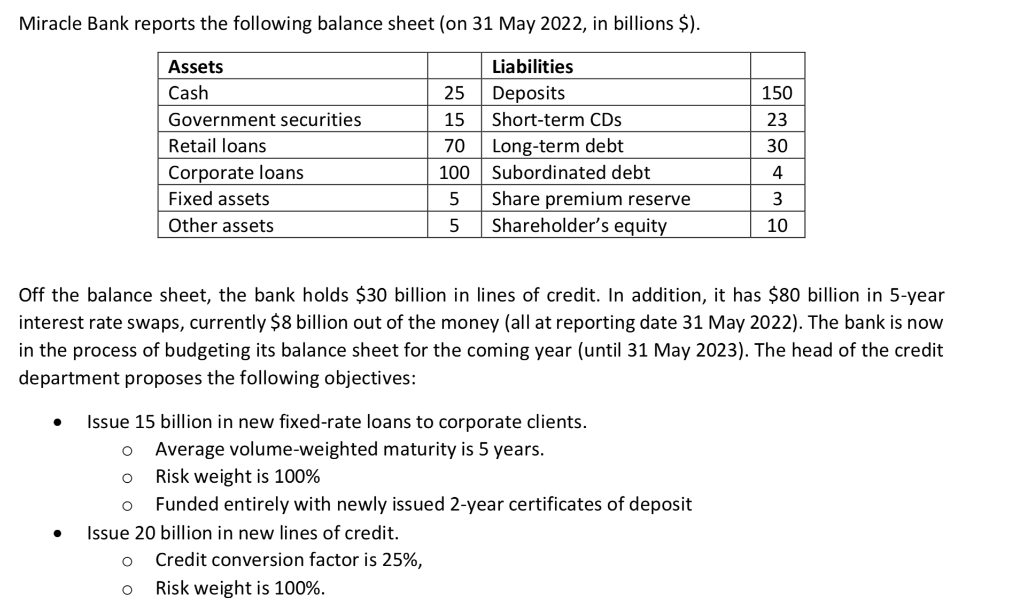

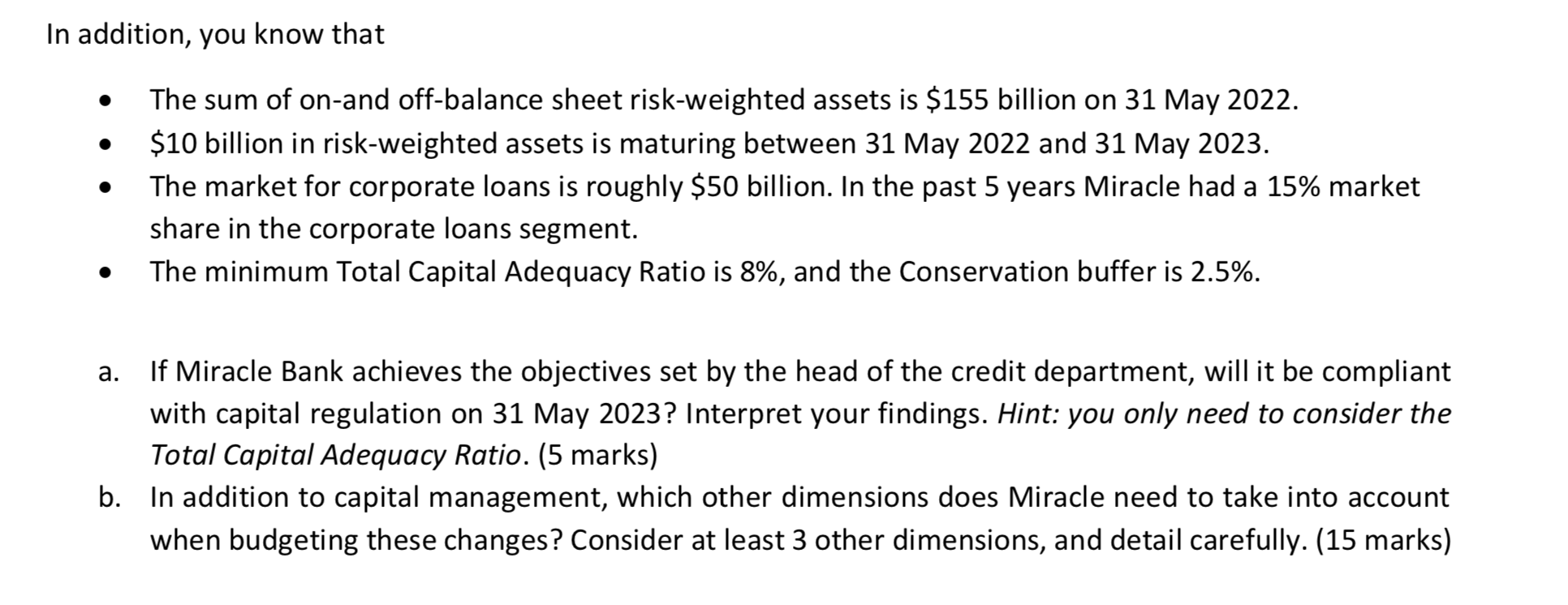

Miracle Bank reports the following balance sheet (on 31 May 2022, in billions $). Assets Liabilities Cash 25 Deposits 150 Government securities 15 Short-term CDs 23 Retail loans 70 Long-term debt 30 Corporate loans 100 Subordinated debt 4 Fixed assets 5 3 Share premium reserve Shareholder's equity Other assets 5 10 Off the balance sheet, the bank holds $30 billion in lines of credit. In addition, it has $80 billion in 5-year interest rate swaps, currently $8 billion out of the money (all at reporting date 31 May 2022). The bank is now in the process of budgeting its balance sheet for the coming year (until 31 May 2023). The head of the credit department proposes the following objectives: Issue 15 billion in new fixed-rate loans to corporate clients. O Average volume-weighted maturity is 5 years. O Risk weight is 100% O Funded entirely with newly issued 2-year certificates of deposit Issue 20 billion in new lines of credit. O Credit conversion factor is 25%, O Risk weight is 100%. In addition, you know that The sum of on-and off-balance sheet risk-weighted assets is $155 billion on 31 May 2022. $10 billion in risk-weighted assets is maturing between 31 May 2022 and 31 May 2023. The market for corporate loans is roughly $50 billion. In the past 5 years Miracle had a 15% market share in the corporate loans segment. The minimum Total Capital Adequacy Ratio is 8%, and the Conservation buffer is 2.5%. a. If Miracle Bank achieves the objectives set by the head of the credit department, will it be compliant with capital regulation on 31 May 2023? Interpret your findings. Hint: you only need to consider the Total Capital Adequacy Ratio. (5 marks) b. In addition to capital management, which other dimensions does Miracle need to take into account when budgeting these changes? Consider at least 3 other dimensions, and detail carefully. (15 marks) Miracle Bank reports the following balance sheet (on 31 May 2022, in billions $). Assets Liabilities Cash 25 Deposits 150 Government securities 15 Short-term CDs 23 Retail loans 70 Long-term debt 30 Corporate loans 100 Subordinated debt 4 Fixed assets 5 3 Share premium reserve Shareholder's equity Other assets 5 10 Off the balance sheet, the bank holds $30 billion in lines of credit. In addition, it has $80 billion in 5-year interest rate swaps, currently $8 billion out of the money (all at reporting date 31 May 2022). The bank is now in the process of budgeting its balance sheet for the coming year (until 31 May 2023). The head of the credit department proposes the following objectives: Issue 15 billion in new fixed-rate loans to corporate clients. O Average volume-weighted maturity is 5 years. O Risk weight is 100% O Funded entirely with newly issued 2-year certificates of deposit Issue 20 billion in new lines of credit. O Credit conversion factor is 25%, O Risk weight is 100%. In addition, you know that The sum of on-and off-balance sheet risk-weighted assets is $155 billion on 31 May 2022. $10 billion in risk-weighted assets is maturing between 31 May 2022 and 31 May 2023. The market for corporate loans is roughly $50 billion. In the past 5 years Miracle had a 15% market share in the corporate loans segment. The minimum Total Capital Adequacy Ratio is 8%, and the Conservation buffer is 2.5%. a. If Miracle Bank achieves the objectives set by the head of the credit department, will it be compliant with capital regulation on 31 May 2023? Interpret your findings. Hint: you only need to consider the Total Capital Adequacy Ratio. (5 marks) b. In addition to capital management, which other dimensions does Miracle need to take into account when budgeting these changes? Consider at least 3 other dimensions, and detail carefully. (15 marks)