Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Calculate the risk-adjusted on-balance-sheet assets of the bank as defined under Basel II. b. Calculate the risk-adjusted off-balance-sheet assets of the bank as defined

a. Calculate the risk-adjusted on-balance-sheet assets of the bank as defined under Basel II.

b. Calculate the risk-adjusted off-balance-sheet assets of the bank as defined under Basel II. Calculate total capital required for both off-balance sheet assets and on-balance sheet assets.

c. What type of risk the aforementioned capital adequacy ratio is accounting for? Is it a concern for the regulators?

d. How does the prudential framework manage the liquidity risk of regulated institutions?

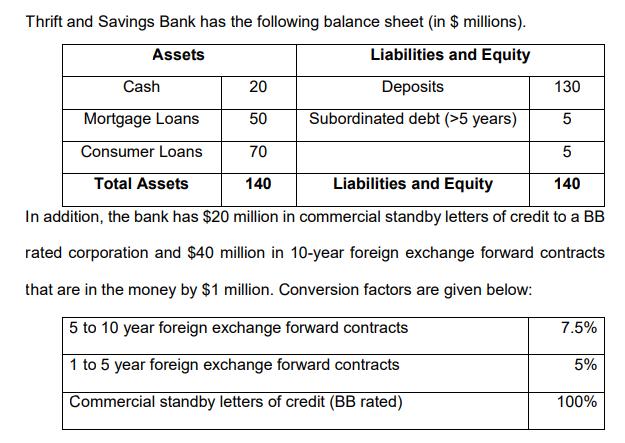

Thrift and Savings Bank has the following balance sheet (in $ millions). Assets Liabilities and Equity Deposits Subordinated debt (>5 years) Cash 20 Mortgage Loans 50 Consumer Loans 70 Total Assets 140 Liabilities and Equity In addition, the bank has $20 million in commercial standby letters of credit to a BB rated corporation and $40 million in 10-year foreign exchange forward contracts that are in the money by $1 million. Conversion factors are given below: 5 to 10 year foreign exchange forward contracts 1 to 5 year foreign exchange forward contracts Commercial standby letters of credit (BB rated) 130 5 5 140 7.5% 5% 100%

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a To calculate the riskadjusted onbalancesheet assets of the bank as defined under Basel II we need to assign risk weights to each category of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started