Question

Minnie and Sutton are each 50% shareholders in the Hanley Corporation, a baby supply business. During the year, Hanley Corporation had E&P of $100,000.

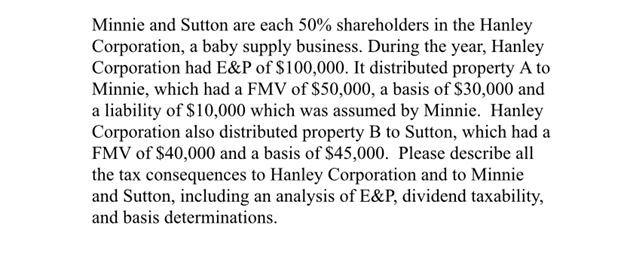

Minnie and Sutton are each 50% shareholders in the Hanley Corporation, a baby supply business. During the year, Hanley Corporation had E&P of $100,000. It distributed property A to Minnie, which had a FMV of $50,000, a basis of $30,000 and a liability of $10,000 which was assumed by Minnie. Hanley Corporation also distributed property B to Sutton, which had a FMV of $40,000 and a basis of $45,000. Please describe all the tax consequences to Hanley Corporation and to Minnie and Sutton, including an analysis of E&P, dividend taxability, and basis determinations.

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Hanley Corporation would have a 100000 distribution which would be a return of capital to th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Texts and Cases

Authors: Robert Anthony, David Hawkins, Kenneth Merchant

13th edition

1259097129, 978-0073379593, 007337959X, 978-1259097126

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App