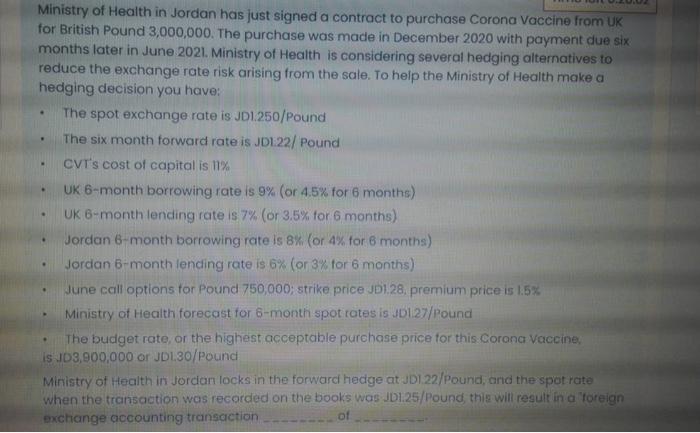

. . Ministry of Health in Jordan has just signed a contract to purchase Corona Vaccine from UK for British Pound 3,000,000. The purchase was made in December 2020 with payment due six months later in June 2021. Ministry of Health is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. To help the Ministry of Health make a hedging decision you have: The spot exchange rate is JD1.250/Pound The six month forward rate is JD122/ Pound CVT's cost of capital is 11% UK 6-month borrowing rate is 9% (or 4.5% for 6 months) UK 6-month lending rate is 7% (or 3.5% for 6 months) Jordan 6-month borrowing rate is 8% (or 4% for 6 months) Jordan 6-month lending rate is 6% (or 3% for 6 months) June call options for Pound 750,000; strike price JDI.28. premium price is 1.5% Ministry of Health forecast for 6-month spot rates is JD127/Pound The budget rate, or the highest acceptable purchase price for this Corona Vaccine, is JD3,900,000 or JD1.30/Pound Ministry of Health in Jordan locks in the forward hedge at JDI 22/Pound, and the spot rate when the transaction was recorded on the books was JD1.25/Pound this will result in a foreign exchange accounting transaction of . . Ministry of Health in Jordan has just signed a contract to purchase Corona Vaccine from UK for British Pound 3,000,000. The purchase was made in December 2020 with payment due six months later in June 2021. Ministry of Health is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. To help the Ministry of Health make a hedging decision you have: The spot exchange rate is JD1.250/Pound The six month forward rate is JD122/ Pound CVT's cost of capital is 11% UK 6-month borrowing rate is 9% (or 4.5% for 6 months) UK 6-month lending rate is 7% (or 3.5% for 6 months) Jordan 6-month borrowing rate is 8% (or 4% for 6 months) Jordan 6-month lending rate is 6% (or 3% for 6 months) June call options for Pound 750,000; strike price JDI.28. premium price is 1.5% Ministry of Health forecast for 6-month spot rates is JD127/Pound The budget rate, or the highest acceptable purchase price for this Corona Vaccine, is JD3,900,000 or JD1.30/Pound Ministry of Health in Jordan locks in the forward hedge at JDI 22/Pound, and the spot rate when the transaction was recorded on the books was JD1.25/Pound this will result in a foreign exchange accounting transaction of