Answered step by step

Verified Expert Solution

Question

1 Approved Answer

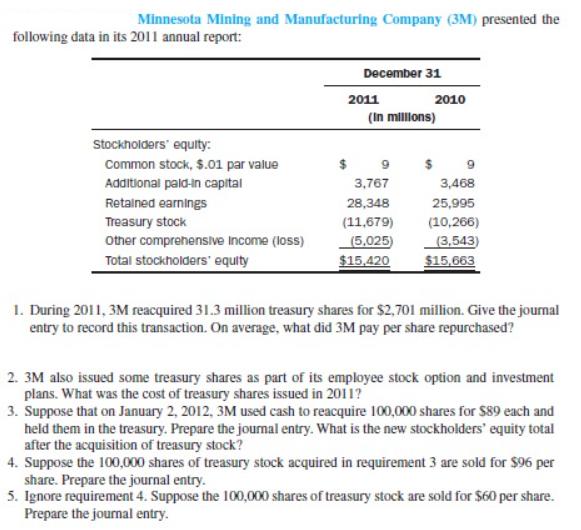

Minnesota Mining and Manufacturing Company (3M) presented the following data in its 2011 annual report: December 31 2011 2010 (in millions) Stockholders' equity: Common

Minnesota Mining and Manufacturing Company (3M) presented the following data in its 2011 annual report: December 31 2011 2010 (in millions) Stockholders' equity: Common stock, $.01 par value Additional paid-in capital 9 $ 9 3,767 3,468 Retained earnings 28,348 25,995 Treasury stock (11,679) (10,266) Other comprehensive Income (loss) (5,025) (3,543) Total stockholders' equity $15,420 $15,663 1. During 2011, 3M reacquired 31.3 million treasury shares for $2,701 million. Give the journal entry to record this transaction. On average, what did 3M pay per share repurchased? 2. 3M also issued some treasury shares as part of its employee stock option and investment plans. What was the cost of treasury shares issued in 2011? 3. Suppose that on January 2, 2012, 3M used cash to reacquire 100,000 shares for $89 each and held them in the treasury. Prepare the journal entry. What is the new stockholders' equity total after the acquisition of treasury stock? 4. Suppose the 100,000 shares of treasury stock acquired in requirement 3 are sold for $96 per share. Prepare the journal entry. 5. Ignore requirement 4. Suppose the 100,000 shares of treasury stock are sold for $60 per share. Prepare the journal entry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Journal entry to record the reacquisition of treasury shares Treasury Stock 2701 million Cash 2701 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642d9032eb88_973645.pdf

180 KBs PDF File

6642d9032eb88_973645.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started