Question

Miranda works full-time as an accountant with an accounting firm in Brisbane. She is currently enrolled in a Bachelor of Business (Accountancy) degree at

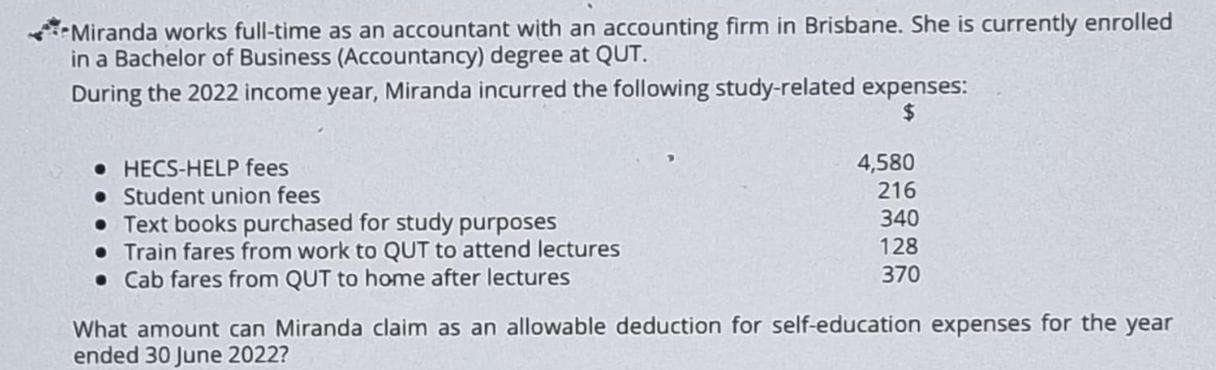

Miranda works full-time as an accountant with an accounting firm in Brisbane. She is currently enrolled in a Bachelor of Business (Accountancy) degree at QUT. During the 2022 income year, Miranda incurred the following study-related expenses: $ HECS-HELP fees . Student union fees Text books purchased for study purposes Train fares from work to QUT to attend lectures Cab fares from QUT to home after lectures 4,580 216 340 128 370 What amount can Miranda claim as an allowable deduction for self-education expenses for the year ended 30 June 2022?

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount Miranda can claim as an allowable deduction for selfeducation expenses for t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

10th edition

978-0077511388, 78034779, 9780077511340, 77511387, 9780078034770, 77511344, 978-0077861759

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App