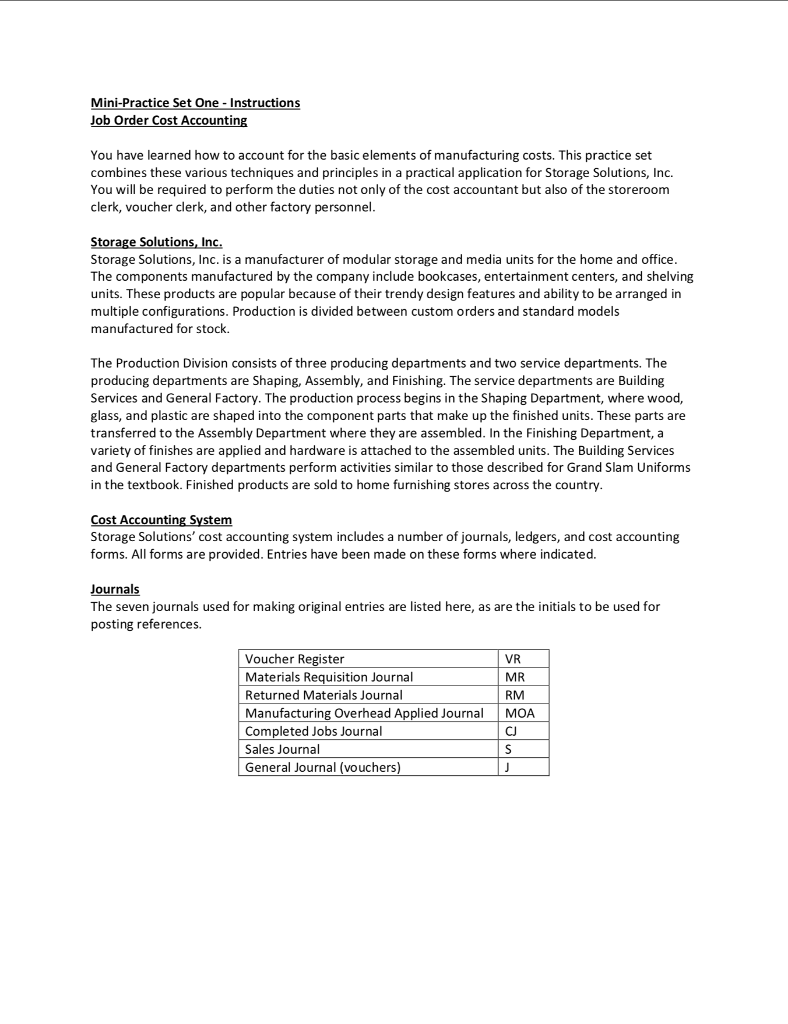

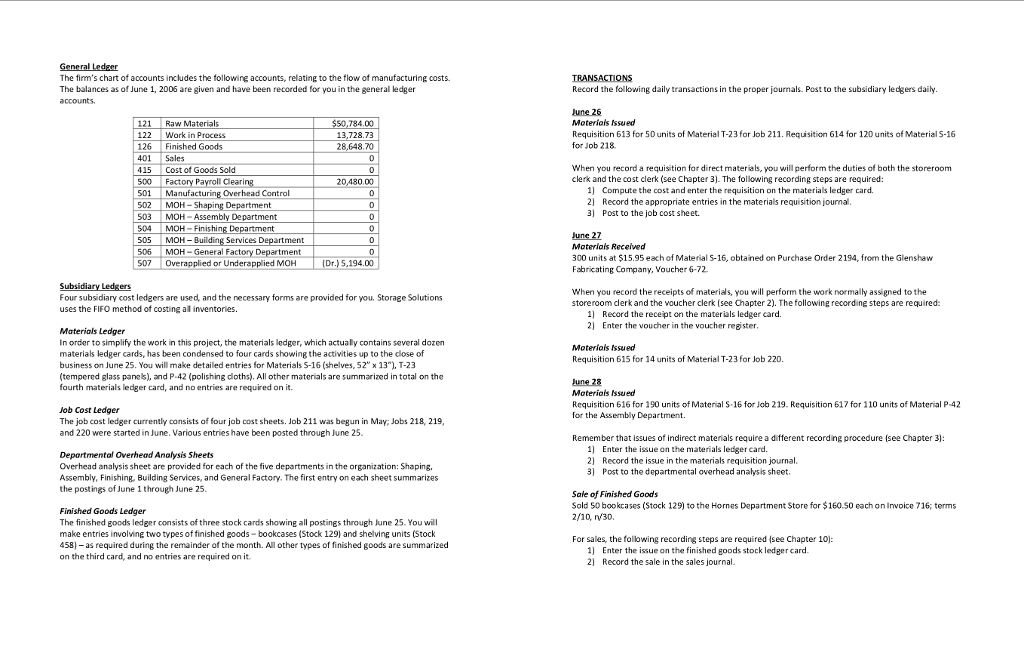

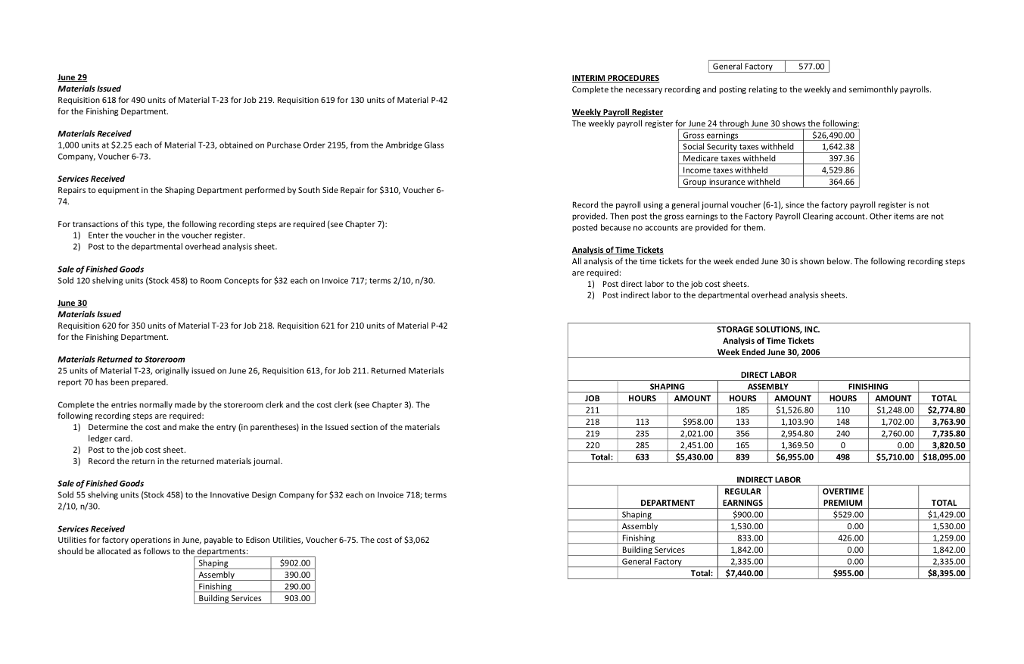

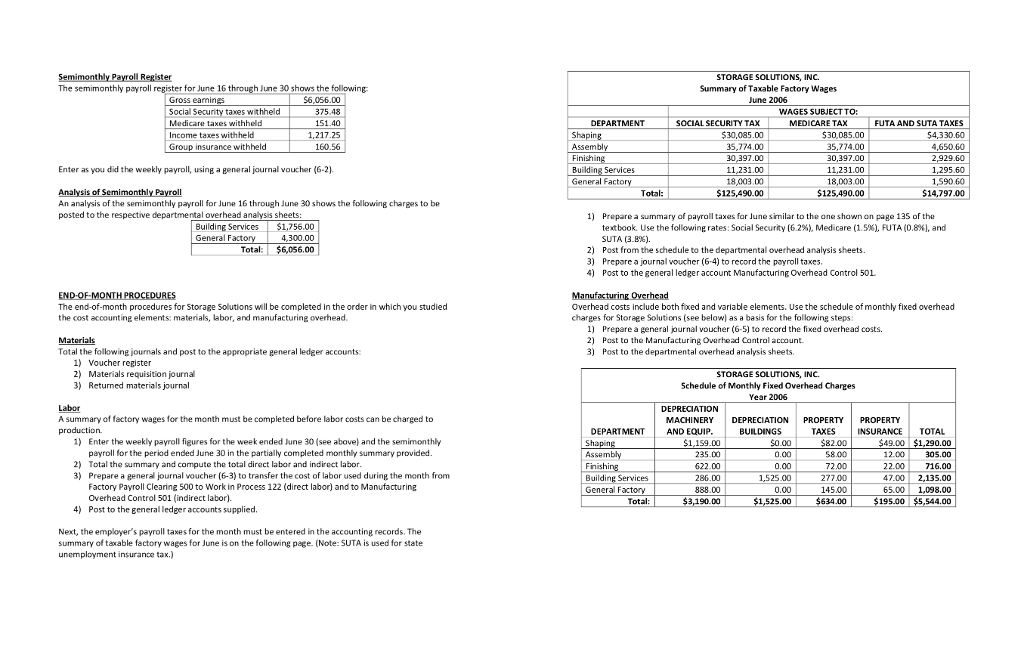

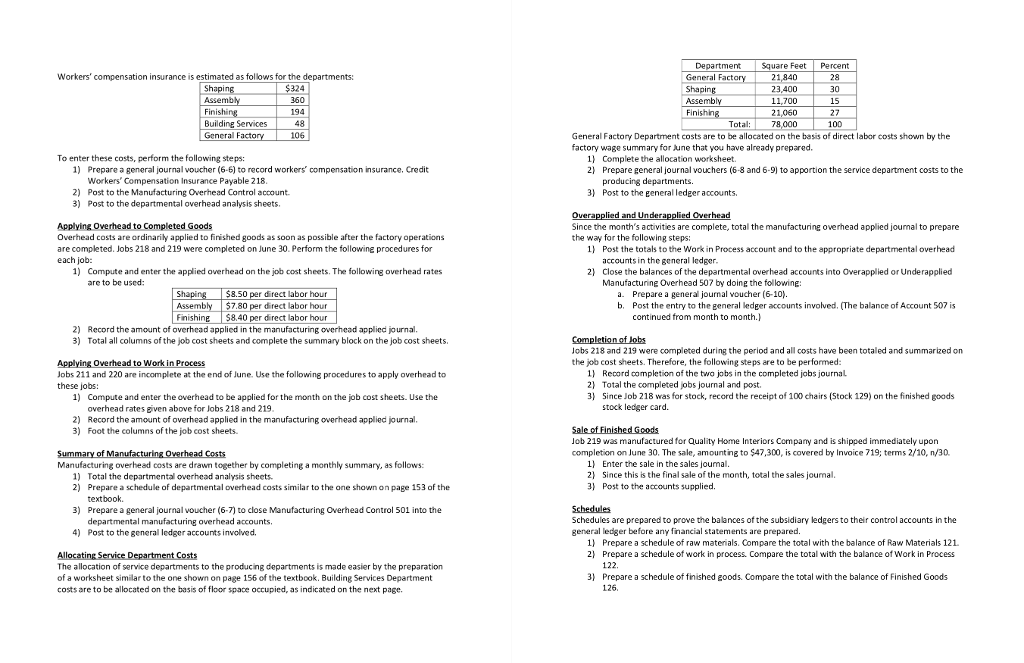

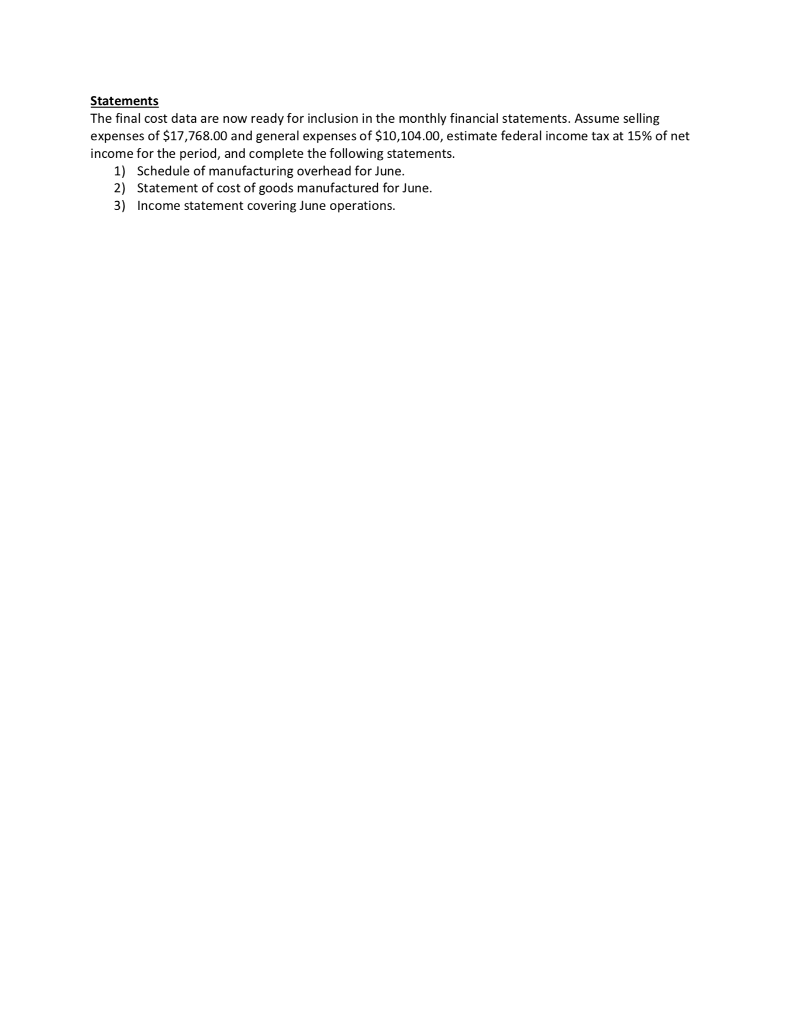

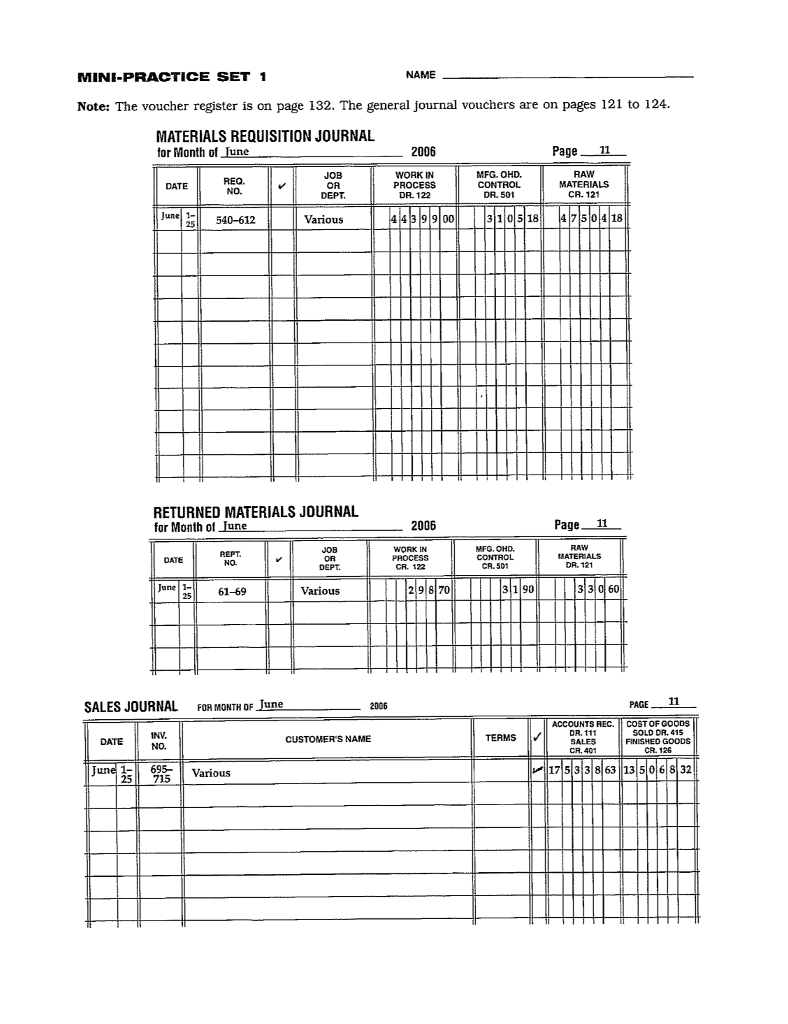

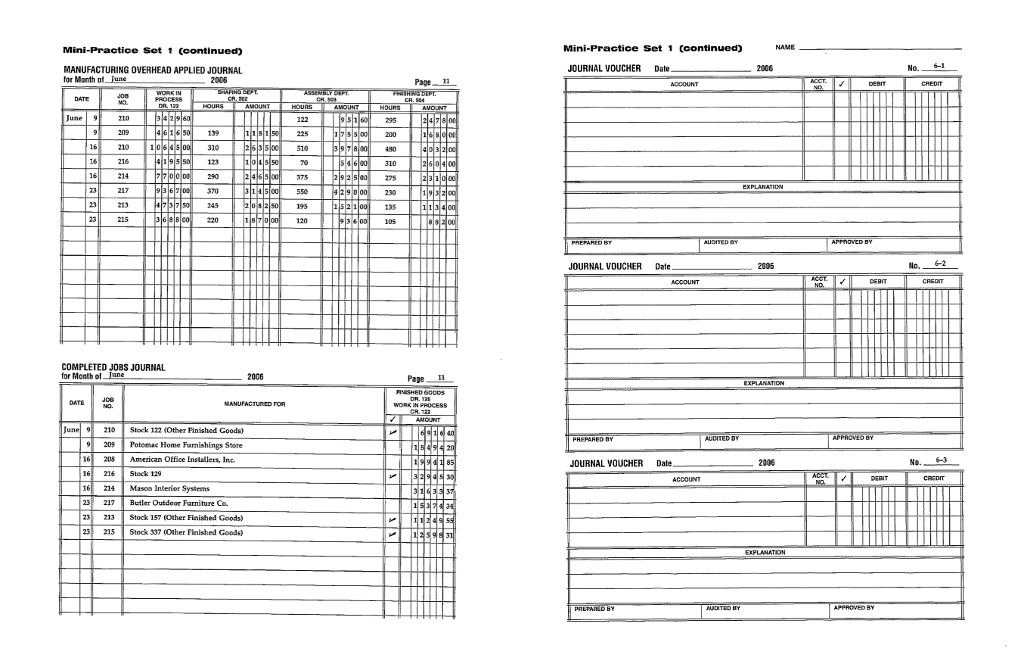

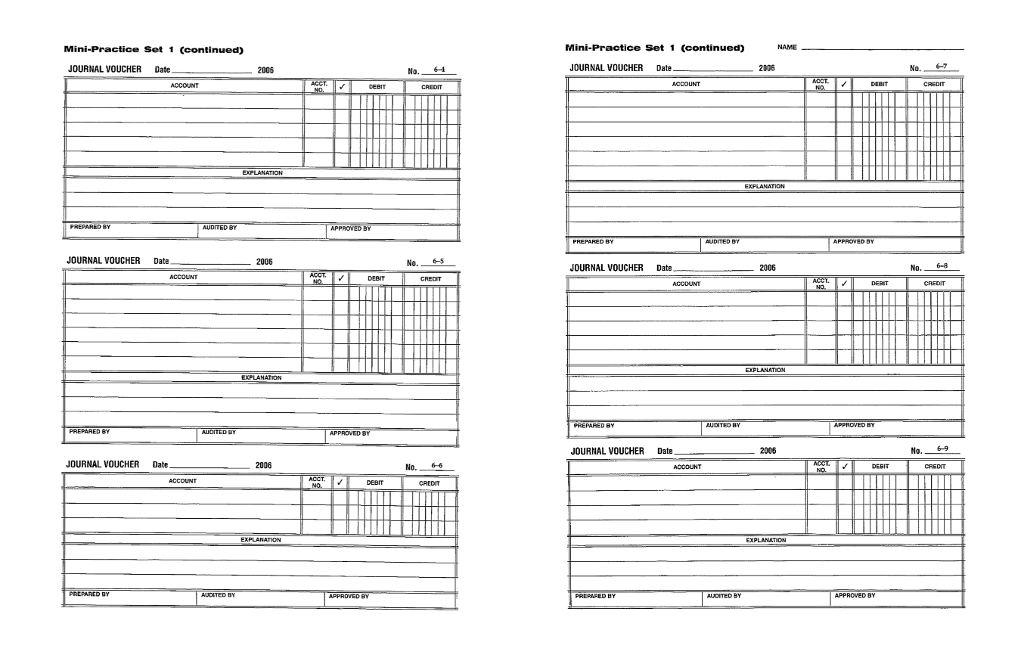

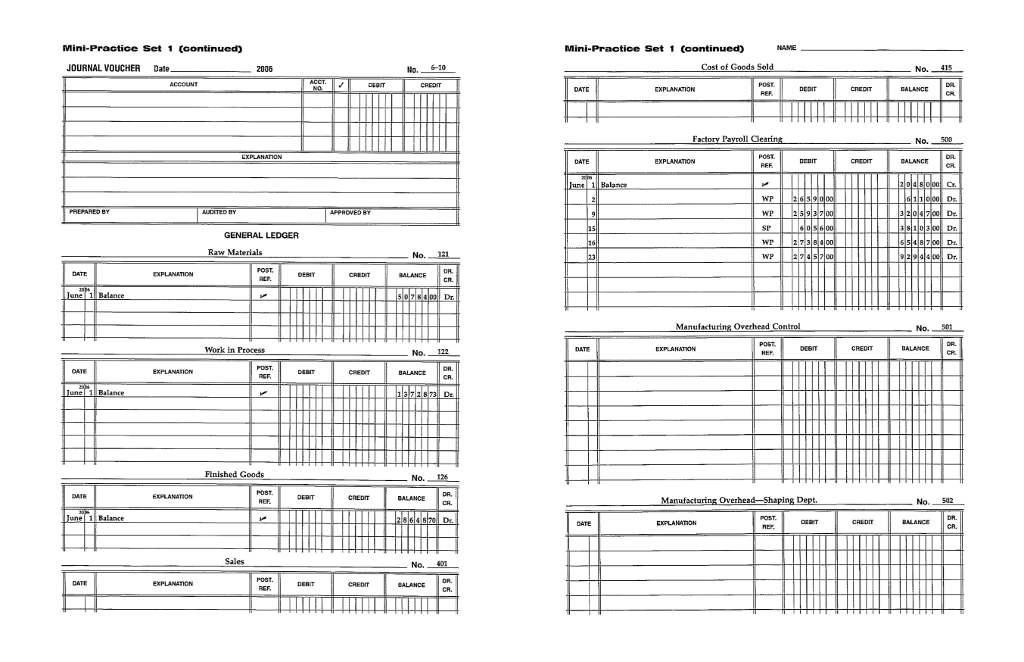

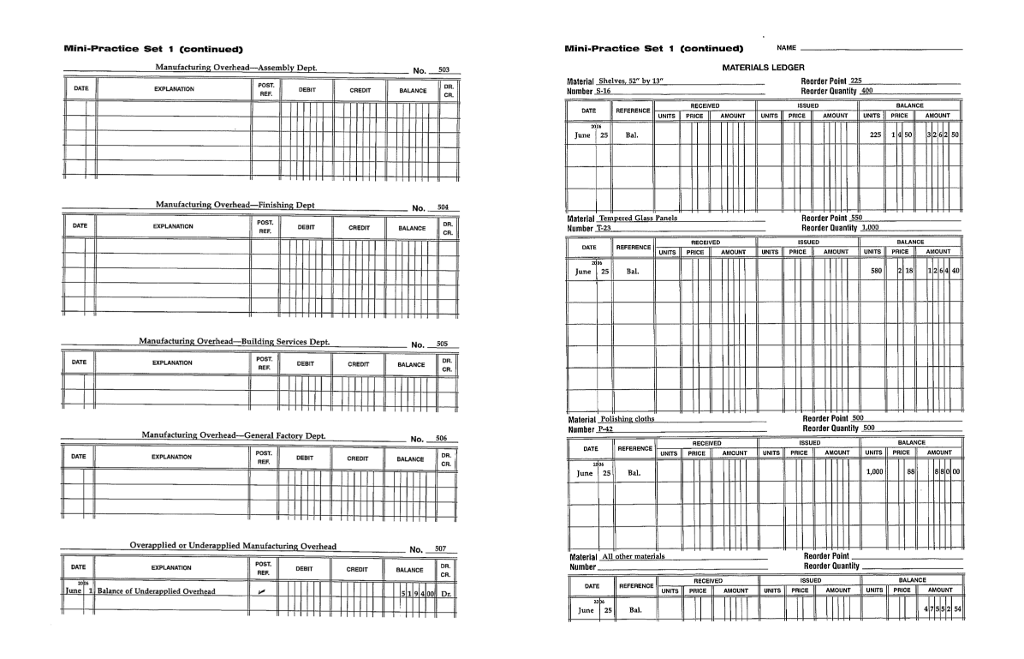

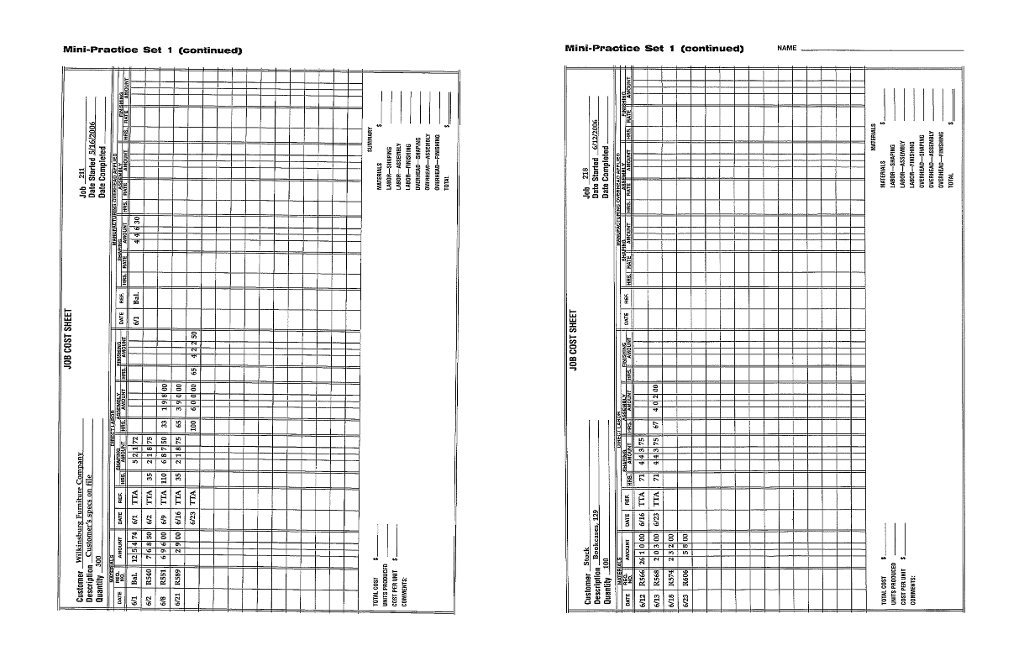

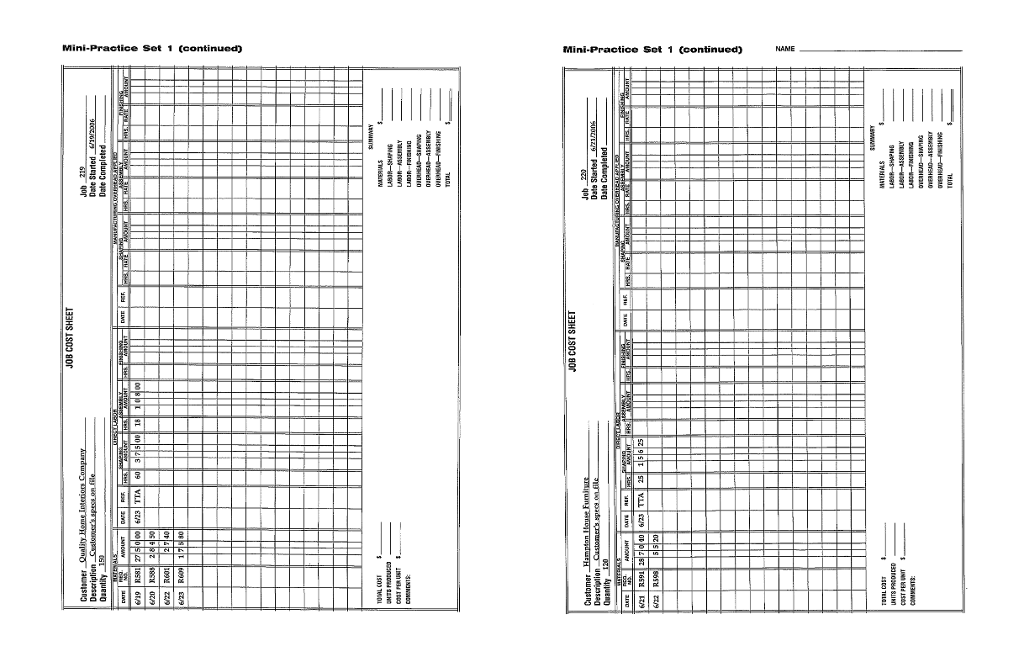

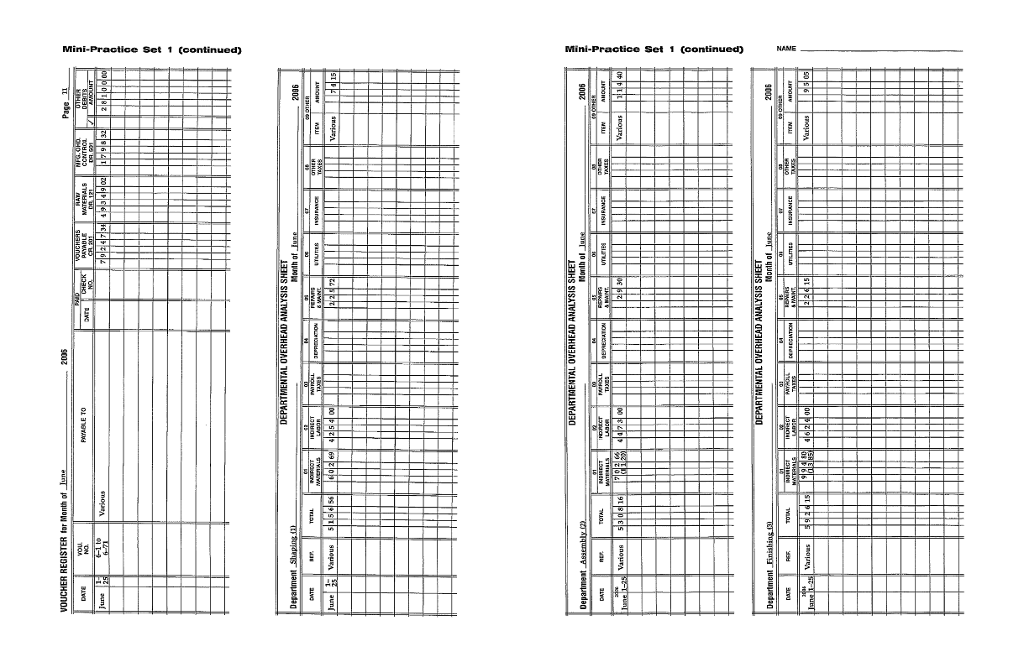

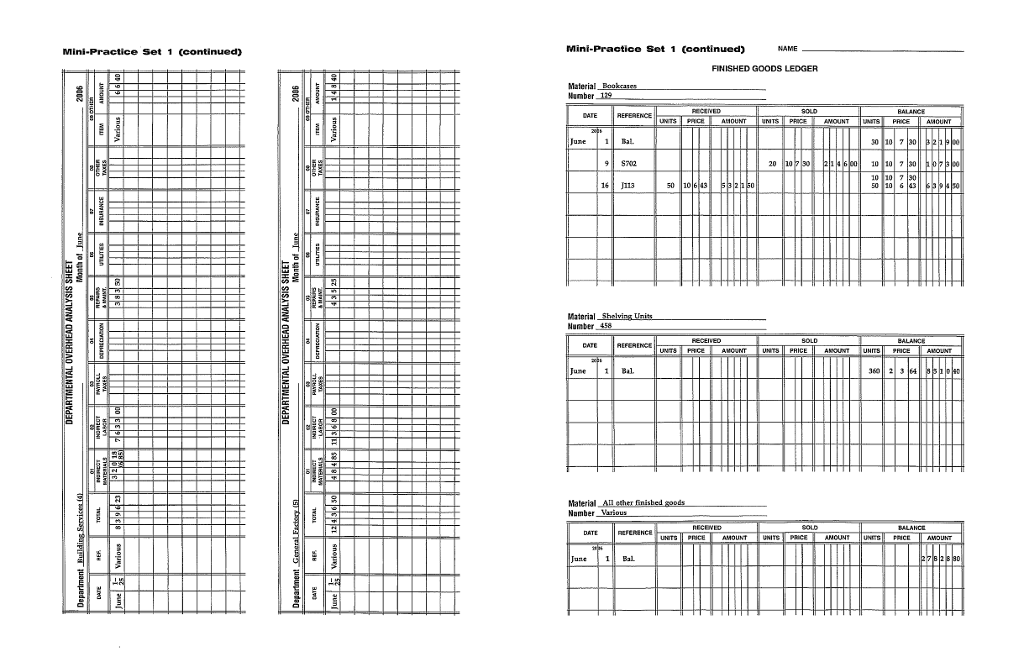

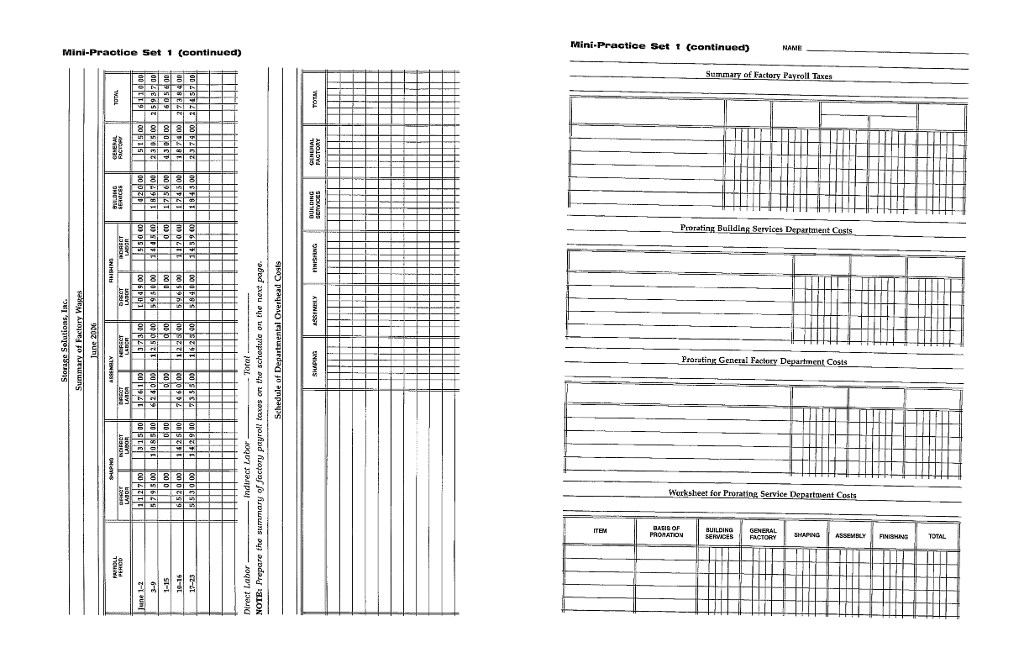

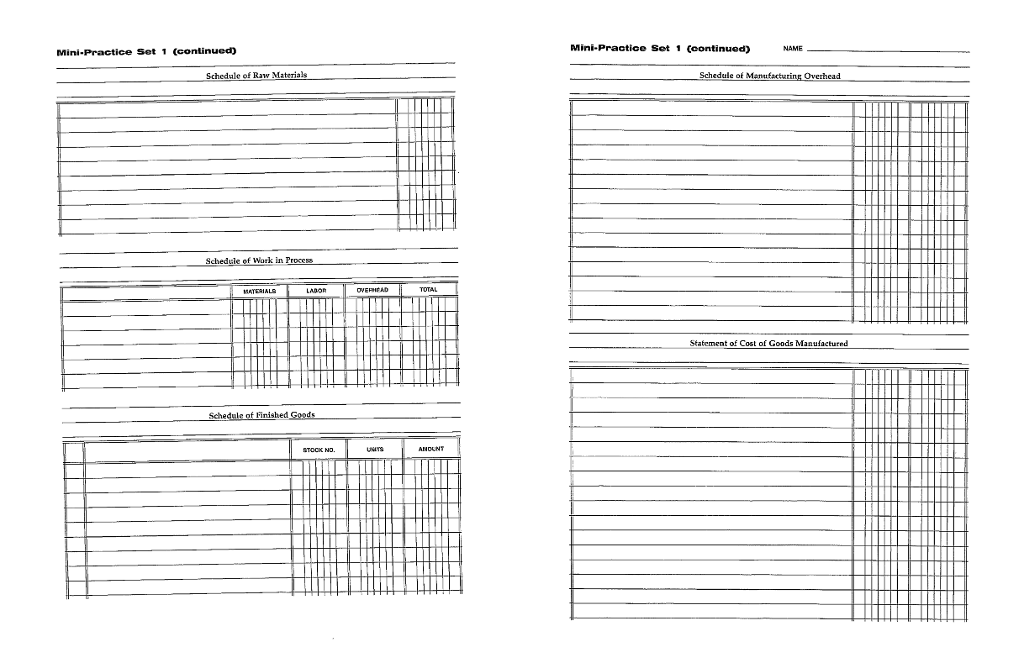

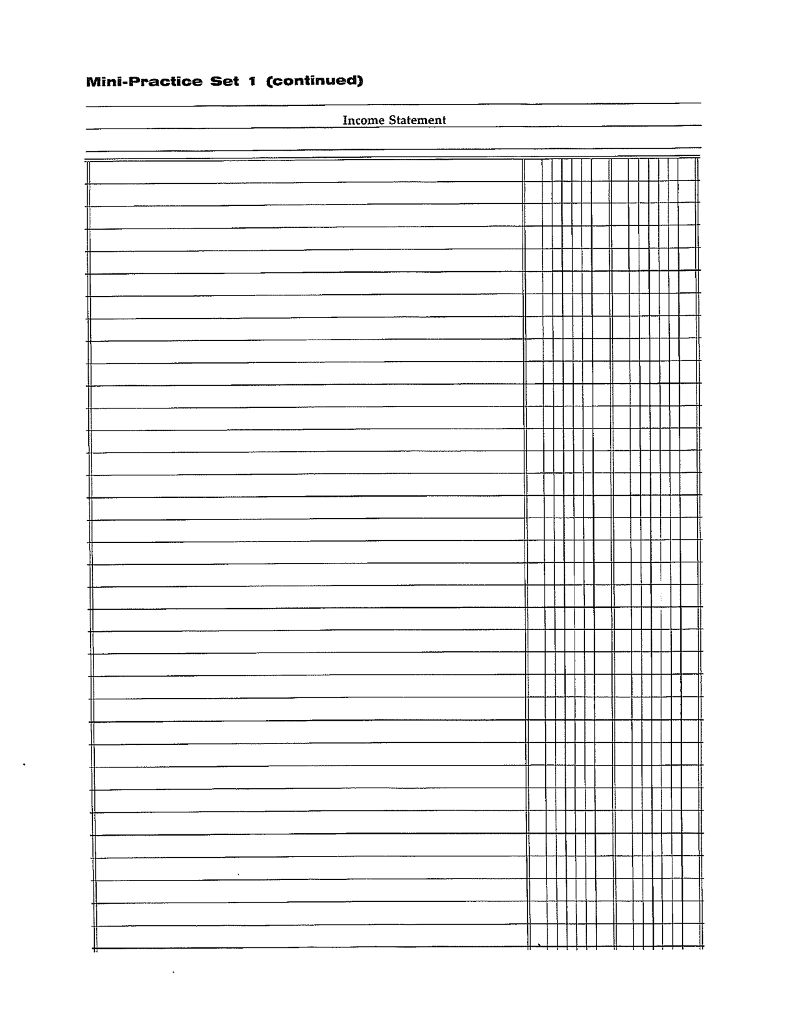

Mini-Practice Set One Instructions Job Order Cost Accountin You have learned how to account for the basic elements of manufacturing costs. This practice set combines these various techniques and principles in a practical application for Storage Solutions, Inc. You will be required to perform the duties not only of the cost accountant but also of the storeroom clerk, voucher clerk, and other factory personnel ns Storage Solutions, Inc. is a manufacturer of modular storage and media units for the home and office The components manufactured by the company include bookcases, entertainment centers, and shelving units. These products are popular because of their trendy design features and ability to be arranged in multiple configurations. Production is divided between custom orders and standard models manufactured for stock. The Production Division consists of three producing departments and two service departments. The producing departments are Shaping, Assembly, and Finishing. The service departments are Building Services and General Factory. The production process begins in the Shaping Department, where wood, glass, and plastic are shaped into the component parts that make up the finished units. These parts are transferred to the Assembly Department where they are assembled. In the Finishing Department, a variety of finishes are applied and hardware is attached to the assembled units. The Building Services and General Factory departments perform activities similar to those described for Grand Slam Uniforms in the textbook. Finished products are sold to home furnishing stores across the country Cost Accountin Storage Solutions' cost accounting system includes a number of journals, ledgers, and cost accounting forms. All forms are provided. Entries have been made on these forms where indicated ste ournals The seven journals used for making original entries are listed here, as are the initials to be used for posting references. Voucher Register Materials Requisition Journal Returned Materials Journal Manufacturing Overhead Applied Journa Completed Jobs Journal Sales Journal General Journal (vouchers VR MR RM MOA CJ The firm's chart of accounts includes the following accounts, relating to the flow of manufacturing costs The balances as of June 1, 2006 are given and have been recorded for you in the general ledger accounts Record the following daily transactions in the proper journals. Post to the subsidiary ledgers daily 121 Raw Materials 122 Work in Process 126 Finished Goods 401 Sales 50,784.00 13,728.73 28,648.70 June 26 Moteriois Issued Requisition 613 for 5D units of Material T-23 for Job 211. Requisition 614 for 120 units of Material S-16 for Job 218 When you record a requisition for direct materials, you will perform the duties of both the storeroom clerk and the cost clerk(see Chapter 3). The following recording steps are required 415 Cost of Goods Sold 500 Factory Payroll Cleari 01 Manufacturing Overhead Control 502 MOH-Shaping Department 503 MOH-Assembly Department Compute the cost and enter the requisition on the materials ledger card. 2] Record the appropriate entries in the materials requisition journal 3) Post to the job cost sheet. 504 MOH-Finishing Department June 27 Moteriais Recelved 300 units at $15.95 each of Material S-16, obtained on Purchase Order 2194, from the Glenshaw Fabricating Company, Voucher 6-72 505 MOH Services 505 MOH- General Factory Department 07 Overapplied or Underapplied MOH Dr.)5,194.00 Four subsidiary cost ledgers are used, and the necessary forms are provided for you. Storage Solutions uses the FIFO method of costing all inwentories. When you record the receipts of materials, you will perform the work normally assigned to the storeroom clerk and the voucher clerk (see Chapter 2). The following recording steps are required: 1) Record the receipt on the materials ledger card. 21 Enter the voucher in the voucher regster Materials Ledger In order to simplify the work in this project, the materials ledger, which actualy contains several dozen materials ledger cards, has been condensed to four cards showing the activities up to the close of business on June 25, You will make detailed entries for Materials S-16 (shelves, 52" x 13 ), T-23 (tempered glass panels), and P-42 (polishing doths). All other materials are summarized in total on the fourth materials ledger card, and no entries are required on it. Moteriois Issued Requisition 615 for 14 units of Material T-23 for Job 220 lune 28 Moteriois Issued Requisition 616 for 190 units of Material S 16 for Job 219. Reqistion 617 for 110 units of Material P 42 for the Assembly Department. Job Cost Ledger The job cost ledger currently consists af four job cost sheets. Job 211 was begun in May; Jobs 218, 219, and 220 were started in June. Various entries have been posted through June 25 Remember that issues of indirect materials require a different recording procedure (see Chapter 3 Enter the issue on the materials ledger card. 2] 1 Departmental Overhead Analysis Sheets Overhead analysis sheet are provided for each of the five departments in the organization: Shaping, Assembly, Finishing,Building Services, and General Factory. The first entry on each sheet summarizes the postings of June 1 through June 25. Record the issue in the materials requisition journal. 3) Post to the departmental overhead analysis sheet. Sale of Finished Goods Sold 50 bookrases (Stock 129) to the Hornes Department Store for $160.50 each on Invoice 716, terms 2/10, ry3D Finished Goods Ledger The finished goods ledger consists of three stock cards showing all postings through lune 25. You wil make entries involving two types of finished goods- bookcases (Stock 129) and shelving units (Stock 458) -as required during the remainder of the month. All other types of finished goods are summarized on the third card, and no entries are required on it For sales, the following recording steps are required (see Chapter 10): Enter the issue on the finished goods stock ledger card 2 Record the sale in the sales journal Rerister STORAGE SOLUTIONS, INC. Summary of Taxable Factory Wages une 2006 The semimonthly payroll egister for June 16 through June 30 shows the following Gross earnin 6,056.00 Social Security taxes withheld WAGES SUBJECT TO MEDICARE TAX DEPARTMENT SOCIAL SECURITY TAX 30,085.00 35,774.00 FUTA AND SUTA TAXES Income taxes with held Shaping 1,217.25 160.56 30,085.00 35,774.00 30,397.00 11,231.00 4,650.60 2,929.60 1,295.60 1,590 60 14,797.00 p insurance withheld sembly Finishi Buiking Services GeneralF Enter as you did the weekly payroll, sing a general journal voucher (6-2. 11,231.00 18,003.00 125,490.00 18,003.00 125,490.00 Total: An analysis of the semimonthly payroll for June 16 through June 30 shows the following charges to be posted to the respective departmental overhead analysis sheets 1) Building Services General F 1,756.00 4,300.00 Total: $6,056.00 Prepare a summary af payroll taxes for lune similar to the ane shawn on page 135 of the textbook. Use the following rates: Social Security (62%), Medicare (1.5%), FUTA (0.8%), and SUTA (3-8%). 2) Post from the schedule to the departmental overhead analysis sheets. 3) Prepare a journal oucher (6-4) to record the payroll taxes. 4) Post to the general ledge r account Manufacturing Overhead Control 50L END-OF-MONTH PROCEDURES The end-of-month procedures for Storage Solutions will be completed in the order in which you studied the cost accounting elements: materials, labor, and manufacturing overhead Overhead costs include both fixed and variable elements. Use the schedule of monthly fixed overhead charges for Storage Solutions (see below) as a basis for the following steps 1) Prepare a general journal voucher (6-5) to record the fixed overhead costs. 2) Post to the Manufacturing Ovarhead Cantrol account. 3) Post to the departmental overhead analysis sheets Materials Total the following journals and post to the appropriate eneral ledger accounts: 1) Voucher register 2 Materials requisition journal 3) Returned materials journal STORAGE SOLUTIONS, INC. Schedule of Monthly Fixed Overhead Charges Year 2006 Labor A summary of factory wages for the month must be completed before labor costs can be charged to DEPRECIATION MACHINERY DEPRECIATION PROPERTY PROPERTY DEPARTMENT AND EQUIP TAXES | INSURANCE TOTAL 1) Enter the weekly payroll figures for the week ended June 30 (see above) and the semimonthly payroll for the period ended June 30 in the partially completed monthly summary provided Total the summary and compute the total direct labor and indirect labor. 49.00 $1,290.00 12.00305.00 22.00 716.00 47.00 2,135.00 65.00 1,098.00 195.00 82.00 Assembly Finishi Building Services General Factory 2) 3) Prepare a genera journal voucher (6-3) to transfer the cost of labor used during the month from 72.00 277.00 286.00 888.00 3,190.00 1,525.00 Factory Payroll Clearing 500 to Work in Process 122 (direct labor) and to Manufacturing Overhead Control 501 indirect labor) Post to the general ledger accounts supplied. 634.00 544.00 4) Next, the employer's payroll taxes for the month must be entered in the accounting records. The summary of taxable factory wages for June is on the following page. (Note: SUTA is used for state unemployment insurance tax.) Department Square Feet Percent General Facto Shaping Assembly Fini Workers' compensation insurance is estimated as follows for the departments: Shaping Asse Finis Building Services General Fa 21840 23,400 11,700 21,060 Total: 78.000 28 30 15 27 100 324 194 48 106 General Factory Department costs are to be allocated on the basis of direct labor costs shown by the factory wage summary for June that you have already prepared. To enter these costs, perform the following steps: 1) Complete the allocation worksheet. 21 Prepare general journal vouchers (6-8 and 6-9 to apportion the service department costs to the 1) Prepare a general journal voucher (6-6) to record workers' compensation insurance. Credit Workers' Compensation Insurance Payable 218 Post to the Manufacturing Overhead Control account. Post to the departmental overhead analysis sheets. producing departments. ) Post to the general ledger accounts, 2) 3) lied and Undera Applying Overhead to Completed Goods Overhead costs are ordinarily applied to finished goods as soon as possible after the factory operations are completed. Jobs 218 and 219 were completed on June 30. Perform the following procedures for each job: Since the month's activities are complete, total the manufacturing overhead applied joumal to prepare 1 Post the totals to the Work in Process account and to the appropriate departmental overhead 21 Close the balances of the departmental overhead accounts into Overapplied or Underapplied the way for the following steps accountsin the general ledger 1) Compute and enter the applied overhead on the job cost sheets. The following overhead rates are to be used: Manufactuning Overhead 507 by doing the folloing: 8.50 per direct labor hour ssembly $7.80 per direct labor hour Finishing $8,40 per direct labor hour a. b. Prepare a general journal voucher (6-10). Post the entry to the general ledger accounts involved. (The balance of Account 507 is continued from month to month.) 2) Record the amount of overhead applied in the manufacturing overhead applied journal 3Tol ll columns of the job cost sheets and complete the summary block on the job cost sheets lobs 218 and 219 were completed during the period and all costs have been totaled and summarizedon the job cost sheets. Therefore, the following steps are to be performed: Applying Overhead to Work in Process Jobs 211 and 220 are incomplete at the end of June. Use the following procedures to apply overhead to these jobs: Record completion of the two jobs in the completed jobs journal 2 Total the completed jobs journal and post. 3 Since Job 218 was for stock, record the receipt of 100 chairs (Stock 129) on the finished goods 1) Compute and enter the overhead to be applied for the month on the job cost sheets. Use the overhead rates gven above for lobs 218 and 219 Record the amount of overhead applied in the manufacturing overhead applied journal Foot the columns of the job cost sheets. stock ledger card. 2) 3) Job 219 was manufactured for Quality Home Interiors Company and is shipped immediately upon completion on lune 30. The sale, amounting to $47,300, is covered by Invoice 719; terms 2/10, n/30 Manufacturing overhead costs are drawn together by completing a monthly summary, as follows: 11 Enter the sale in the sales joumal 2 Since this is the final sale of the month, total the sales joumal 3) Post to the accounts supplied. 1) 2) 3) 4) Post to the general ledger accounts involved Total the departmental overhead analysis sheets. Prepare a schedule of departmental overhead costs similar to the one shown on page 153 of the textbook. Prepare a general journal voucher (6-7) to close Manufacturing Overhead Control 501 into the departmental manufacturing overhead accounts. Schedules Schedules are prepared to prove the balances of the subsidiary ledgers to their control accounts in the general ledger before any financial statements are prepared. 1 Prepare a schedule of raw materials. Compare the total with the balance of Raw Materials 121 21 Prepare a schedule of work in process. Compare the total with the balance of Work in Process 122 The allocation of service departments to the producing departments is made easier by the preparation of a worksheet similar to the one shown on page 156 of the textbook. Building Services Department costs are to be allocated on the basis of floor space occupied, as indicated on the next page. 3 Prepare a schedule of finished goods. Compare the total with the balance of Finished Goods 126. tatements The final cost data are now ready for inclusion in the monthly financial statements. Assume selling expenses of $17,768.00 and general expenses of $10,104.00, estimate federal income tax at 15% of net income for the period, and complete the following statements. 1) Schedule of manufacturing overhead for June 2) Statement of cost of goods manufactured for June. Income statement covering June operations. 3) MINI-PRACTICE SET1 NAME Note: The voucher register is on page 132. The general journal vouchers are on pages 121 to 124. MATERIALS REQUISITION JOURNAL for Month of June Page 11 MFG. OHD. REQ. NO. JOB OR DEPT. WORK IN PROCESS DR. 122 RAW MATERIALS CR. 121 DATE DR. 501 June540-612 443 99 00 3105 18 7504 18 RETURNED MATERIALS JOURNAL for Month of June2006 Page- 11- OB MFO, OHD. WORK IN PHOCESS CR. 12 DATE NO. DEPT CR. 501 DA. 121 June61-69 29 8 70 3190 Various 60 SALES JOURNAL F FOR MONTH OF June 2006 PAGE-11, - ACCOUNTS REC. INV. NO. COST OF COODS SOLD DR. 415 FINISHED GOODS CR. 126 CUSTOMER'S NAME TERMS DATE CR. 401 June 695 Various 17 5 3 3 8 63 13 506 832 25715 Mini-Practice Set 1 (econtinued) Mini-Practice Set 1 (continued) JOURNAL VOUCHER Date No. 6-1 MANUFACTURING OVERHEAD APPLIED JOURNAL for Marth of-June 2106 Page JOURNAL VDUCHER Date No, 6-2 for Mcnth of Iane Pape JOB DATE 210 Stock 122 4Other Finished Goods) 209 Potomac Home Furnishings Stone 6208American Office Installers, Ind. JOURNAL VOUCHER Date No. 3 214 Mason Interier Systems 23 21 Buler Outdeor Farniture Ca. 3213Stock 157 (other Finished Goods) 23215Stock 337 (Other Finished Goods) Mini-Practice Set 1 (continued) NAME JOURNAL VOUCHER Date 2006 JOUANAL VOUCHER Dat 2006 No ACCOUNT JOURNAL VOUCHER Data 2006 Ne. JOURNAL VOUCHER Date 2006 No. 6-8 PREPARED BY JOURNAL VOUCHER Date 2006 No. 6-9 JOURNAL VOUCHER Date 2006 No. 6-6 Mini-Practice Set 1 (continued) Mini-Practice Set 1 (continued) JOURNAL VOUCHER Date 2006 Cost of Goods Sold No. 15 - GENERAL LEDGER 87100 D. Raw Materials No. 121 Work in Process No.-12,- Finished Coods No. 6 1 Balance No. No. 503 MATERIALS LEDGER Retrder Paint Rearder Quantity RECENED AMOUNT UNITS June 25 Bal. 225 14 50 No. "-504 Reorfer Point BALANCE CL AMOUNT UNITS June 2SBal 580 No. 505 CREOT BALANCECR Rearder Point Rearder Quantity 500 REFERENCEANTS PRIC June 25 Bal 1,000 Reorder Point Reorder Quantity Number ALANCECR ALANCE AMOUNT UNT une 25 Bal Mini-Praatioc Set 1 (continued) Mini-Practice Set 1 (continued) Mini-Practico Sot 1 (eontinued) Mini-Practice Set 1 (continued) Mini-Practice Set 1 (continued) FINISHED GOODS LEDGER Material REFERENCEUNITS PRICE June 1 0 10 730 9S702 10 10 730 50 10 Matorial Number RECEIVED June 1 B 160 23 ECEVED UNITS PRICE Mini-Practice Set (continued) NAME Mini-Praotioe Set 1 (continuea) of Prorating Bullding Services Department Service SERWICESFACTORY Mini-Practice Set 1 (conlinued) Mini-Practice Set 1 (continued) Schedule of Raw Material Schedule of Schedule of Work in Proces Lnao Statement of Cost of Coods Manufactured Mini-Practice Set Ccontinued) Income Statement Mini-Practice Set One Instructions Job Order Cost Accountin You have learned how to account for the basic elements of manufacturing costs. This practice set combines these various techniques and principles in a practical application for Storage Solutions, Inc. You will be required to perform the duties not only of the cost accountant but also of the storeroom clerk, voucher clerk, and other factory personnel ns Storage Solutions, Inc. is a manufacturer of modular storage and media units for the home and office The components manufactured by the company include bookcases, entertainment centers, and shelving units. These products are popular because of their trendy design features and ability to be arranged in multiple configurations. Production is divided between custom orders and standard models manufactured for stock. The Production Division consists of three producing departments and two service departments. The producing departments are Shaping, Assembly, and Finishing. The service departments are Building Services and General Factory. The production process begins in the Shaping Department, where wood, glass, and plastic are shaped into the component parts that make up the finished units. These parts are transferred to the Assembly Department where they are assembled. In the Finishing Department, a variety of finishes are applied and hardware is attached to the assembled units. The Building Services and General Factory departments perform activities similar to those described for Grand Slam Uniforms in the textbook. Finished products are sold to home furnishing stores across the country Cost Accountin Storage Solutions' cost accounting system includes a number of journals, ledgers, and cost accounting forms. All forms are provided. Entries have been made on these forms where indicated ste ournals The seven journals used for making original entries are listed here, as are the initials to be used for posting references. Voucher Register Materials Requisition Journal Returned Materials Journal Manufacturing Overhead Applied Journa Completed Jobs Journal Sales Journal General Journal (vouchers VR MR RM MOA CJ The firm's chart of accounts includes the following accounts, relating to the flow of manufacturing costs The balances as of June 1, 2006 are given and have been recorded for you in the general ledger accounts Record the following daily transactions in the proper journals. Post to the subsidiary ledgers daily 121 Raw Materials 122 Work in Process 126 Finished Goods 401 Sales 50,784.00 13,728.73 28,648.70 June 26 Moteriois Issued Requisition 613 for 5D units of Material T-23 for Job 211. Requisition 614 for 120 units of Material S-16 for Job 218 When you record a requisition for direct materials, you will perform the duties of both the storeroom clerk and the cost clerk(see Chapter 3). The following recording steps are required 415 Cost of Goods Sold 500 Factory Payroll Cleari 01 Manufacturing Overhead Control 502 MOH-Shaping Department 503 MOH-Assembly Department Compute the cost and enter the requisition on the materials ledger card. 2] Record the appropriate entries in the materials requisition journal 3) Post to the job cost sheet. 504 MOH-Finishing Department June 27 Moteriais Recelved 300 units at $15.95 each of Material S-16, obtained on Purchase Order 2194, from the Glenshaw Fabricating Company, Voucher 6-72 505 MOH Services 505 MOH- General Factory Department 07 Overapplied or Underapplied MOH Dr.)5,194.00 Four subsidiary cost ledgers are used, and the necessary forms are provided for you. Storage Solutions uses the FIFO method of costing all inwentories. When you record the receipts of materials, you will perform the work normally assigned to the storeroom clerk and the voucher clerk (see Chapter 2). The following recording steps are required: 1) Record the receipt on the materials ledger card. 21 Enter the voucher in the voucher regster Materials Ledger In order to simplify the work in this project, the materials ledger, which actualy contains several dozen materials ledger cards, has been condensed to four cards showing the activities up to the close of business on June 25, You will make detailed entries for Materials S-16 (shelves, 52" x 13 ), T-23 (tempered glass panels), and P-42 (polishing doths). All other materials are summarized in total on the fourth materials ledger card, and no entries are required on it. Moteriois Issued Requisition 615 for 14 units of Material T-23 for Job 220 lune 28 Moteriois Issued Requisition 616 for 190 units of Material S 16 for Job 219. Reqistion 617 for 110 units of Material P 42 for the Assembly Department. Job Cost Ledger The job cost ledger currently consists af four job cost sheets. Job 211 was begun in May; Jobs 218, 219, and 220 were started in June. Various entries have been posted through June 25 Remember that issues of indirect materials require a different recording procedure (see Chapter 3 Enter the issue on the materials ledger card. 2] 1 Departmental Overhead Analysis Sheets Overhead analysis sheet are provided for each of the five departments in the organization: Shaping, Assembly, Finishing,Building Services, and General Factory. The first entry on each sheet summarizes the postings of June 1 through June 25. Record the issue in the materials requisition journal. 3) Post to the departmental overhead analysis sheet. Sale of Finished Goods Sold 50 bookrases (Stock 129) to the Hornes Department Store for $160.50 each on Invoice 716, terms 2/10, ry3D Finished Goods Ledger The finished goods ledger consists of three stock cards showing all postings through lune 25. You wil make entries involving two types of finished goods- bookcases (Stock 129) and shelving units (Stock 458) -as required during the remainder of the month. All other types of finished goods are summarized on the third card, and no entries are required on it For sales, the following recording steps are required (see Chapter 10): Enter the issue on the finished goods stock ledger card 2 Record the sale in the sales journal Rerister STORAGE SOLUTIONS, INC. Summary of Taxable Factory Wages une 2006 The semimonthly payroll egister for June 16 through June 30 shows the following Gross earnin 6,056.00 Social Security taxes withheld WAGES SUBJECT TO MEDICARE TAX DEPARTMENT SOCIAL SECURITY TAX 30,085.00 35,774.00 FUTA AND SUTA TAXES Income taxes with held Shaping 1,217.25 160.56 30,085.00 35,774.00 30,397.00 11,231.00 4,650.60 2,929.60 1,295.60 1,590 60 14,797.00 p insurance withheld sembly Finishi Buiking Services GeneralF Enter as you did the weekly payroll, sing a general journal voucher (6-2. 11,231.00 18,003.00 125,490.00 18,003.00 125,490.00 Total: An analysis of the semimonthly payroll for June 16 through June 30 shows the following charges to be posted to the respective departmental overhead analysis sheets 1) Building Services General F 1,756.00 4,300.00 Total: $6,056.00 Prepare a summary af payroll taxes for lune similar to the ane shawn on page 135 of the textbook. Use the following rates: Social Security (62%), Medicare (1.5%), FUTA (0.8%), and SUTA (3-8%). 2) Post from the schedule to the departmental overhead analysis sheets. 3) Prepare a journal oucher (6-4) to record the payroll taxes. 4) Post to the general ledge r account Manufacturing Overhead Control 50L END-OF-MONTH PROCEDURES The end-of-month procedures for Storage Solutions will be completed in the order in which you studied the cost accounting elements: materials, labor, and manufacturing overhead Overhead costs include both fixed and variable elements. Use the schedule of monthly fixed overhead charges for Storage Solutions (see below) as a basis for the following steps 1) Prepare a general journal voucher (6-5) to record the fixed overhead costs. 2) Post to the Manufacturing Ovarhead Cantrol account. 3) Post to the departmental overhead analysis sheets Materials Total the following journals and post to the appropriate eneral ledger accounts: 1) Voucher register 2 Materials requisition journal 3) Returned materials journal STORAGE SOLUTIONS, INC. Schedule of Monthly Fixed Overhead Charges Year 2006 Labor A summary of factory wages for the month must be completed before labor costs can be charged to DEPRECIATION MACHINERY DEPRECIATION PROPERTY PROPERTY DEPARTMENT AND EQUIP TAXES | INSURANCE TOTAL 1) Enter the weekly payroll figures for the week ended June 30 (see above) and the semimonthly payroll for the period ended June 30 in the partially completed monthly summary provided Total the summary and compute the total direct labor and indirect labor. 49.00 $1,290.00 12.00305.00 22.00 716.00 47.00 2,135.00 65.00 1,098.00 195.00 82.00 Assembly Finishi Building Services General Factory 2) 3) Prepare a genera journal voucher (6-3) to transfer the cost of labor used during the month from 72.00 277.00 286.00 888.00 3,190.00 1,525.00 Factory Payroll Clearing 500 to Work in Process 122 (direct labor) and to Manufacturing Overhead Control 501 indirect labor) Post to the general ledger accounts supplied. 634.00 544.00 4) Next, the employer's payroll taxes for the month must be entered in the accounting records. The summary of taxable factory wages for June is on the following page. (Note: SUTA is used for state unemployment insurance tax.) Department Square Feet Percent General Facto Shaping Assembly Fini Workers' compensation insurance is estimated as follows for the departments: Shaping Asse Finis Building Services General Fa 21840 23,400 11,700 21,060 Total: 78.000 28 30 15 27 100 324 194 48 106 General Factory Department costs are to be allocated on the basis of direct labor costs shown by the factory wage summary for June that you have already prepared. To enter these costs, perform the following steps: 1) Complete the allocation worksheet. 21 Prepare general journal vouchers (6-8 and 6-9 to apportion the service department costs to the 1) Prepare a general journal voucher (6-6) to record workers' compensation insurance. Credit Workers' Compensation Insurance Payable 218 Post to the Manufacturing Overhead Control account. Post to the departmental overhead analysis sheets. producing departments. ) Post to the general ledger accounts, 2) 3) lied and Undera Applying Overhead to Completed Goods Overhead costs are ordinarily applied to finished goods as soon as possible after the factory operations are completed. Jobs 218 and 219 were completed on June 30. Perform the following procedures for each job: Since the month's activities are complete, total the manufacturing overhead applied joumal to prepare 1 Post the totals to the Work in Process account and to the appropriate departmental overhead 21 Close the balances of the departmental overhead accounts into Overapplied or Underapplied the way for the following steps accountsin the general ledger 1) Compute and enter the applied overhead on the job cost sheets. The following overhead rates are to be used: Manufactuning Overhead 507 by doing the folloing: 8.50 per direct labor hour ssembly $7.80 per direct labor hour Finishing $8,40 per direct labor hour a. b. Prepare a general journal voucher (6-10). Post the entry to the general ledger accounts involved. (The balance of Account 507 is continued from month to month.) 2) Record the amount of overhead applied in the manufacturing overhead applied journal 3Tol ll columns of the job cost sheets and complete the summary block on the job cost sheets lobs 218 and 219 were completed during the period and all costs have been totaled and summarizedon the job cost sheets. Therefore, the following steps are to be performed: Applying Overhead to Work in Process Jobs 211 and 220 are incomplete at the end of June. Use the following procedures to apply overhead to these jobs: Record completion of the two jobs in the completed jobs journal 2 Total the completed jobs journal and post. 3 Since Job 218 was for stock, record the receipt of 100 chairs (Stock 129) on the finished goods 1) Compute and enter the overhead to be applied for the month on the job cost sheets. Use the overhead rates gven above for lobs 218 and 219 Record the amount of overhead applied in the manufacturing overhead applied journal Foot the columns of the job cost sheets. stock ledger card. 2) 3) Job 219 was manufactured for Quality Home Interiors Company and is shipped immediately upon completion on lune 30. The sale, amounting to $47,300, is covered by Invoice 719; terms 2/10, n/30 Manufacturing overhead costs are drawn together by completing a monthly summary, as follows: 11 Enter the sale in the sales joumal 2 Since this is the final sale of the month, total the sales joumal 3) Post to the accounts supplied. 1) 2) 3) 4) Post to the general ledger accounts involved Total the departmental overhead analysis sheets. Prepare a schedule of departmental overhead costs similar to the one shown on page 153 of the textbook. Prepare a general journal voucher (6-7) to close Manufacturing Overhead Control 501 into the departmental manufacturing overhead accounts. Schedules Schedules are prepared to prove the balances of the subsidiary ledgers to their control accounts in the general ledger before any financial statements are prepared. 1 Prepare a schedule of raw materials. Compare the total with the balance of Raw Materials 121 21 Prepare a schedule of work in process. Compare the total with the balance of Work in Process 122 The allocation of service departments to the producing departments is made easier by the preparation of a worksheet similar to the one shown on page 156 of the textbook. Building Services Department costs are to be allocated on the basis of floor space occupied, as indicated on the next page. 3 Prepare a schedule of finished goods. Compare the total with the balance of Finished Goods 126. tatements The final cost data are now ready for inclusion in the monthly financial statements. Assume selling expenses of $17,768.00 and general expenses of $10,104.00, estimate federal income tax at 15% of net income for the period, and complete the following statements. 1) Schedule of manufacturing overhead for June 2) Statement of cost of goods manufactured for June. Income statement covering June operations. 3) MINI-PRACTICE SET1 NAME Note: The voucher register is on page 132. The general journal vouchers are on pages 121 to 124. MATERIALS REQUISITION JOURNAL for Month of June Page 11 MFG. OHD. REQ. NO. JOB OR DEPT. WORK IN PROCESS DR. 122 RAW MATERIALS CR. 121 DATE DR. 501 June540-612 443 99 00 3105 18 7504 18 RETURNED MATERIALS JOURNAL for Month of June2006 Page- 11- OB MFO, OHD. WORK IN PHOCESS CR. 12 DATE NO. DEPT CR. 501 DA. 121 June61-69 29 8 70 3190 Various 60 SALES JOURNAL F FOR MONTH OF June 2006 PAGE-11, - ACCOUNTS REC. INV. NO. COST OF COODS SOLD DR. 415 FINISHED GOODS CR. 126 CUSTOMER'S NAME TERMS DATE CR. 401 June 695 Various 17 5 3 3 8 63 13 506 832 25715 Mini-Practice Set 1 (econtinued) Mini-Practice Set 1 (continued) JOURNAL VOUCHER Date No. 6-1 MANUFACTURING OVERHEAD APPLIED JOURNAL for Marth of-June 2106 Page JOURNAL VDUCHER Date No, 6-2 for Mcnth of Iane Pape JOB DATE 210 Stock 122 4Other Finished Goods) 209 Potomac Home Furnishings Stone 6208American Office Installers, Ind. JOURNAL VOUCHER Date No. 3 214 Mason Interier Systems 23 21 Buler Outdeor Farniture Ca. 3213Stock 157 (other Finished Goods) 23215Stock 337 (Other Finished Goods) Mini-Practice Set 1 (continued) NAME JOURNAL VOUCHER Date 2006 JOUANAL VOUCHER Dat 2006 No ACCOUNT JOURNAL VOUCHER Data 2006 Ne. JOURNAL VOUCHER Date 2006 No. 6-8 PREPARED BY JOURNAL VOUCHER Date 2006 No. 6-9 JOURNAL VOUCHER Date 2006 No. 6-6 Mini-Practice Set 1 (continued) Mini-Practice Set 1 (continued) JOURNAL VOUCHER Date 2006 Cost of Goods Sold No. 15 - GENERAL LEDGER 87100 D. Raw Materials No. 121 Work in Process No.-12,- Finished Coods No. 6 1 Balance No. No. 503 MATERIALS LEDGER Retrder Paint Rearder Quantity RECENED AMOUNT UNITS June 25 Bal. 225 14 50 No. "-504 Reorfer Point BALANCE CL AMOUNT UNITS June 2SBal 580 No. 505 CREOT BALANCECR Rearder Point Rearder Quantity 500 REFERENCEANTS PRIC June 25 Bal 1,000 Reorder Point Reorder Quantity Number ALANCECR ALANCE AMOUNT UNT une 25 Bal Mini-Praatioc Set 1 (continued) Mini-Practice Set 1 (continued) Mini-Practico Sot 1 (eontinued) Mini-Practice Set 1 (continued) Mini-Practice Set 1 (continued) FINISHED GOODS LEDGER Material REFERENCEUNITS PRICE June 1 0 10 730 9S702 10 10 730 50 10 Matorial Number RECEIVED June 1 B 160 23 ECEVED UNITS PRICE Mini-Practice Set (continued) NAME Mini-Praotioe Set 1 (continuea) of Prorating Bullding Services Department Service SERWICESFACTORY Mini-Practice Set 1 (conlinued) Mini-Practice Set 1 (continued) Schedule of Raw Material Schedule of Schedule of Work in Proces Lnao Statement of Cost of Coods Manufactured Mini-Practice Set Ccontinued) Income Statement